Dorian LPG Ltd. Reports Substantial Earnings Growth in Q3 FY2024

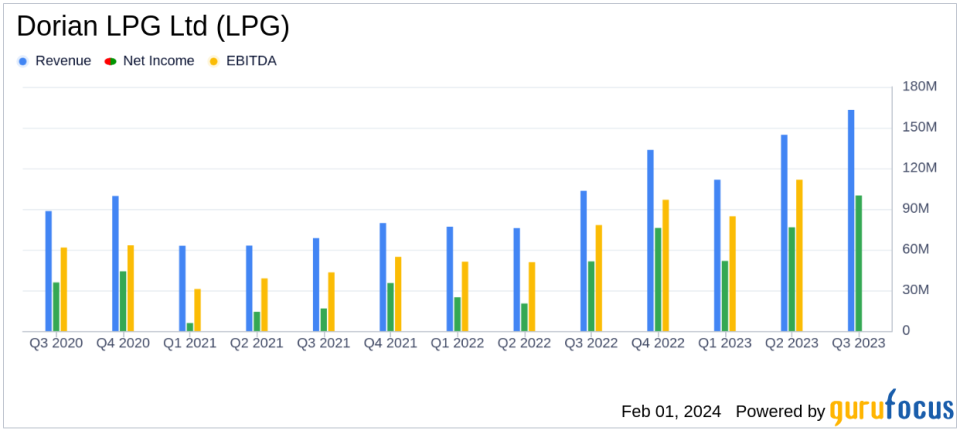

Net Income: $100.0 million, a 95.1% increase from the previous year's quarter.

Adjusted Net Income: $106.0 million, up from $52.0 million in the same quarter last year.

Revenue: Increased by 57.8% to $163.1 million compared to the previous year.

TCE Rate: $76,337 per operating day, a 44.7% increase from the prior year's quarter.

Fleet Utilization: Decreased slightly to 93.6% from 97.8% in the previous year.

Dividends: Cumulative dividend payments now exceed $463 million.

Fleet Expansion: Order placed for a new VLGC/AC, reflecting confidence in LPG market fundamentals.

On February 1, 2024, Dorian LPG Ltd (NYSE:LPG) released its 8-K filing, announcing financial results for the third quarter of the fiscal year 2024. Dorian LPG, an international leader in the shipping of liquefied petroleum gas (NYSE:LPG), operates a fleet of 22 modern very large gas carriers (VLGCs), including 19 ECO-design VLGCs. The company is headquartered in Stamford, Connecticut, with additional offices in London and Athens.

Financial Performance and Market Dynamics

Dorian LPG reported a robust financial performance for the quarter, with net income doubling to $100.0 million, or $2.47 per diluted share, from $51.3 million, or $1.27 per diluted share, in the same period last year. Adjusted net income, which excludes an unrealized loss on derivative instruments, rose to $106.0 million, or $2.62 per diluted share. This performance reflects a favorable market environment, characterized by higher spot rates and moderately lower bunker prices, leading to a significant 44.7% increase in the TCE rate per operating day to $76,337.

However, the company did face challenges, including a slight decrease in fleet utilization from 97.8% to 93.6%, and increases in various operating expenses. Vessel operating expenses per day rose to $9,936, driven by higher costs for spares, stores, and repairs. General and administrative expenses also increased, primarily due to higher stock-based compensation and cash bonuses.

Revenue and Expenses

Revenues for the quarter surged by 57.8% to $163.1 million, primarily due to an increase in average TCE rates and fleet size, despite a reduction in fleet utilization. Charter hire expenses increased by 60.3% to $8.4 million, mainly due to an increase in chartered-in days. Vessel operating expenses also saw a 7.1% increase to $19.2 million, reflecting the delivery of the dual-fuel VLGC Captain Markos and higher per-day operating costs.

Interest and finance costs rose by 16.7% to $10.1 million, mainly due to higher loan interest rates driven by rising SOFR on the company's floating-rate long-term debt. Unrealized loss on derivatives amounted to $6.1 million, a significant increase from the previous year, attributable to changes in forward SOFR yield curves.

Market Outlook and Strategic Moves

The company's strategic decision to order a new VLGC/AC signals confidence in the long-term fundamentals of the LPG market and the potential for ammonia transportation. The geopolitical environment remains a concern, with recent hostilities in the Red Sea underscoring the importance of seafarer safety.

Exports from the U.S. reached record levels in Q4 2023, with 5.5 million metric tons of LPG exported in December 2023 alone. The market outlook remains positive, with the VLGC orderbook representing approximately 14% of the current global fleet, and an additional 71 VLGCs expected to join the global fleet by 2027.

Dorian LPG's financial results demonstrate a strong position in a dynamic market, with significant growth in revenue and adjusted net income. The company's focus on expanding its fleet and capitalizing on favorable market conditions positions it well for future growth, despite the challenges posed by increased operating expenses and geopolitical risks.

For a more detailed analysis of Dorian LPG's financial results and market outlook, investors are encouraged to join the conference call on February 1, 2024, at 10:00 a.m. ET.

Dorian LPG continues to navigate the complex LPG shipping market with strategic foresight and operational excellence, as reflected in its latest financial results. For further information and updates, please visit the investor relations section at www.dorianlpg.com.

Explore the complete 8-K earnings release (here) from Dorian LPG Ltd for further details.

This article first appeared on GuruFocus.