Don't Overlook Wix.com (WIX) or Yeti's (YETI) Stock as Earnings Approach

Two top-rated stocks highlighting this week’s earnings lineup are Wix.com WIX and Yeti Holdings YETI which are set to report their third-quarter results on Thursday, November 9.

Momentum is starting to build for both companies with the Zacks Earnings ESP (Expected Surprise Prediction) indicating they could surpass Q3 earnings expectations.

Q3 Previews

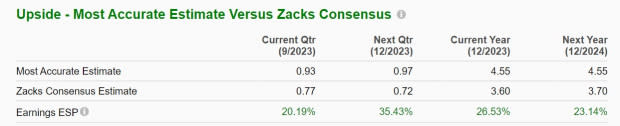

Providing a cloud-based web development platform, Wix.com is a very promising growth stock at the moment. To that point, Q3 earnings are anticipated at $0.77 per share compared to $0.06 a share in the prior-year quarter with sales forecasted to rise 12% to $389.51 million.

Even better, the Zacks ESP indicates Wix.com could easily surpass earnings expectations with the Most Accurate Estimate having Q3 EPS at $0.93 per share and 20% above the Zacks Consensus.

Image Source: Zacks Investment Research

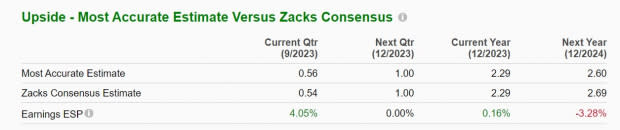

Facing a tougher-to-compete-against quarter, Yeti provides products for the outdoor and recreation market geared toward various activities such as hunting, fishing, and camping among others.

Yeti’s Q3 earnings are expected to dip -14% to $0.54 a share versus $0.63 per share a year ago. Quarterly sales are projected to be down -2% to $425.33 million. However, the Zacks ESP suggests Yeti could beat earnings expectations by 4% with the Most Accurate Estimate having Q3 EPS at $0.56 per share.

Image Source: Zacks Investment Research

Intriguing Outlooks

Further bolstering the possibility of Wix.com and Yeti surpassing Q3 earnings estimates is their strengthening outlooks.

With earnings estimate revisions nicely up over the last 30 days, Wix.com’s fiscal 2023 EPS is now forecasted at $3.60 per share and climb swinging from an adjusted loss of -$0.17 a share last year. Plus, FY24 earnings are expected to rise another 3%. Total sales are projected to rise 12% this year and climb another 12% in FY24 to $1.74 billion.

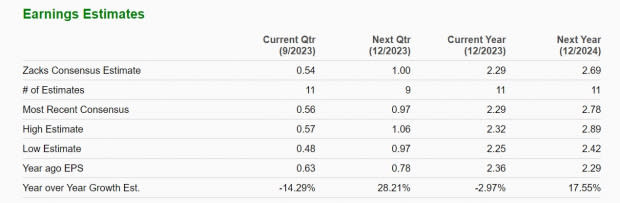

Image Source: Zacks Investment Research

Pivoting to Yeti, earnings are forecasted to dip -3% in FY23 but rebound and soar 17% in FY24 to $2.69 per share. Furthermore, sales are projected to be up 4% this year and jump another 10% in FY24 to $1.87 billion.

Image Source: Zacks Investment Research

Takeaway

Going into their Q3 reports Wix.com’s stock covets a Zacks Rank #1 (Strong Buy) with Yeti sporting a Zacks Rank #2 (Buy). Now looks like a good time to invest in Wix.com and Yeti stock as both companies may be able to surpass earnings expectations and perhaps provide guidance that reconfirms their intriguing outlooks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

YETI Holdings, Inc. (YETI) : Free Stock Analysis Report