Dover (DOV) to Boost Portfolio With FW Murphy Acquisition

Dover Corporation DOV announced that it signed a definitive agreement to acquire the business of FW Murphy Production Controls, LLC, a subsidiary of privately-owned Genisys Controls LLC. This move is in sync with Dover’s long tradition of successful acquisitions in diverse end markets.

Founded in 1939, FW Murphy provides reciprocating compressor control, remote monitoring, digital-twin-based predictive maintenance, and adaptive performance optimization components, solutions and instruments. Headquartered in Rosenberg, TX, the business is projected to generate $120 million in revenues in 2023, with significant aftermarket and recurring revenues.

FW Murphy's solutions are employed in the natural gas production, transportation and industrial markets. These are also used in the new hydrogen and carbon capture applications. Adding FW Murphy's solution portfolio will enable Dover to provide reciprocating compression customers with an outstanding selection of technology to improve efficiency and promote safety. It will further reduce carbon emissions and boost clean energy adoption.

Dover anticipates the combined product range and global go-to-market channels to result in tangible growth synergies.

The deal is set at a cash consideration of $530 million and is expected to close in the fourth quarter of 2023, subject to closing conditions. The transaction price, net of positive tax attributes, represents roughly 13X of FW Murphy's 2023 adjusted EBITDA, with its margin accretive to Dover's consolidated margin.

After closing, FW Murphy will become part of Dover's Pumps & Process Solutions segment's Dover Precision Components operational unit.

The Pumps & Process Solutions segment’s revenues increased 5.4% year over year to $465 million in the second quarter of 2023. The adjusted EBITDA of the segment totaled $141 million compared with the year-ago quarter’s $148 million.

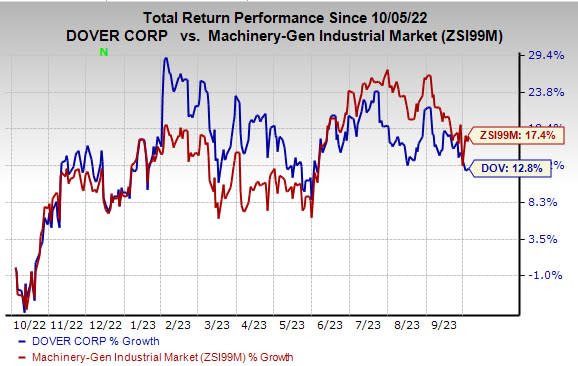

Price Performance

Shares of DOV have gained 12.8% in the past year compared with the industry’s rise of 17.4%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Dover currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Astec Industries, Inc. ASTE, Caterpillar Inc. CAT and EnerSys ENS. ASTE sports a Zacks Rank #1 (Strong Buy), and CAT and ENS have a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $2.81 per share. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. ASTE’s shares gained 22.8% in the last year.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.81 per share. The consensus estimate for 2023 earnings has moved north by 11.4% in the past 60 days. Its shares gained 51.6% in the last year.

The Zacks Consensus Estimate for EnerSys’ 2023 earnings per share is pegged at $7.78. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 10.3%. Shares of ENS rallied 49.7% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report