Don't Overlook These Affordable Stocks as Earnings Approach

This week’s earnings lineup features several top-rated stocks that are starting to look cheap ahead of their quarterly reports on Wednesday, August 9.

Components such as valuation, growth, and rising earnings estimates help reconfirm it's time to buy these stocks for their affordable prices and investment potential.

Townsquare Media (TSQ)

We’ll start with Townsquare Media with its stock currently boasting a Zacks Rank #1 (Strong Buy) going into its second-quarter report.

Notably, Townsquare’s Broadcast Radio and Television Industry is in the top 28% of over 250 Zacks industries. In addition to this Townsquare stock trades at $11 a share and has an “A” Zacks Style Scores grade for Value.

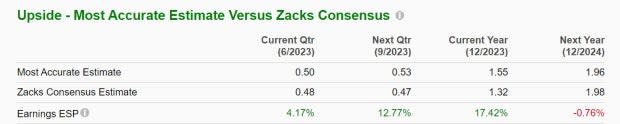

Townsquare operates digital and live event properties with ownership of FM and AM stations throughout the U.S. Intriguingly, the Zacks Expected Surprise Prediction (ESP) indicates Townsquare could top Q2 EPS estimates despite earnings forecasted to decline -32% at $0.48 per share following a very tough-to-compete-against quarter.

Still, the Most Accurate Estimate has Q2 EPS pegged at $0.50 per share which would give Townsquare an earnings surprise of 4%. Second-quarter sales are expected to be roughly flat at $121.08 million.

Image Source: Zacks Investment Research

After a stellar 2022 that saw EPS at $2.77, Townsquare’s earnings are now forecasted to be down -52% in fiscal 2023 but rebound and climb 49% in FY24 at $1.98 per share. Plus, Townsquare’s stock currently trades at just 8.7X forward earnings. This is an attractive discount to the industry average of 20X and nicely below the S&P 500’s 21.2X.

The cherry on top is that Townsquare currently offers investors a 6.51% dividend yield in an industry where most companies don’t offer a payout. Furthermore,Townsquare’s dividend yield towers over the benchmark’s 1.41% average.

Image Source: Zacks Investment Research

Everi (EVRI)

Next up, Everi Holdings stock is worth a look going into its Q2 report on Wednesday and currently sports a Zacks Rank #2 (Buy). Everi’s Business-Services Industry is in Zacks top 37% with its subsidiaries providing integrated gaming payment solutions among other related services.

Everi stock trades at $14 a share and also stands out in terms of valuation with an “A” Zacks Style Scores grade for Value. Even better, the Zacks ESP indicates Everi could surpass Q2 earnings expectations.

Second-quarter earnings are expected to be down -27% at $0.24 a share with Everi up against a tough-to-compete quarter but the Most Accurate Estimate has Q2 EPS at $0.25. This would give Everi a 2% earnings surprise with it being noteworthy that the company most recently obliterated Q1 EPS estimates by 105%.

Image Source: Zacks Investment Research

On the top line, Q2 sales are forecasted to be up 5% to $207.65 million. Notably, total sales are expected to jump 8% in fiscal 2023 and rise another 5% in FY24 to $884.68 million. Annual earnings are projected to dip -12% this year but rebound and jump 13% in FY24 at $1.23 per share.

Plus, Everi stock trades at 13.7X forward earnings which is nicely beneath the industry average of 18.6X and the benchmark. Earnings estimate revisions have also remained higher offering further support.

Image Source: Zacks Investment Research

Magnite (MGNI)

Lastly, Magnite is a tech company that is worthy of investors’ consideration and lands a Zacks Rank #2 (Buy). Premiums are returning for tech stocks but Magnite stock still trades reasonably at $14 a share with its Internet-Software Industry in Zacks top 31%.

Magnite provides an omnichannel advertising platform that enables publishers to monetize across all auction types and formats including CTV, desktop display, video, audio, and mobile.

Second-quarter earnings are expected to slightly dip at $0.12 per share compared to $0.14 a share in Q2 2022 but the Zacks ESP indicates Magnite should reach expectations. It’s also noteworthy that Magnite most recently crushed its Q1 bottom-line expectations with earnings at $0.04 per share compared to estimates that called for an adjusted loss of -$0.22 a share.

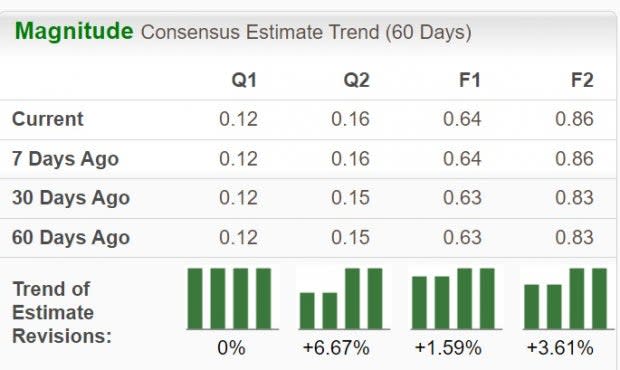

Image Source: Zacks Investment Research

Second-quarter sales are forecasted to dip -2% to $134.56 million with total sales now expected to be down -3% in FY23 but stabilize and climb 15% in FY24 to $645.82 million. Annual earnings are projected to be virtually flat this year and then soar 34% in FY24 at $0.86 per share.

More importantly, earnings estimates have trended higher over the last 30 days which is a good sign there could be more upside for Magnite stock ahead.

Image Source: Zacks Investment Research

Takeaway

Townsquare Media, Everi Holdings, and Magnite stock are intriguing ahead of their second-quarter reports. With all three companies expected to reach or exceed quarterly earnings expectations, they may be able to offer positive guidance making their attractive stock prices more compelling.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Townsquare Media, Inc. (TSQ) : Free Stock Analysis Report

Everi Holdings Inc. (EVRI) : Free Stock Analysis Report

Magnite, Inc. (MGNI) : Free Stock Analysis Report