Dow (DOW) Warms Up to Q3 Earnings: What's in the Cards?

Dow Inc. DOW is scheduled to come up with third-quarter 2023 results before the opening bell on Oct 24.

The company surpassed the Zacks Consensus Estimate in three of the trailing four quarters while missed once. DOW delivered a trailing four-quarter earnings surprise of 13.1% on average. It posted an earnings surprise of 7.1% in the last reported quarter.

The company is expected to have benefited, in the third quarter, from its cost and productivity initiatives. However, soft demand due to weak global economic activities and plant turnaround costs are likely to have affected its performance.

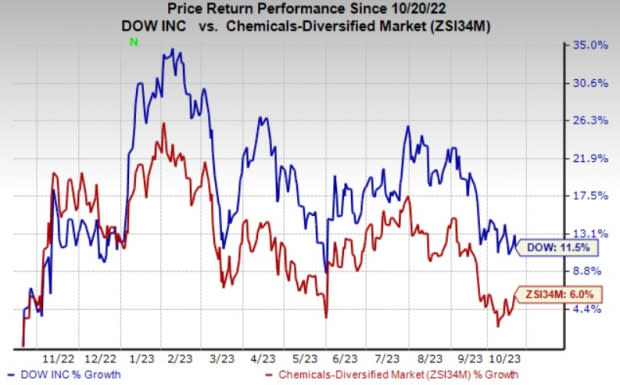

Dow’s shares are up 11.5% over a year compared with 6% rise recorded by the industry.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

Zacks Model

Our proven model predicts an earnings beat for Dow this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earning beat.

Earnings ESP: Earnings ESP for Dow is +6.30%. The Zacks Consensus Estimate for the third quarter is currently pegged at 44 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Dow currently carries a Zacks Rank #3.

What do the Estimates Say?

The Zacks Consensus Estimate for revenues for Dow for the third quarter is currently pegged at $10,392 million, suggesting a decline of around 26.4% year over year.

Some Factors at Play

Dow is expected to have gained from cost-saving and productivity actions in the September quarter. It remains focused on maintaining cost and operational discipline. DOW is implementing targeted actions focused on optimizing labor and purchased service costs. It expects these initiatives to deliver $1 billion in cost savings in 2023. Benefits of its restructuring program are likely to get reflected on the company’s bottom line in the third quarter.

However, DOW is expected to have faced headwinds from demand softness in Europe and Asia Pacific. Lower consumer spending amid inflationary pressures is likely to have impacted demand in Europe. In the Performance Materials & Coatings segment, the company is seeing weaker demand in consumer electronics and industrial end markets.

Softness across these markets is likely to have hurt volumes in this segment in the quarter to be reported. Our estimate for revenues for the Performance Materials & Coatings unit is pinned at $2,010.4 million, suggesting a decline of around 24.3% year over year.

Inflationary pressures are also impacting consumer durables and building and construction demand in Europe. This is likely to have affected the Industrial Intermediates & Infrastructure segment in the third quarter. Our estimate for revenues for the Industrial Intermediates & Infrastructure segment is pegged at $2,900.2 million, indicating a roughly 28.6% year-over-year decline.

In Packaging & Specialty Plastics, weaker consumer demand in Europe is likely to continue to have impacted volumes and sales in this unit. Prices are also expected to have remained weak in this segment. Our estimate for revenues for the Packaging & Specialty Plastics segment is currently pegged at $5,425.6 million, calling for a decline of 26% year over year.

The company is also likely to have faced headwinds from plant turnaround costs in the third quarter. Increased planned maintenance turnaround activities are expected to have affected the Packaging & Specialty Plastics segment in the quarter. Dow expects an associated headwind of roughly $100 million in the third quarter. The company also expects a $100 million headwind on earnings in the third quarter associated with an outage at its Plaquemine glycol plant in Louisiana.

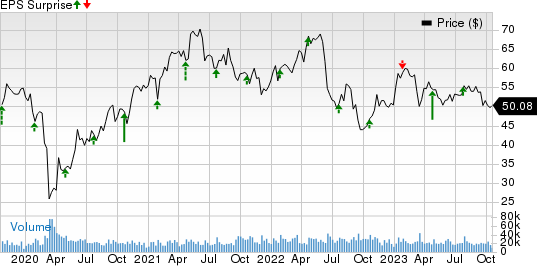

Dow Inc. Price and EPS Surprise

Dow Inc. price-eps-surprise | Dow Inc. Quote

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they too have the right combination of elements to post an earnings beat this quarter:

Element Solutions Inc ESI, scheduled to release earnings on Oct 25, has an Earnings ESP of +1.94% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for ESI’s earnings for the third quarter is currently pegged at 34 cents.

Methanex Corporation MEOH, slated to release earnings on Oct 25, has an Earnings ESP of +125.81% and carries a Zacks Rank #2 at present.

The consensus mark for MEOH’s third-quarter earnings is currently pegged at a loss of 8 cents.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +8.70%.

The Zacks Consensus Estimate for Kinross' earnings for the third quarter is currently pegged at 9 cents. KGC currently carries a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report