Don't Sweat ConocoPhillips Stock's Recent Breather

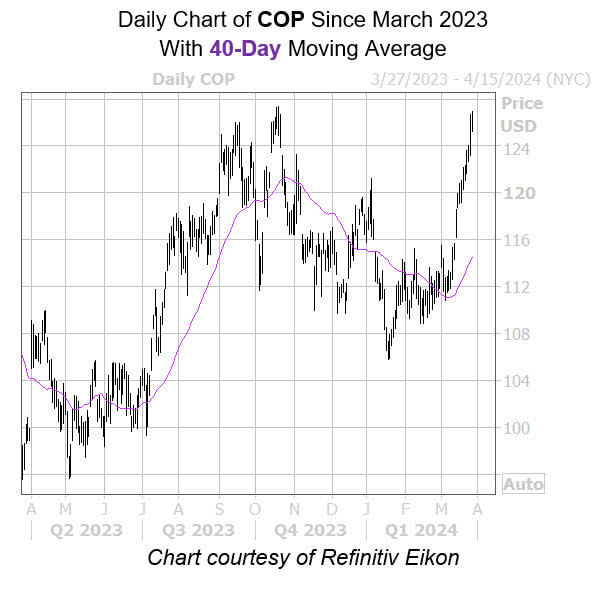

ConocoPhillips (NYSE:COP) is down 0.1% to trade at $126.02 at last check, but still sports a 29.2% year-over-year lead, with more than 8% amassed in 2024. The security surged to its highest level since October earlier, however, after staging a bounce off the supportive 40-day moving average a couple of weeks ago.

It may not be long until shares resume their rally, however, as they are currently flashing a historically bullish signal. ConocoPhillips stock's recent highs come amid historically low implied volatility (IV), as its Schaeffer's Volatility Index (SVI) of 20% ranks in the low 1st percentile of its annual range.

According to Schaeffer's Senior Quantitative Analyst Rocky White, COP has seen four signals over the past five years when it was trading within 2% of its 52-week high, while its SVI sat in the 20th percentile of its annual range or lower, as is the case now. Shares were higher one month later each time after these signals, averaging an 11.2% gain. A move of similar magnitude would place the stock at a new record high of $140.13.

An unwinding of pessimism in could fuel additional gains. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), COP's 10-day put/call volume ratio of 1.31 ranks higher than 91% of annual readings. This means short-term puts have been getting picked up at a quicker-than-usual clip.