Donald Smith & Co's Q2 2023 Portfolio Update: Key Trades and Holdings

Donald Smith & Co (Trades, Portfolio), a renowned investment firm, has recently disclosed its portfolio for the second quarter of 2023, which concluded on June 30, 2023. The firm was established in 1980 by Donald G. Smith, who served as its Chief Investment Officer until his demise in 2019. Smith had an illustrious career, starting as an analyst with Capital Research Company and later working at Capital Guardian Trust Co. He was also the CIO of Home Insurance Company and the President of Home Portfolio Advisors, Inc., which he later acquired and renamed Donald Smith & Co (Trades, Portfolio). Smith held a B.S. in Finance and Accounting from the University of Illinois, an MBA from Harvard University, and a J.D. from UCLA Law School. He was also a member of the Bar Association of California.

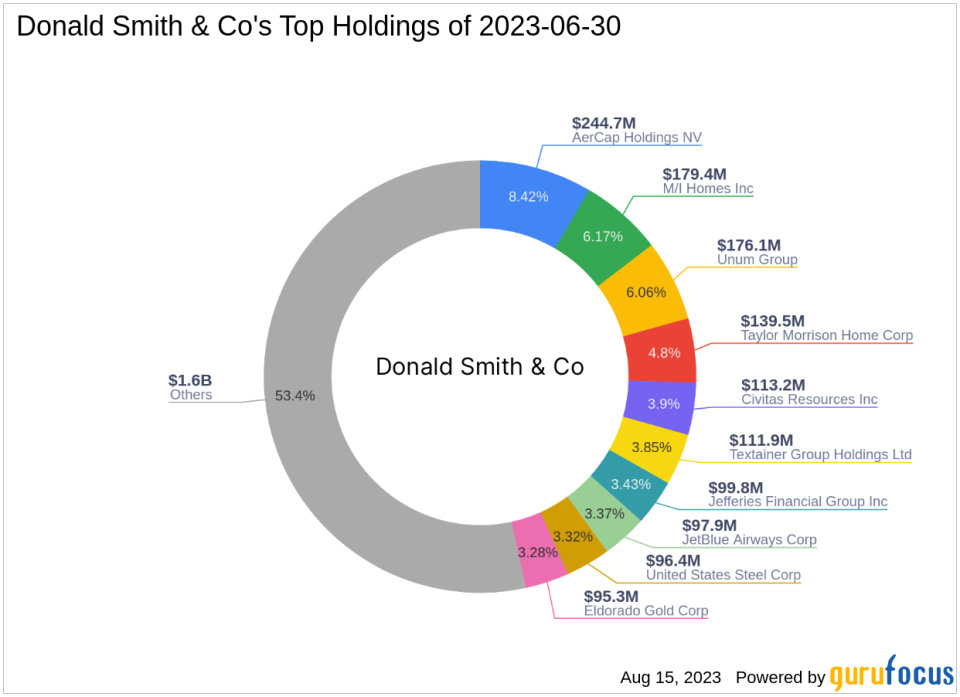

Portfolio Overview

The firm's portfolio for Q2 2023 comprised 61 stocks with a total value of $2.91 billion. The top holdings included AER (8.42%), MHO (6.17%), and UNM (6.06%).

Key Trades of the Quarter

Donald Smith & Co (Trades, Portfolio) made several significant trades during the quarter. Here are the top three:

Taylor Morrison Home Corp (NYSE:TMHC)

The firm reduced its investment in Taylor Morrison Home Corp (NYSE:TMHC) by 1,003,040 shares, impacting the equity portfolio by 1.41%. The stock traded at an average price of $42.98 during the quarter. As of August 15, 2023, TMHC had a market cap of $5.35 billion and a stock price of $48.91, reflecting a 72.28% return over the past year. GuruFocus rates the company's financial strength and profitability at 7/10 and 10/10, respectively. TMHC's valuation ratios include a P/E ratio of 5.38, a P/B ratio of 1.05, a PEG ratio of 0.16, an EV-to-Ebitda ratio of 4.62, and a P/S ratio of 0.64.

Constellation Energy Corp (NASDAQ:CEG)

Donald Smith & Co (Trades, Portfolio) completely sold out its 288,609-share investment in Constellation Energy Corp (NASDAQ:CEG), which previously accounted for 0.83% of the portfolio. The stock traded at an average price of $82.83 during the quarter. As of August 15, 2023, CEG had a market cap of $34.18 billion and a stock price of $106.28, reflecting a 32.25% return over the past year. GuruFocus rates the company's financial strength and profitability at 5/10 and 3/10, respectively. CEG's valuation ratios include a P/E ratio of 44.58, a P/B ratio of 3.04, an EV-to-Ebitda ratio of 11.68, and a P/S ratio of 1.32.

Triton International Ltd (NYSE:TRTN)

The firm also reduced its investment in Triton International Ltd (NYSE:TRTN) by 302,028 shares, impacting the equity portfolio by 0.71%. The stock traded at an average price of $80.72 during the quarter. As of August 15, 2023, TRTN had a market cap of $4.59 billion and a stock price of $83.45, reflecting a 31.15% return over the past year. GuruFocus rates the company's financial strength and profitability at 2/10 and 8/10, respectively. TRTN's valuation ratios include a P/E ratio of 8.13, a P/B ratio of 1.81, a PEG ratio of 0.51, an EV-to-Ebitda ratio of 9.69, and a P/S ratio of 2.66.

In conclusion, Donald Smith & Co (Trades, Portfolio)'s Q2 2023 portfolio reveals a strategic approach to investment, with significant trades in diverse sectors. The firm's portfolio and trading activity provide valuable insights for investors seeking to understand market trends and investment strategies.

This article first appeared on GuruFocus.