DOW Unveils MDI Distillation & Prepolymers Facility in Texas

Dow Inc. DOW has announced the commencement of operation of a new MDI distillation and prepolymer facility at its world-scale manufacturing facility in Freeport, TX. This investment improves Dow's existing asset infrastructure while advancing its leadership positions in applications in the automotive, construction, consumer and industrial markets.

Dow's customers will receive 30% additional product from the new Freeport MDI facility, replacing its North America capacity in La Porte, TX. The company shut down its polyurethane assets at the La Porte site in connection with the start-up of the new MDI operations.

By reducing Dow's annual greenhouse gas emissions from operations by the amount equivalent of 6,000 cars off the road annually, lowering the amount of freshwater intake and the percentage of wastewater discharged annually, the new facility in Freeport contributes to a more environment-friendly production process.

With the assistance of Dow's vast Polyurethane franchise, rigid, semi-rigid and flexible foams, coatings, adhesives, sealants, elastomers and composites can be produced. These goods are utilized in a variety of applications, from energy-efficient insulation materials to automotive solutions for car interiors, from industrial and infrastructural solutions to consumer comfort solutions such as flooring, furniture, bedding and footwear.

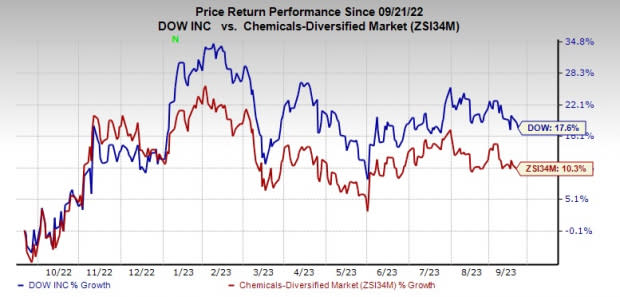

Shares of DOW have gained 17.6% over the past year compared with an 10.3% rise of its industry.

Image Source: Zacks Investment Research

Dow, on its second-quarter call, said that it remains focused on cost-savings actions and will continue to advance its longer-term strategic priorities as it faces a challenging macroeconomic environment in the second half of 2023. It is making progress with its actions to deliver $1 billion in cost savings in 2023. The company noted that its disciplined and balanced capital allocation priorities support its “Decarbonize and Grow” strategy to deliver long-term value creation for its shareholders.

The company expects third-quarter net sales in the band of $10.25-$10.75 billion.

Dow Inc. Price and Consensus

Dow Inc. price-consensus-chart | Dow Inc. Quote

Zacks Rank & Key Picks

Dow currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, The Andersons Inc. ANDE and Hawkins Inc. HWKN.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). The stock has rallied roughly 79.2% in the past year. CRS beat the Zacks Consensus Estimate in three of the last four quarters while meeting in one. It delivered a trailing four-quarter earnings surprise of 9.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Andersons currently carries a Zacks Rank #1. The stock has gained roughly 54.7% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Hawkins currently carries a Zacks Rank #1. The stock has rallied roughly 54.6% in the past year. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 25.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report