Downgrade: Here's How Analysts See EuroDry Ltd. (NASDAQ:EDRY) Performing In The Near Term

The analysts covering EuroDry Ltd. (NASDAQ:EDRY) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

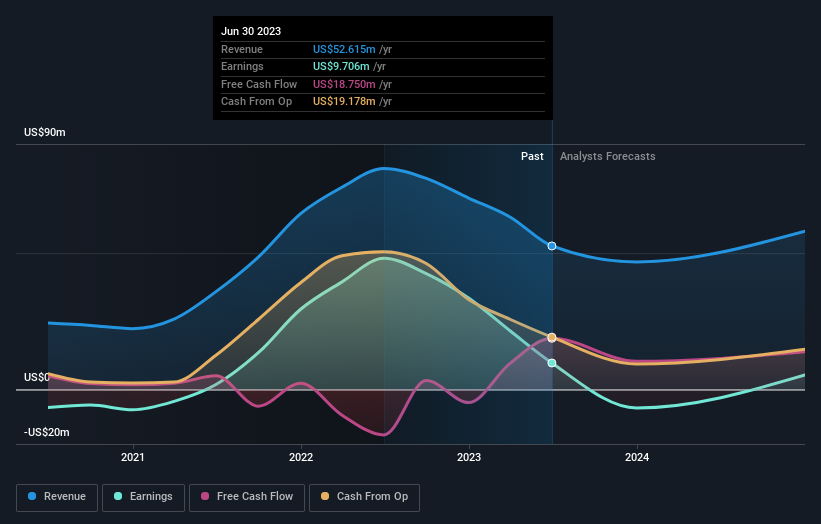

After the downgrade, the consensus from EuroDry's twin analysts is for revenues of US$47m in 2023, which would reflect a considerable 11% decline in sales compared to the last year of performance. Following this this downgrade, earnings are now expected to tip over into loss-making territory, with the analysts forecasting losses of US$2.45 per share in 2023. Prior to this update, the analysts had been forecasting revenues of US$62m and earnings per share (EPS) of US$1.31 in 2023. There looks to have been a major change in sentiment regarding EuroDry's prospects, with a pretty serious reduction to revenues and the analysts now forecasting a loss instead of a profit.

View our latest analysis for EuroDry

The consensus price target fell 6.0% to US$23.50, implicitly signalling that lower earnings per share are a leading indicator for EuroDry's valuation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 21% by the end of 2023. This indicates a significant reduction from annual growth of 28% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 3.2% annually for the foreseeable future. The forecasts do look bearish for EuroDry, since they're expecting it to shrink faster than the industry.

The Bottom Line

The biggest low-light for us was that the forecasts for EuroDry dropped from profits to a loss this year. Unfortunately they also downgraded their revenue estimates, and our aggregation of analyst estimates suggests that EuroDry revenue is expected to perform worse than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of EuroDry.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with EuroDry, including its declining profit margins. For more information, you can click here to discover this and the 3 other flags we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.