Donaldson Co Inc (DCI) Posts Record Q2 Fiscal 2024 Sales and Earnings, Raises Full-Year Guidance

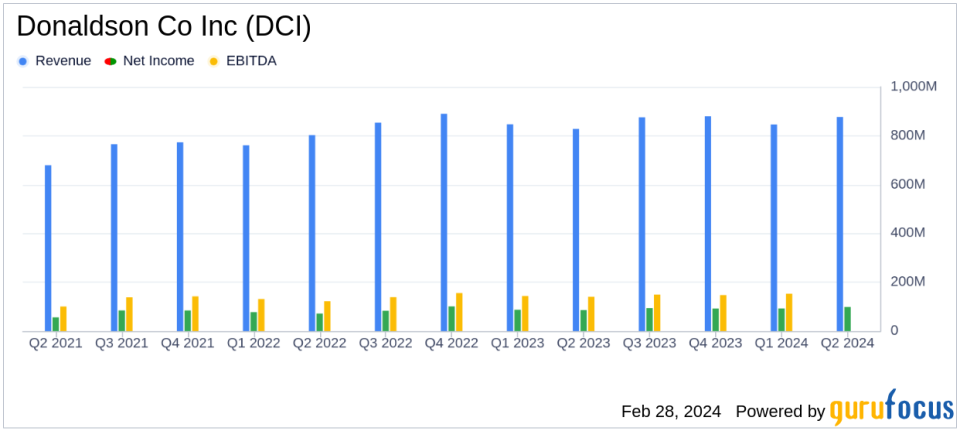

Net Sales: Increased by 5.8% to $876.7 million in Q2 FY2024.

Earnings Per Share (EPS): Grew by 15.9% to $0.81, reflecting solid sales growth and margin expansion.

Operating Margin: Improved to 14.8%, with an 80 basis point increase over the previous year.

Dividends and Share Repurchases: Paid $60.3 million in dividends and repurchased 1.2% of outstanding shares for $87.1 million.

Fiscal 2024 Outlook: Full-year EPS forecast raised to between $3.24 and $3.32, with sales expected to grow between 3% and 7%.

On February 28, 2024, Donaldson Co Inc (NYSE:DCI) released its 8-K filing, announcing a record performance for the second quarter of fiscal year 2024. The company, a global leader in technology-led filtration products and solutions, reported a 5.8% increase in sales to $876.7 million compared to the same period in 2023. This growth was attributed to volume growth and pricing benefits across all three operating segments: Mobile Solutions, Industrial Solutions, and Life Sciences.

Company Overview

Donaldson operates in a diverse range of end markets, including construction, mining, agriculture, truck, and industrial. With a business model organized into three segments, Donaldson has generated approximately $3.4 billion in revenue and $480 million in operating income in fiscal 2023. The company's commitment to "Advancing Filtration for a Cleaner World" is evident in its product offerings, which include air filtration systems, liquid filtration systems, and dust, fume, and mist collectors.

Financial Performance and Challenges

The company's earnings per share (EPS) saw a significant increase of 15.9% to $0.81, up from $0.70 in 2023. This improvement reflects the company's ability to deliver solid sales growth and gross margin expansion despite challenges in the global market. The Mobile Solutions segment experienced mixed results with a decrease in On-Road and Off-Road sales, while the Aftermarket sales surged by 11.3%. The Industrial Solutions segment saw a 6.9% increase in sales, driven by volume growth and strong market conditions, particularly in Aerospace and Defense, which grew by 12.4%. The Life Sciences segment also reported a 6.0% increase in sales.

Donaldson's performance is significant as it demonstrates the company's resilience and adaptability in a challenging economic environment. The ability to achieve growth in such conditions is crucial for maintaining investor confidence and market position within the Industrial Products industry.

Financial Achievements and Importance

Donaldson's financial achievements, including the improved operating margin of 14.8% and gross margin of 35.2%, are important indicators of the company's operational efficiency and pricing strategy effectiveness. These margins reflect the company's ability to manage costs and optimize pricing in response to market conditions, which is particularly important for sustaining profitability in the competitive Industrial Products sector.

Key Financial Metrics

Donaldson's financial strength is further highlighted by its balance sheet and cash flow performance. The company's total assets stood at $2,783.5 million as of January 31, 2024, with a strong cash and cash equivalents position of $193.8 million. The net cash provided by operating activities was $225.0 million for the six months ended January 31, 2024, demonstrating the company's ability to generate cash efficiently from its operations.

These metrics are crucial for Donaldson as they provide the financial flexibility to invest in growth opportunities, pay dividends, and repurchase shares, which in turn can enhance shareholder value.

"Our second quarter results reflect strength in several key businesses across all three operating segments," said Tod Carpenter, chairman, president and chief executive officer. "Given our confidence in executing on our strategic growth initiatives while investing for future profitable growth for the remainder of the year, we are increasing our earnings expectations for fiscal 2024."

Analysis of Company's Performance

Donaldson's performance in the second quarter of fiscal 2024 is a testament to its diversified business model and strategic growth initiatives. The company's ability to raise its full-year EPS guidance amidst market challenges indicates strong operational execution and a robust business strategy. The focus on expanding gross margins and controlling operating expenses has allowed Donaldson to improve profitability and deliver value to shareholders.

As Donaldson continues to navigate global economic uncertainties and invest in its Life Sciences segment, the company's balanced growth strategy positions it well to achieve its fiscal 2026 Investor Day targets. The commitment to returning value to shareholders through dividends and share repurchases further underscores the company's financial health and optimistic outlook.

For more detailed information and to access the full earnings report, please visit the 8-K filing.

Explore the complete 8-K earnings release (here) from Donaldson Co Inc for further details.

This article first appeared on GuruFocus.