Donnelley Financial Solutions Inc Reports Growth Amid Market Challenges

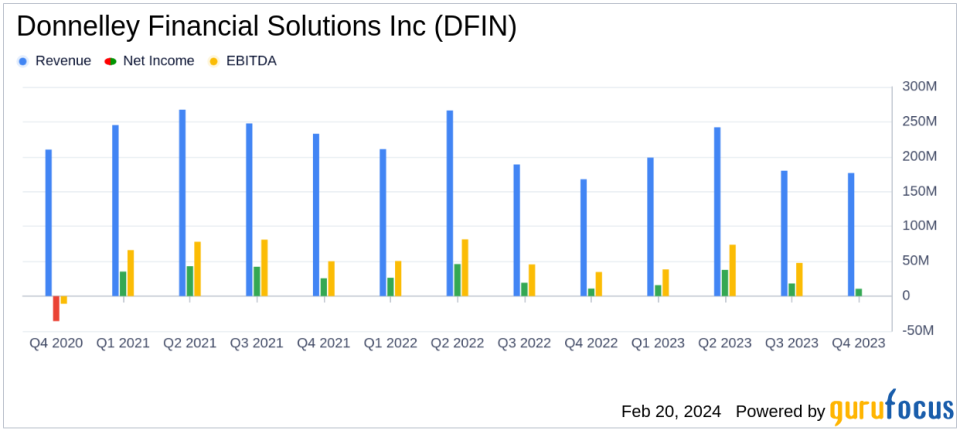

Total Net Sales: Q4 net sales increased by 5.2% to $176.5 million; Full-year net sales reached $797.2 million.

Software Solutions Growth: Q4 software solutions net sales rose by 7.3% to $73.7 million, representing 41.8% of total Q4 net sales.

Net Earnings: Q4 net earnings slightly decreased to $10.6 million, or $0.35 per diluted share; Full-year net earnings were $82.2 million, or $2.69 per diluted share.

Adjusted EBITDA: Q4 Adjusted EBITDA increased by 5.1% to $41.3 million; Full-year Adjusted EBITDA stood at $207.4 million.

Free Cash Flow and Leverage: Q4 Free Cash Flow was $56.0 million; Gross leverage at 0.6x and net leverage at 0.5x as of December 31, 2023.

Stock Repurchase: Repurchased 82,445 shares for $4.6 million in Q4; Board authorized a new stock repurchase program of up to $150 million.

Regulatory Changes: Anticipates annual net sales increase of $20 million to $25 million in 2025 due to the Tailored Shareholder Reports rule.

On February 20, 2024, Donnelley Financial Solutions Inc (NYSE:DFIN) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. DFIN, a global risk and compliance solutions company, operates primarily in the United States and offers a suite of services including regulatory filing and deal solutions through its software-as-a-service platform.

Performance Highlights and Challenges

DFIN reported a 5.2% increase in total net sales for Q4, reaching $176.5 million, and a 5.4% increase on an organic basis. The full-year total net sales amounted to $797.2 million. The company's software solutions segment experienced robust growth, with Q4 net sales up by 7.3% to $73.7 million, accounting for 41.8% of the total Q4 net sales. For the full year, software solutions net sales increased by 4.7% to $292.7 million, representing 36.7% of the total net sales.

Despite the positive sales growth, DFIN faced a slight decrease in Q4 net earnings to $10.6 million, or $0.35 per diluted share, compared to $10.9 million, or $0.36 per diluted share, in the same quarter of the previous year. The full-year net earnings were reported at $82.2 million, or $2.69 per diluted share. The company's Adjusted EBITDA for Q4 increased by 5.1% to $41.3 million, with a margin of 23.4%, consistent with the previous year's Q4. The full-year Adjusted EBITDA was $207.4 million, with a margin of 26.0%.

Financial Achievements and Importance

DFIN's financial achievements, particularly in the software solutions segment, underscore the company's strategic focus on expanding its recurring regulatory and compliance offerings. This shift aims to drive more predictable performance and align with the company's long-term goals. The company's strong Adjusted EBITDA margin demonstrates its ability to control costs and optimize operations, even amid challenging market conditions.

Financial Metrics and Commentary

DFIN's Q4 net cash provided by operating activities was $74.8 million, and the Free Cash Flow was $56.0 million. The company maintained a healthy leverage position with a gross leverage of 0.6x and a net leverage of 0.5x as of December 31, 2023. During Q4, DFIN repurchased shares and announced a new stock repurchase program, signaling confidence in its financial stability and commitment to delivering shareholder value.

"We are pleased with the strong performance in the quarter, including organic consolidated net sales growth of 5.4%. Total software solutions net sales increased 8.2% on an organic basis, compared to the fourth quarter of 2022, which is a continuation of the recent growth trend," said Daniel N. Leib, DFINs president and chief executive officer.

"Throughout 2023, the focused execution of our strategy enabled us to achieve solid financial and operational results, in light of challenging market conditions. We delivered $207.4 million of Adjusted EBITDA and Adjusted EBITDA margin of 26.0% for the full-year 2023, despite event-driven capital markets transactional revenue being down nearly $52 million, or 22%," Leib continued.

Analysis and Outlook

Looking ahead to 2024, DFIN anticipates opportunities arising from new regulations such as the Tailored Shareholder Reports, which are expected to increase annual net sales by $20 million to $25 million in 2025. The company is prepared to assist clients with these regulatory changes and expects a half-year impact in 2024. Despite the uncertain outlook for transactional market activity, DFIN's portfolio of regulatory and compliance offerings positions it well for future growth.

DFIN's earnings press release and additional financial details are available on the company's investor relations website, and a conference call and webcast to discuss the results were held on February 20, 2024.

For more detailed financial information and analysis on Donnelley Financial Solutions Inc's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Donnelley Financial Solutions Inc for further details.

This article first appeared on GuruFocus.