Don't Overlook These Top-Rated Stocks it's Time to Buy

Despite recent market volatility, there has been a slew of stocks added to the Zacks Rank #1 (Strong Buy) list this month as better buying opportunities have been presented.

Here are several of these companies that may be flying under investors' radars but they shouldn’t be overlooked as their stocks also covet an overall “A” Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Advanced Drainage Systems WMS

There are lucrative pockets to invest in among the Zacks Construction sector with Advanced Drainage Systems’ stock standing out and its Zacks Building Products-Miscellaneous Industry in the top 15% of over 250 Zacks industries.

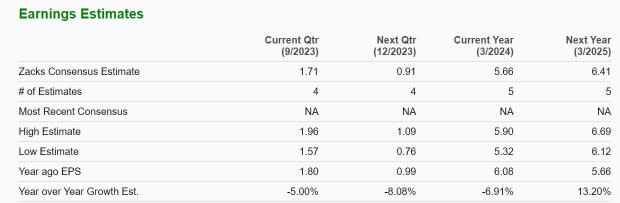

A reasonable P/E valuation of 21.7X forward earnings is alluring considering Advanced Drainage’s strengthening market environment. As a manufacturer of thermoplastic corrugated pipe used for drainage systems, the company’s fiscal 2023 earnings are forecasted to dip -7% following a tougher-to-compete-against year but rebound and jump 13% in FY24 at $6.41 per share.

Image Source: Zacks Investment Research

Plus, FY24 EPS projections would represent an astonishing 424% growth from pre-pandemic levels with 2019 earnings at $1.22 per share. ‘

Considering this very impressive growth and recovery, Advanced Drainage's stock is starting to look like a worthy buy-the-dip candidate with WMS shares still up a stellar +45% this year but 11% from 52-week highs of $134 a share in August.

Image Source: Zacks Investment Research

J. Jill JILL

Specialty retailer J. Jill continues to look poised for growth offering women's clothing apparel and accessories. After going public in 2017, now looks like an ideal time to buy JILL shares at a 10.2X forward earnings multiple that is nicely beneath its Zacks Retail-Apparel and Shoes Industry average of 16.9X and the S&P 500’s 20.5X.

Image Source: Zacks Investment Research

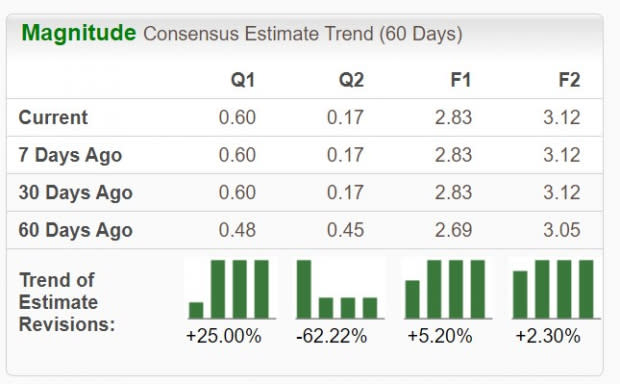

Furthermore, while annual earnings are expected to dip -6% in FY23, J. Jill’s EPS is forecasted to rebound and rise 10% in FY24 at $3.12 per share. More reassuring, over the last 60 days, FY23 and FY24 EPS estimates have risen 5% and 2% respectively with JILL shares up +16% YTD.

Image Source: Zacks Investment Research

The Marcus MCS

Past performance is not always an indicator of future success and The Marcus Corporation’s stock is up a respectable +8% in 2023 with the company starting to flex its niche in the lodging and entertainment industries.

Operating movie theatres, hotels, and resorts in several states, The Marcus Corporation's expansion is attractive again as its post-pandemic turnaround continues. Annual earnings are anticipated at $0.28 per share in FY23 compared to an adjusted loss of -$0.16 a share last year. Fiscal 2024 earnings are expected to jump another 19%.

Image Source: Zacks Investment Research

Even better, sales are projected to be up 6% this year and rise another 3% in FY24 to $745.89 million. Notably, as The Marcus Corporation retakes the profitability line the price-to-sales metric may still be a better measure of the company’s valuation.

To that point, MCS shares have a P/S ratio of 0.6X which is attractively below the optimum level of less than 2X, the Zacks Leisure and Recreation Services Industry average of 1.3X, and the S&P 500’s 3.7X.

Image Source: Zacks Investment Research

Bottom Line

Newly added to the Zacks Rank #1 (Strong Buy) list on Thursday, now looks like an opportunistic time to buy Advanced Drainage Systems, The Marcus Corporation, and J. Jill stock as they are starting to check many of the fundamental boxes that point to more upside.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Drainage Systems, Inc. (WMS) : Free Stock Analysis Report

Marcus Corporation (The) (MCS) : Free Stock Analysis Report

J.Jill, Inc. (JILL) : Free Stock Analysis Report