DoubleVerify Holdings Inc (DV) Reports Robust Revenue Growth and Solid Profitability in Q4 and ...

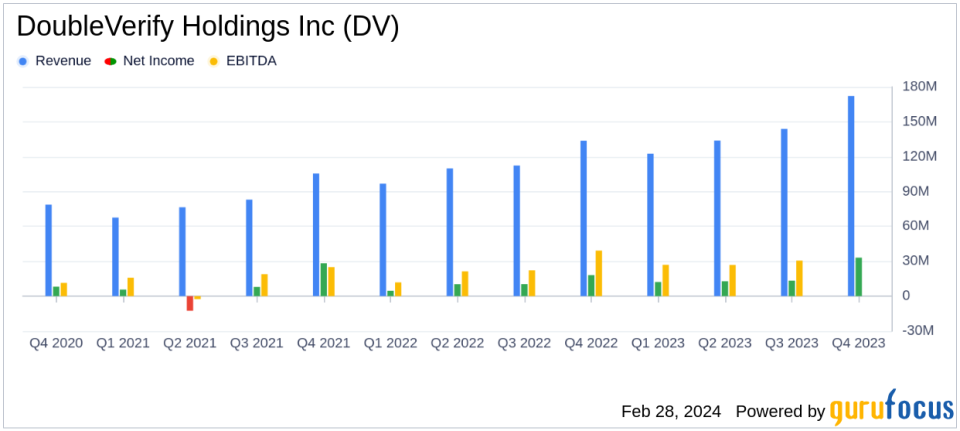

Revenue Growth: Q4 revenue increased by 29% year-over-year to $172.2 million; Full year revenue up 27% to $572.5 million.

Net Income: Q4 net income reached $33.1 million; 2023 annual net income totaled $71.5 million.

Adjusted EBITDA: Q4 Adjusted EBITDA stood at $65.4 million with a 38% margin; Full year Adjusted EBITDA at $187.1 million with a 33% margin.

Cash Flow: Net cash from operating activities for 2023 approximately $120 million.

Guidance: Anticipates continued revenue and Adjusted EBITDA growth for Q1 and full-year 2024.

On February 28, 2024, DoubleVerify Holdings Inc (NYSE:DV), a leading software platform for digital media measurement, data, and analytics, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company's Authentic Ad solution ensures that digital ads are delivered in a brand-safe environment, viewable by real individuals, and in the correct geography, generating revenue through Measured Transaction Fees based on the volume of Media Transactions Measured.

Financial Performance and Challenges

DoubleVerify's financial performance in Q4 and the full year of 2023 was marked by significant revenue growth, driven by global expansion in social, CTV measurement, and programmatic activation. The company achieved a 29% year-over-year increase in Q4 revenue, reaching $172.2 million, and a 27% increase in annual revenue, totaling $572.5 million. The robust growth in social measurement revenue, which surged by 62% year-over-year in Q4, underscores the company's strong execution and ability to capitalize on market opportunities.

Despite these achievements, DoubleVerify must navigate the challenges of a competitive digital advertising industry, where technological advancements and evolving industry standards are constant. The company's ability to maintain its growth trajectory and market share will depend on its continued innovation and the effectiveness of its solutions in a rapidly changing market.

Financial Achievements and Industry Significance

DoubleVerify's financial achievements, including a Q4 net income of $33.1 million and an adjusted EBITDA of $65.4 million, representing a 38% margin, are significant for the software industry. These results demonstrate the company's profitability and operational efficiency, which are particularly important in the software sector where margins are closely watched. The full-year net income of $71.5 million and adjusted EBITDA of $187.1 million, with a 33% margin, further highlight DoubleVerify's ability to scale profitably.

Key Financial Metrics and Commentary

Key financial metrics from DoubleVerify's income statement, balance sheet, and cash flow statement reveal a solid financial position. The company's cash and cash equivalents stood at $310.1 million at the end of 2023, up from $267.8 million in the previous year. Net cash provided by operating activities was approximately $119.7 million for the year, indicating strong cash generation capabilities.

"2023 was another year of exceptional growth and profitability driven by strong execution," said Mark Zagorski, CEO of DoubleVerify. "We measured 7 trillion media transactions, grew revenue by 27% to more than $572 million, achieved 33% adjusted EBITDA margins and generated approximately $120 million of net cash from operating activities."

"Our industry-leading 29% year-over-year revenue growth and 38% adjusted EBITDA margins in the fourth quarter are a testament to the strength of our platform," said Nicola Allais, CFO of DoubleVerify.

Analysis of Company Performance

DoubleVerify's performance in 2023 reflects its strategic focus on expanding its global footprint and enhancing its product offerings. The company's significant outpacing of the broader digital advertising industry's growth is indicative of the effectiveness of its solutions and the trust placed in them by global brands. With the introduction of new growth opportunities like Scibids AI and the expanded social video verification suite, DoubleVerify is well-positioned to continue its trajectory of market share growth.

The company's guidance for the first quarter and full-year 2024 suggests confidence in its ability to maintain momentum, with anticipated revenue and Adjusted EBITDA growth. However, as with any forward-looking statements, these projections are subject to various risks and uncertainties that could impact future performance.

For value investors and potential GuruFocus.com members, DoubleVerify's latest earnings report showcases a company with strong fundamentals, a clear growth strategy, and the ability to generate shareholder value in a competitive industry. The company's focus on innovation and market share expansion, coupled with its solid financial results, make it a noteworthy consideration for those interested in the software sector.

Explore the complete 8-K earnings release (here) from DoubleVerify Holdings Inc for further details.

This article first appeared on GuruFocus.