Douglas Elliman Inc (DOUG) Reports Mixed 2023 Financial Results Amid Real Estate Challenges

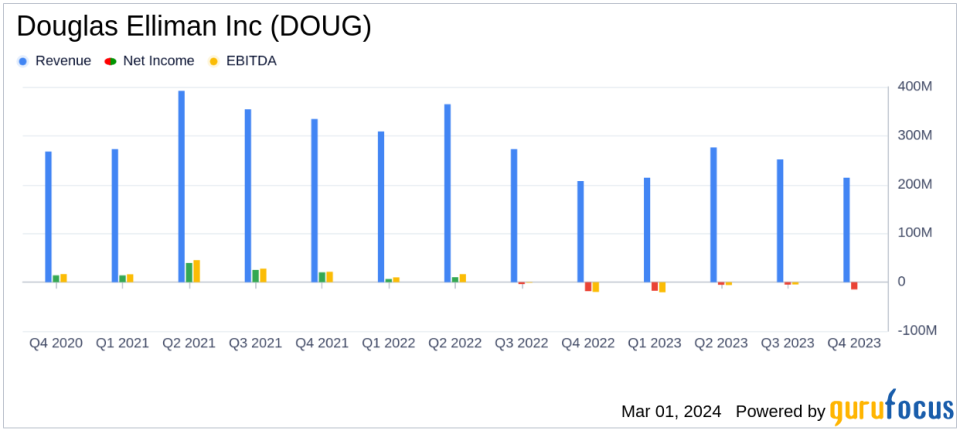

Q4 Revenue Increase: Douglas Elliman Inc (NYSE:DOUG) reported a slight increase in Q4 revenues to $214.1 million, up from $207.3 million in the same quarter last year.

Annual Revenue Decline: Full-year revenues declined to $955.6 million from $1.15 billion in the previous year, reflecting broader real estate market challenges.

Net Losses: The company experienced a net loss of $14.8 million in Q4 and $42.6 million for the full year, indicating ongoing operational challenges.

Adjusted EBITDA: Adjusted EBITDA showed a loss both quarterly and annually, with a Q4 loss of $17.5 million and a full-year loss of $40.7 million.

Gross Transaction Value: The gross transaction value for the real estate brokerage segment was approximately $7.9 billion in Q4 and $34.4 billion for the full year.

Douglas Elliman Inc (NYSE:DOUG) released its 8-K filing on March 1, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The company, a prominent real estate firm offering a wide range of services including sales, rentals, and new development, faced a challenging market environment yet managed to report a year-over-year increase in quarterly revenues for the first time since Q1 2022.

Financial Performance Overview

For the fourth quarter, Douglas Elliman Inc reported revenues of $214.1 million, a modest increase from $207.3 million in the prior year quarter. This was attributed to the strength of the luxury markets and a stabilization in home purchasing activity. However, the company recorded an operating loss of $23.6 million and a net loss of $14.8 million, or $0.18 per diluted common share, which was an improvement from the net loss of $18.4 million, or $0.23 per diluted common share, in the prior year quarter.

For the full year, revenues decreased to $955.6 million from $1.15 billion in the prior year, with the company's real estate brokerage segment experiencing a significant drop in gross transaction value from approximately $42.9 billion to $34.4 billion. The operating loss for the year was substantial at $64.5 million, and the net loss attributed to Douglas Elliman was $42.6 million, or $0.52 per diluted common share, compared to a loss of $5.6 million, or $0.08 per diluted common share, in the prior year.

Adjusted EBITDA and Net Loss

Adjusted EBITDA for the fourth quarter showed a loss of $17.5 million, slightly worse than the loss of $17.1 million in the prior year quarter. For the full year, the adjusted EBITDA loss widened significantly to $40.7 million from an income of $15.0 million in the prior year. The adjusted net loss for the year was $40.9 million, or $0.50 per diluted share, compared to a loss of $6.2 million, or $0.08 per diluted share, for the year ended December 31, 2022.

Market Position and Future Outlook

Despite the losses, Douglas Elliman's Chairman and CEO, Howard M. Lorber, expressed optimism about the company's positioning.

As the interest rate environment continues to improve, Douglas Elliman is well-positioned to drive long-term growth and value for stockholders due to the distinct competitive advantages provided by our dedicated team of world-class agents and leading development marketing business,"

Lorber stated.

With a strong balance sheet, including cash and cash equivalents of $119.8 million at the end of 2023, Douglas Elliman Inc appears to be maintaining financial stability despite the market downturn. Investors and stakeholders will be watching closely to see if the company's strategic advantages can translate into improved financial performance in the coming year.

For a more detailed analysis of Douglas Elliman Inc's financial results and to access the full earnings report, visit the SEC filing.

Explore the complete 8-K earnings release (here) from Douglas Elliman Inc for further details.

This article first appeared on GuruFocus.