Donald Smith & Co's Strategic Moves: A Closer Look at Celestica Inc's Portfolio Impact

Insights from the Latest 13F Filing for Q3 2023

Donald Smith & Co (Trades, Portfolio), known for its deep-value investment strategy, has recently disclosed its 13F holdings for the third quarter of 2023. The firm, founded by the late Donald G. Smith, has a legacy of focusing on undervalued companies with strong earnings potential. Smith's investment philosophy was deeply rooted in a bottom-up approach, targeting stocks with low price-to-tangible book ratios. The firm's latest moves offer a glimpse into their current market strategy and adjustments.

New Additions to the Portfolio

Donald Smith & Co (Trades, Portfolio) has expanded its portfolio with three new stocks in the third quarter:

Golar LNG Ltd (NASDAQ:GLNG) is the standout addition with 914,291 shares, making up 0.76% of the portfolio and valued at $22.18 million.

Hudbay Minerals Inc (NYSE:HBM) follows, comprising 800,000 shares or approximately 0.13% of the portfolio, with a total value of $3.90 million.

Netgear Inc (NASDAQ:NTGR) rounds out the new picks with 210,000 shares, accounting for 0.09% of the portfolio and a total value of $2.64 million.

Significant Increases in Existing Holdings

The firm has also ramped up its investment in several companies, with notable increases in:

Navient Corp (NASDAQ:NAVI), where an additional 1,269,039 shares were purchased, bringing the total to 2,727,611 shares. This represents an 87.01% increase in share count and a 0.75% portfolio impact, valued at $46.97 million.

Park Hotels & Resorts Inc (NYSE:PK) saw an addition of 1,457,191 shares, resulting in a total of 4,800,745 shares. This adjustment marks a 43.58% increase in share count, with a total value of $59.15 million.

Exiting Positions

Donald Smith & Co (Trades, Portfolio) has completely sold out of three holdings in the third quarter:

Greenbrier Companies Inc (NYSE:GBX) saw the sale of all 131,328 shares, impacting the portfolio by -0.19%.

Unifi Inc (NYSE:UFI) was liquidated with all 120,600 shares sold, causing a -0.03% portfolio impact.

Noteworthy Reductions

The firm reduced its positions in 21 stocks, with significant reductions in:

Celestica Inc (NYSE:CLS), where 1,840,906 shares were sold, leading to a -36.36% decrease in shares and a -0.92% portfolio impact. The stock traded at an average price of $20.47 during the quarter and has seen a 22.55% return over the past three months and a 127.15% year-to-date return.

Triton International Ltd (TRTN) was reduced by 252,714 shares, a -99.42% decrease, impacting the portfolio by -0.73%. The stock's average trading price was $83.52 during the quarter, with a -3.58% return over the past three months and an 18.86% year-to-date return.

Portfolio Overview

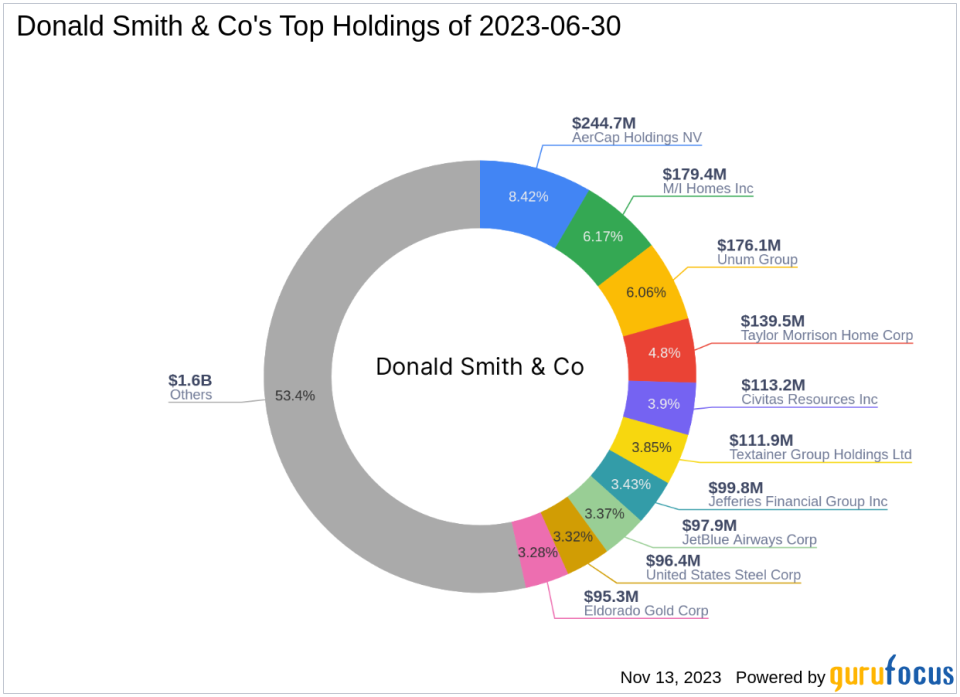

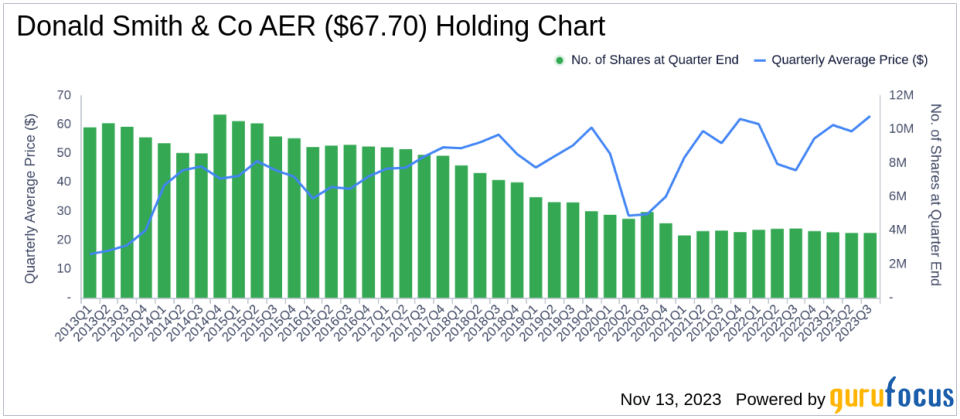

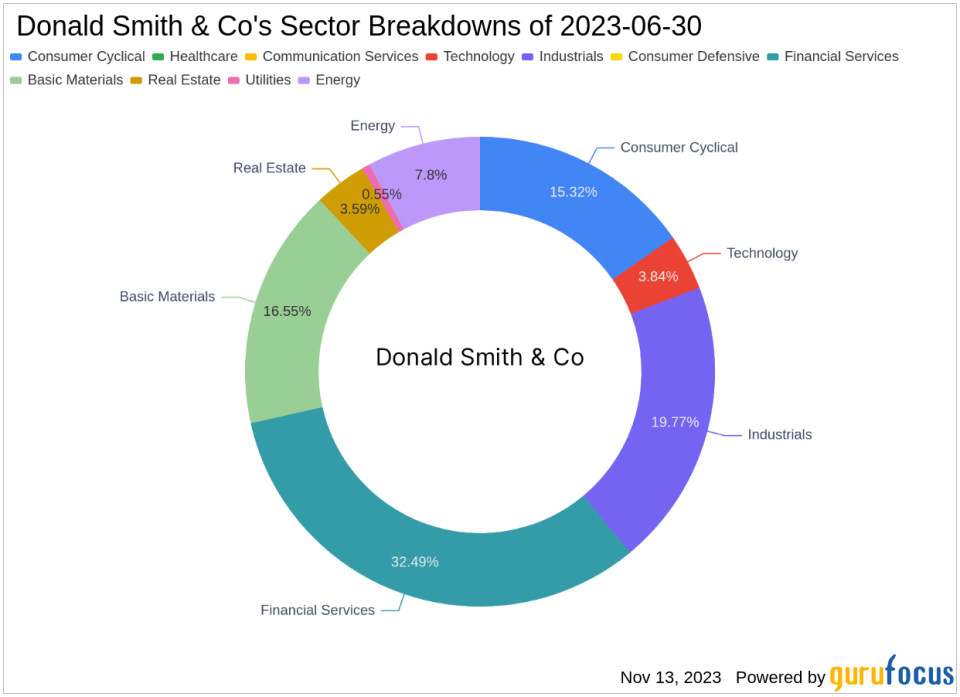

As of the third quarter of 2023, Donald Smith & Co (Trades, Portfolio)'s portfolio consists of 61 stocks. The top holdings include 8.31% in AerCap Holdings NV (NYSE:AER), 5.96% in Unum Group (NYSE:UNM), 5.87% in M/I Homes Inc (NYSE:MHO), 4.54% in United States Steel Corp (NYSE:X), and 4.06% in Civitas Resources Inc (NYSE:CIVI). The investments are primarily concentrated across eight industries: Financial Services, Basic Materials, Industrials, Consumer Cyclical, Energy, Technology, Real Estate, and Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.