Doximity Inc (DOCS) Reports Robust Fiscal 2024 Q3 Results with Net Income Surging by 43%

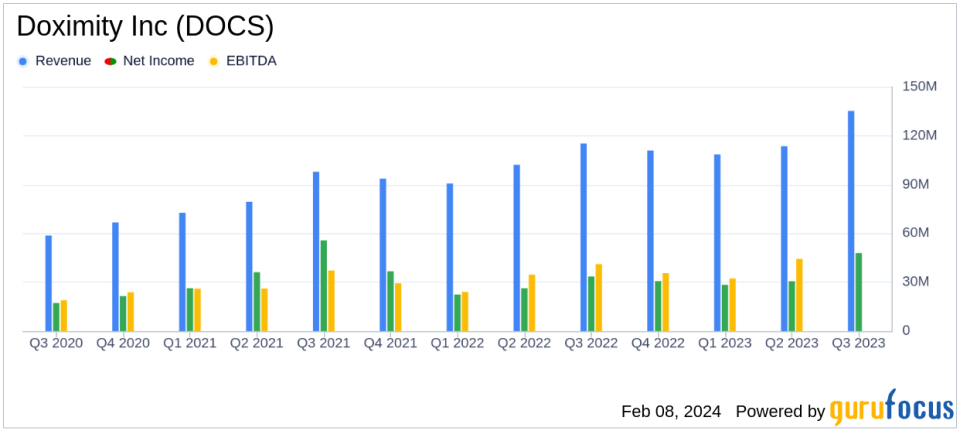

Revenue Growth: Doximity Inc (NYSE:DOCS) reported a 17% year-over-year increase in revenue, reaching $135.3 million.

Net Income: Net income grew by 43% compared to the same quarter last year, with a net income margin of 35%.

Adjusted EBITDA: Adjusted EBITDA rose by 32% year-over-year, with a margin of 54%.

Earnings Per Share: Diluted net income per share increased to $0.24 from $0.16, while non-GAAP diluted net income per share rose to $0.29 from $0.22.

Cash Flow: Operating cash flow and free cash flow both saw a 3% increase year-over-year.

On February 8, 2024, Doximity Inc (NYSE:DOCS), the premier digital platform for U.S. medical professionals, released its 8-K filing, disclosing its financial results for the fiscal third quarter ended December 31, 2023. The company's cloud-based platform offers a suite of tools for medical professionals, including collaboration features, virtual patient visits, and career management, which have contributed to its continued growth and financial success.

Fiscal 2024 Third Quarter Financial Performance

Doximity Inc (NYSE:DOCS) has reported a significant year-over-year revenue increase of 17%, totaling $135.3 million for the fiscal third quarter. This growth is attributed to the company's robust platform engagement and expansion of enterprise software clients, with 17 of the top 22 U.S. hospitals now utilizing Doximity's clinical workflow tools.

The company's net income margin impressively stood at 35%, with net income growing by 43% to $48.0 million. Adjusted EBITDA also saw a substantial increase of 32% year-over-year, reaching $73.3 million, which reflects a high adjusted EBITDA margin of 54%. These margins are particularly noteworthy as they demonstrate Doximity's ability to not only increase revenue but also to manage expenses effectively, resulting in strong profitability.

Doximity's diluted net income per share increased to $0.24, up from $0.16 in the previous year, while non-GAAP diluted net income per share rose to $0.29 from $0.22. This earnings growth is a clear indicator of the company's enhanced profitability and operational efficiency.

Cash Flow and Financial Health

The company's operating cash flow and free cash flow both experienced a 3% increase, indicating a steady cash generation capability. Operating cash flow was reported at $50.1 million, while free cash flow stood at $48.7 million. These figures are essential for investors as they provide insight into the company's ability to generate cash from its core business operations, which is crucial for funding growth initiatives and potential shareholder returns.

Looking at the balance sheet, Doximity Inc (NYSE:DOCS) maintains a strong financial position with $123.1 million in cash and cash equivalents and $587.1 million in marketable securities. The company's total assets amount to $1.0 billion, with liabilities totaling $136.0 million, indicating a solid net asset position.

Forward Guidance and Market Position

Doximity provided guidance for its fiscal fourth quarter, projecting revenue between $115.9 million and $116.9 million, and adjusted EBITDA between $50.5 million and $51.5 million. The company also updated its full fiscal year guidance, anticipating revenue between $473.3 million and $474.3 million, with adjusted EBITDA between $224.5 million and $225.5 million.

The company's performance is a testament to its leading position in the healthcare providers and services industry, where digital tools and platforms are increasingly critical for medical professionals. Doximity's ability to deliver double-digit engagement growth and expand its client base among top U.S. hospitals underscores its importance in the healthcare sector and its potential for future growth.

For more detailed information on Doximity Inc (NYSE:DOCS)'s financial results, please refer to the full 8-K filing.

Investors and potential GuruFocus.com members interested in the healthcare technology sector may find Doximity Inc (NYSE:DOCS)'s continued growth and profitability an appealing opportunity for value investment. The company's robust financial results and positive outlook reflect its strong market position and the increasing demand for digital healthcare solutions.

Explore the complete 8-K earnings release (here) from Doximity Inc for further details.

This article first appeared on GuruFocus.