Douglas Emmett Inc Reports Mixed Results Amidst Market Challenges

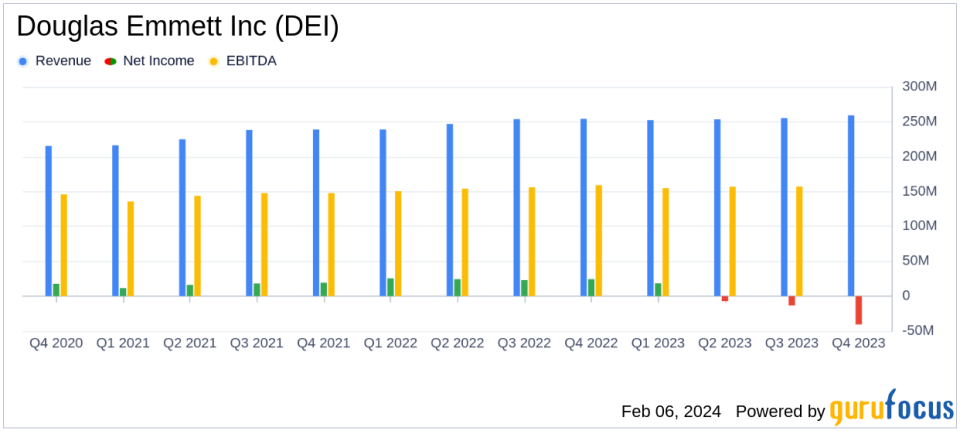

Revenue: Increased by 2.7% year-over-year to $1.02 billion.

Net Income: Decreased by 144.0% year-over-year to a net loss of $42.7 million.

Funds from Operations (FFO): Decreased by 10.1% year-over-year to $377.3 million.

Adjusted Funds from Operations (AFFO): Decreased by 15.7% year-over-year to $299.5 million.

Same Property Cash NOI: Decreased by 0.8% year-over-year to $603.6 million.

Leasing: Signed 872 office leases totaling 3.2 million square feet in 2023.

Guidance: 2024 Net Income Per Common Share - Diluted expected to be between $0.04 and $0.10.

On February 6, 2024, Douglas Emmett Inc (NYSE:DEI), a prominent real estate investment trust, released its 8-K filing, revealing a mixed financial performance for the fourth quarter and full year ended December 31, 2023. The company, which specializes in acquiring, developing, and managing Class A office properties and multifamily residential units in Los Angeles and Honolulu, reported a slight revenue increase but faced challenges that led to a net loss and decreased Funds from Operations (FFO).

Financial Performance and Challenges

Douglas Emmett's revenue for the quarter increased by 2.0% to $259.3 million, attributed to higher multifamily revenues and a one-time payment of accumulated back rent. However, the company's net income attributable to common stockholders saw a significant decrease, turning into a net loss of $40.5 million, or $0.24 per diluted share. This was partially due to an impairment charge on an interest in an unconsolidated fund and accelerated depreciation.

The company's FFO, a key metric for REITs, decreased by 12.0% to $92.9 million, or $0.46 per fully diluted share, primarily because of higher interest expenses, which were only partially offset by the increased multifamily revenue and back ground rent. Similarly, the AFFO decreased by 8.1% to $74.6 million. The same property Cash NOI also saw a decrease of 1.1% to $153.1 million, driven by a comparison to a strong prior period that benefited from one-time tax refunds.

Leasing and Balance Sheet Strengths

Despite the challenges, Douglas Emmett signed a substantial number of office leases in 2023, totaling 3.2 million square feet. The company's multifamily portfolio remained robust, with an occupancy rate of 98.5%. At the end of the quarter, Douglas Emmett had a strong cash position with cash and cash equivalents of $523.1 million and no corporate level debt, with almost half of its office properties unencumbered.

The company paid a quarterly cash dividend of $0.19 per common share on January 17, 2024, and provided guidance for 2024, projecting a Net Income Per Common Share - Diluted between $0.04 and $0.10, and an FFO per fully diluted share between $1.64 and $1.70. The guidance takes into account the expected move out of a large tenant in Burbank, modest leasing, the removal of Barrington Plaza from the rental market, and higher interest costs.

Analysis and Outlook

While Douglas Emmett's revenue growth indicates resilience in its core operations, the net loss and decline in FFO and AFFO reflect the broader market challenges, including higher interest rates and operating costs. The company's strong leasing activity and high occupancy rates in its multifamily portfolio demonstrate the enduring demand for its properties. However, the impairment charge and accelerated depreciation underscore the volatility in the valuation of real estate assets and investments.

Looking ahead, Douglas Emmett's guidance suggests cautious optimism, with modest growth expectations tempered by anticipated tenant departures and increased costs. The company's strong balance sheet, with significant cash reserves and no corporate level debt, positions it well to navigate the uncertain market conditions and continue its strategic operations in its high-demand markets.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing of Douglas Emmett Inc.

Explore the complete 8-K earnings release (here) from Douglas Emmett Inc for further details.

This article first appeared on GuruFocus.