Donaldson (DCI) Shares Rise 3% Since Q1 Earnings Release

Donaldson Company, Inc. DCI reported first-quarter fiscal 2024 (ended Oct 31, 2023) earnings of 75 cents per share, which missed the Zacks Consensus Estimate of earnings of 72 cents per share. The bottom line was unchanged from the year-ago reported number. Banking on this stellar performance, shares of the company have gained approximately 3% since the earnings release on Nov 29.

Revenue Results

In the fiscal first quarter, total revenues of $846.3 million underperformed the Zacks Consensus Estimate of $856 million. The top line declined 0.1% in the reported quarter due to volume declines in the Mobile Solutions and Life Sciences segments.

Region-wise, DCI’s net sales in the United States/Canada increased 1.7% and expanded 3.4% in Europe, the Middle East and Africa, year over year. However, the same decreased 4.5% in Latin America and 7.1% in the Asia Pacific.

Donaldson started reporting revenues under three segments starting the fiscal second quarter of 2023. The segments are as follows: Mobile Solutions, Industrial Solutions and Life Sciences.

A brief snapshot of the segmental sales is provided below:

The Mobile Solutions segment’s (accounting for 63.8% of net sales in first-quarter fiscal 2024) sales were $540.0 million, reflecting a year-over-year decline of 2.7%.

The results were negatively impacted by a 9% decline in Off-Road and a 2% decline in aftermarket sales. However, On-Road increased 5% in the quarter.

Revenues generated from the Industrial Solutions segment (accounting for 29.1% of net sales in first-quarter fiscal 2024) were $246.2 million, increasing 7.2% from the year-ago fiscal quarter.

The results benefited from sales growth of 7% in Industrial Filtration Solutions and 6% in Aerospace and Defense.

Revenues generated from Life Sciences (accounting for 7.1% of net sales in first-quarter fiscal 2024) were $60.1 million, decreasing 4.1% from the year-ago fiscal quarter.

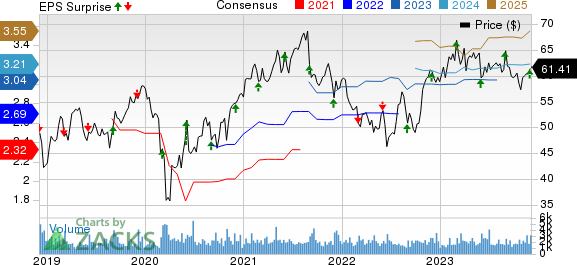

Donaldson Company, Inc. Price, Consensus and EPS Surprise

Donaldson Company, Inc. price-consensus-eps-surprise-chart | Donaldson Company, Inc. Quote

Margin Profile

In the fiscal first quarter, Donaldson’s cost of sales decreased 2.6% year over year to $545.4 million. Gross profit jumped 4.8% to $300.9 million. The gross margin increased 170 basis points (bps) to 35.6%. The margin results benefited from pricing benefits, deflation in freight and select material costs, and mix.

Operating expenses increased 5% year over year to $176.3 million. Operating profit in the quarter under review increased 4.5% to $124.6 million. The operating margin was 14.7%, decreasing 60 bps year over year.

The effective tax rate in the quarter was 25.1% compared with 25.2% in the year-ago quarter.

Balance Sheet & Cash Flow

Exiting first-quarter fiscal 2024, Donaldson’s cash and cash equivalents were $217.8 million compared with $187.1 million recorded in the fourth quarter of fiscal 2023. Long-term debt was $366.6 million compared with $496.6 million reported in the fourth quarter of fiscal 2023.

In the first three months of fiscal 2024, Donaldson repaid its long-term debt of $73.8 million.

In the same time, DCI generated net cash of $138.0 million from operating activities, reflecting an increase of 16.8% from the year-ago figure. Capital expenditure (net) totaled $23.2 million compared with $28.1 million in the year-ago fiscal period. Free cash flow increased 27.4% to $114.8 million.

DCI also used $53.3 million to repurchase treasury stocks and $30.2 million to pay out dividends during the first three months of fiscal 2024.

2024 Outlook

For fiscal 2024 (ending July 2024), Donaldson expects adjusted earnings per share to be $3.14-$3.30. The midpoint of the guided range of earnings of $3.22 per share is above the Zacks Consensus Estimate of earnings of $3.21 per share. Sales are anticipated to increase 3-7% from the fiscal 2023 level. Positive pricing is anticipated to have an accretive impact of 2%. Movement in foreign currencies is expected to positively impact sales by roughly 1%.

On a segmental basis, Mobile Solutions’ sales are anticipated to increase 1-5% from the fiscal 2023 level. Sales growth for Industrial Solutions is anticipated to be 3-7% from the fiscal 2023 figure. The company expects its Life Sciences segment’s sales to increase approximately 20%.

Interest expenses are predicted to be approximately $23 million. The effective tax rate is anticipated to be 24-26%.

Capital expenditure for the fiscal year is expected to be $95-$115 million. Free cash flow conversion is anticipated to be 95-115%. Share buybacks are expected to account for 2% of the outstanding shares.

Zacks Rank & Stocks to Consider

Donaldson currently carries a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Flowserve Corporation FLS presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FLS delivered a trailing four-quarter average earnings surprise of 27.3%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2023 earnings has increased 3.1%. The stock has risen 24% in the past year.

Applied Industrial Technologies, Inc. AIT currently has a Zacks Rank of 2. It has a trailing four-quarter average earnings surprise of 13.9%.

The consensus estimate for AIT’s fiscal 2024 earnings has increased 3.7% in the past 60 days. Shares of Applied Industrial have jumped 29% in the past year.

A. O. Smith Corporation AOS presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 14%.

In the past 60 days, the consensus estimate for A. O. Smith’s 2023 earnings has improved 5%. The stock has risen 28.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report