Dow Inc (DOW) Reports Decline in Q4 Sales Amid Macroeconomic Challenges

Net Sales: $10.6 billion, a 10% decrease compared to the same period last year.

Operating EBIT: $559 million, down $42 million year-over-year.

GAAP Net Loss: $95 million, compared to a net income of $647 million in the year-ago period.

Operating Earnings Per Share: $0.43, a slight decrease from $0.46 in the year-ago period.

Free Cash Flow: $870 million, with returns to shareholders totaling $616 million in the quarter.

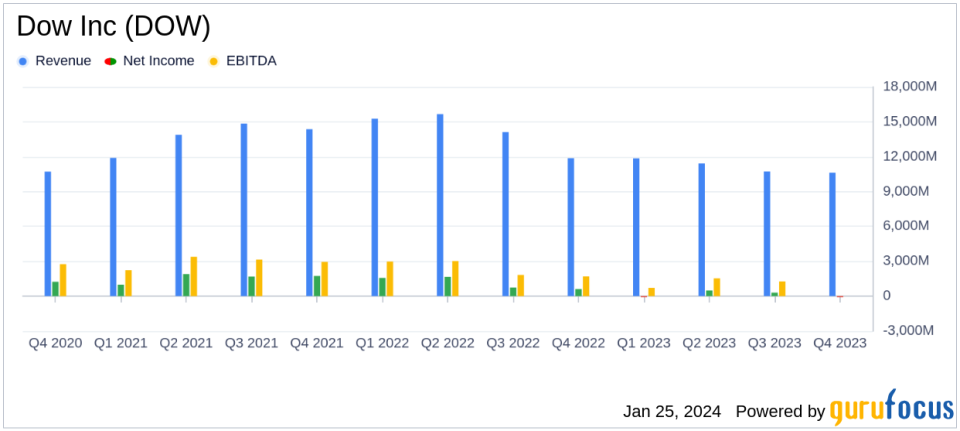

Full Year Net Sales: $44.6 billion for 2023, down from $56.9 billion in 2022.

Full Year GAAP Net Income: $660 million, a significant decrease from $4.6 billion in 2022.

On January 25, 2024, Dow Inc (NYSE:DOW) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a global leader in materials science with a focus on high-growth markets such as packaging and infrastructure, faced a challenging macroeconomic environment that led to a decrease in net sales and a GAAP net loss for the quarter.

Dow Inc (NYSE:DOW) reported net sales of $10.6 billion, a 10% decrease from the year-ago period, primarily due to declines in all operating segments as a result of slower global economic activity. Despite a 2% increase in volume compared to the previous year, local price decreases and lower feedstock and energy costs contributed to the overall sales decline. The company's operating earnings per share (EPS) of $0.43 reflected a slight decrease from $0.46 in the year-ago period, excluding significant items such as a one-time non-cash settlement charge related to pension de-risking plans.

The GAAP net loss of $95 million contrasted with a net income of $647 million in the same quarter of the previous year. Operating EBIT was down $42 million year-over-year, primarily driven by lower prices. Cash provided by operating activities from continuing operations was $1.6 billion, a decrease from the prior year, with free cash flow reaching $870 million. Despite the downturn, Dow Inc (NYSE:DOW) maintained its commitment to shareholder returns, totaling $616 million for the quarter, including dividends and share repurchases.

For the full year of 2023, Dow Inc (NYSE:DOW) reported net sales of $44.6 billion, a decrease from $56.9 billion in 2022. The GAAP net income for the year was $660 million, significantly lower than the $4.6 billion reported in the previous year. The company's operating EBIT for 2023 was $2.8 billion, down from $6.6 billion in 2022.

Segment Performance and Outlook

The Packaging & Specialty Plastics segment saw a 7% decrease in net sales compared to the year-ago period, with local price decreases being a major factor. However, volume increased by 3% year-over-year, led by higher packaging demand. The Industrial Intermediates & Infrastructure segment experienced a 19% decrease in net sales, with local price declines and reduced supply availability. The Performance Materials & Coatings segment's net sales were down 8% year-over-year, despite a 3% increase in volume.

Looking ahead, CEO Jim Fitterling highlighted the company's strategic priorities and focus on cash generation, which enabled significant free cash flow and shareholder returns. He also mentioned the commencement of construction for the Path2Zero project in Alberta, which aligns with Dow's long-term Decarbonize & Grow strategy.

In 2024, we will maintain our commitment to financial and operational discipline as we continue to navigate dynamic market conditions. While we expect softness in industrial and durable goods demand to continue in the first quarter, we are encouraged by early positive signals in areas including construction, automotive and consumer electronics," said Fitterling.

Dow Inc (NYSE:DOW) remains focused on navigating the economic cycle while advancing its strategic growth initiatives, with projects expected to deliver more than $3 billion in underlying earnings annually by 2030. The company's cost-advantaged footprint and leadership in attractive end markets position it well for long-term value creation.

For more detailed information on Dow Inc (NYSE:DOW)'s financial performance, investors and interested parties can access the full earnings report and listen to the earnings conference call via the events and presentations page of investors.dow.com.

Explore the complete 8-K earnings release (here) from Dow Inc for further details.

This article first appeared on GuruFocus.