Don't Race Out To Buy U.S. Energy Corp. (NASDAQ:USEG) Just Because It's Going Ex-Dividend

It looks like U.S. Energy Corp. (NASDAQ:USEG) is about to go ex-dividend in the next 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. In other words, investors can purchase U.S. Energy's shares before the 7th of November in order to be eligible for the dividend, which will be paid on the 22nd of November.

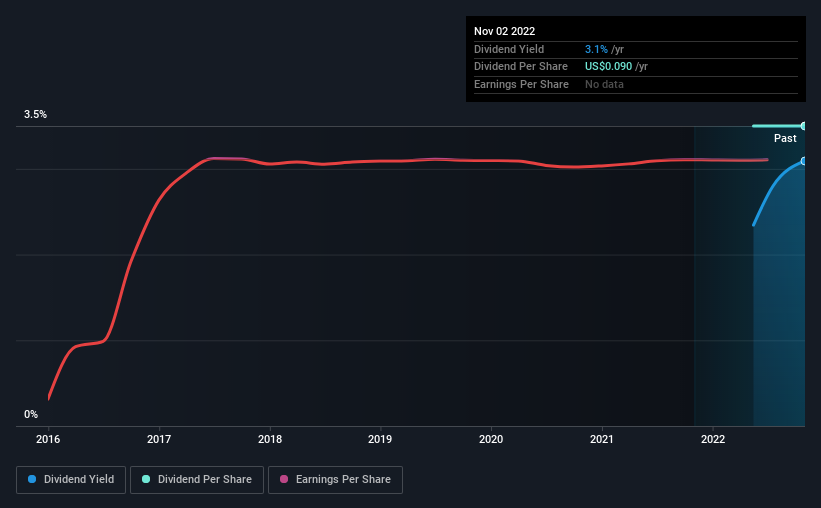

The upcoming dividend for U.S. Energy will put a total of US$0.022 per share in shareholders' pockets. If you buy this business for its dividend, you should have an idea of whether U.S. Energy's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for U.S. Energy

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. U.S. Energy lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. U.S. Energy paid a dividend despite reporting negative free cash flow last year. That's typically a bad combination and - if this were more than a one-off - not sustainable.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. U.S. Energy was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

This is U.S. Energy's first year of paying a dividend, so it doesn't have much of a history yet to compare to.

Remember, you can always get a snapshot of U.S. Energy's financial health, by checking our visualisation of its financial health, here.

The Bottom Line

From a dividend perspective, should investors buy or avoid U.S. Energy? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Second, the dividend was not well covered by cash flow." Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with U.S. Energy. Be aware that U.S. Energy is showing 4 warning signs in our investment analysis, and 2 of those are concerning...

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here