Donald Trump's Social Security Proposal Has a Fatal Flaw

For more than 80 years, Social Security has been laying a financial foundation for our nation's aging workforce. According to data from the Center on Budget and Policy Priorities, the guaranteed payments provided by Social Security pulled 22.7 million people above the federal poverty line in 2022, 16.5 million of which were aged 65 and over.

Considering how important Social Security is to the financial well-being of so many retired workers, workers with disabilities, and survivors of deceased workers, you'd think maintaining the health of the program would be high on the list for lawmakers. However, the latest annual "checkup" for Social Security revealed that this critical program is in big trouble.

Strengthening Social Security begins in Washington, D.C. With the election less than eight months away, former president and presumptive Republican presidential nominee Donald Trump may, once again, be tasked with ensuring the financial health of America's top retirement program.

Social Security is staring down a $22.4 trillion (and widening) long-term funding shortfall

Before digging into Trump's approach with Social Security, it's important to first understand why the program's financial outlook has deteriorated.

Every year since the first Social Security benefit check was doled out in 1940, the Social Security Board of Trustees has released an all-encompassing report that details the current financial health of the program. It's like looking at the balance sheet of a publicly traded company.

The Trustees Report also contains forward-looking assumptions based on fiscal and monetary policy changes, along with demographic shifts, to estimate how financially "healthy" Social Security will be 10 years (the "short term") and 75 years (the "long term") following the release of a report.

The 2023 Social Security Board of Trustees Report estimates that Social Security's long-term funding shortfall grew by $2 trillion from the previous year to $22.4 trillion. To be clear, this doesn't mean Social Security is going bankrupt or is in any way insolvent. Rather, it means the existing payout schedule, including cost-of-living adjustments, isn't sustainable over the long run, based on current projections.

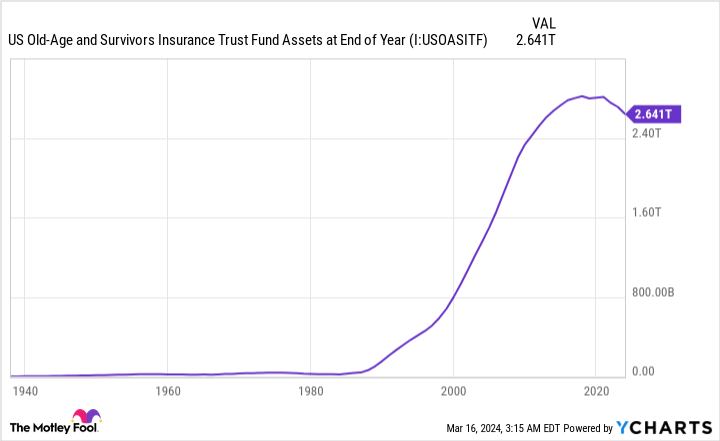

The Trustees Report opines that the Old-Age and Survivors Insurance Trust Fund (OASI), which is responsible for dishing out monthly benefits to more than 50 million retired workers and approximately 5.8 million survivor beneficiaries, could exhaust its asset reserves by 2033. If the OASI's asset reserves are depleted, sweeping benefit cuts of up to 23% may be needed to avoid any further cuts through 2097. For the average retired-worker beneficiary, a 23% benefit cut in 2033 would reduce their annual take-home by an estimated $6,638.

While social media message boards are littered with false postulations of "Congress stealing money from Social Security" and "undocumented workers receiving benefits," the bulk of Social Security's woes can be traced to ongoing demographic shifts. This includes:

A more-than-halving in net migration into the U.S. since 1998.

A historically low U.S birth rate, which is weighing on the worker-to-beneficiary ratio.

Rising income inequality, which has allowed more earned income to escape payroll taxation.

Donald Trump's Social Security proposal misses the mark

With a clearer picture of what is and isn't behind Social Security's widening long-term funding shortfall, let's return to the topic at hand: How best to strengthen this critical program?

Despite being out of public office for more than three years, former President Trump hasn't shied away from offering policy advice. With regard to Social Security, he has one clear message for Republicans in Congress: Stay away.

In January 2023, Trump posted a video on social media in which he said:

Under no circumstances should Republicans cut a single penny from Medicare or Social Security. ... Do not cut the benefits our seniors worked for and paid for their entire lives. Save Social Security. Don't destroy it!

Trump also had this to say during a town hall discussion with Sean Hannity of Fox News in December 2023: "You don't have to touch Social Security. We have money laying in the ground far greater than anything we can do by hurting senior citizens with their Social Security."

While Trump would clearly prefer a hands-off approach to Social Security, doing nothing is a fatal flaw that's guaranteed to end poorly. Based on projections from the Trustees, doing nothing will only increase the funding gap for America's leading retirement program. Although the estimate for the OASI's asset reserve depletion could be adjusted modestly in the coming years, doing nothing isn't a viable solution.

A bipartisan solution will almost certainly be needed to strengthen Social Security

The blunt reason tackling Social Security's long-term funding shortfall head-on is so difficult for lawmakers is that every solution leads to a group of people being worse off than they are now.

For example, Democrats on Capitol Hill widely believe that reinstating the 12.4% payroll tax on earned income for high earners is the smartest solution to strengthen Social Security.

President Biden floated this exact proposal before being elected in November 2020. He wanted to reinstate the payroll tax on earned income above $400,000, while creating a doughnut hole between the maximum taxable earnings cap ($168,600 in 2024) and $400,000 where earned income would remain exempt from the payroll tax. Since the maximum taxable earnings cap rises in lockstep with the National Average Wage Index most years, this doughnut hole would naturally close over time and expose all earned income to the payroll tax.

However, Social Security benefits at full retirement age are capped at $3,822 in 2024. Increasing taxation without providing a cent in added benefits would make high-earning workers worse off. To boot, taxing the rich, by itself, doesn't come anywhere close to closing the program's $22.4 trillion funding obligation shortfall through 2097.

On the other end of the spectrum, Republican lawmakers have approached "fixing" Social Security by reducing its long-term outlays. This would be accomplished by gradually raising the full retirement age -- i.e., the age you become eligible to receive 100% of your retired-worker benefit. Currently, anyone born in or after 1960 has a full retirement age of 67.

Some GOP lawmakers have floated the idea of gradually raising the full retirement age to as high as 70. Increasing the full retirement age would require workers to either wait longer to receive 100% of their monthly benefit, or accept a steeper reduction to their payout if claiming early. Either way, future generations of retired workers would see their lifetime benefits reduced.

While the Republican proposal would, eventually, reduce long-term outlays, it does nothing to address the OASI's impending asset reserve depletion that's projected by 2033.

Regardless of which presumptive presidential nominee -- Donald Trump or Joe Biden -- finds himself in the Oval Office come January 2025, tackling Social Security's financial woes will need to be a bipartisan effort. Locating a middle-ground solution that incorporates pieces of the Democrats' and Republicans' proposals into one bill, much in the same way the Social Security Amendments of 1983 did, will offer the best chance to strengthen Social Security and avoid dreaded benefits cuts within a decade.

The $22,924 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Simply click here to discover how to learn more about these strategies.

View the "Social Security secrets"

The Motley Fool has a disclosure policy.

Donald Trump's Social Security Proposal Has a Fatal Flaw was originally published by The Motley Fool