Dr. Reddy's: A Profitable, Predictable Margin Expander

The Profitable Predictable Margin Expanders screener on GuruFocus has been a helpful one for me when searching for quality stocks that show solid growth. It does what the name suggests - it sorts through the thousands of stocks in the GuruFocus database and selects those that are currently profitable, have a business predictability ranking of at least 3 out of 5 stars and have expanding operating margins. There are no criteria for valuation or other considerations.

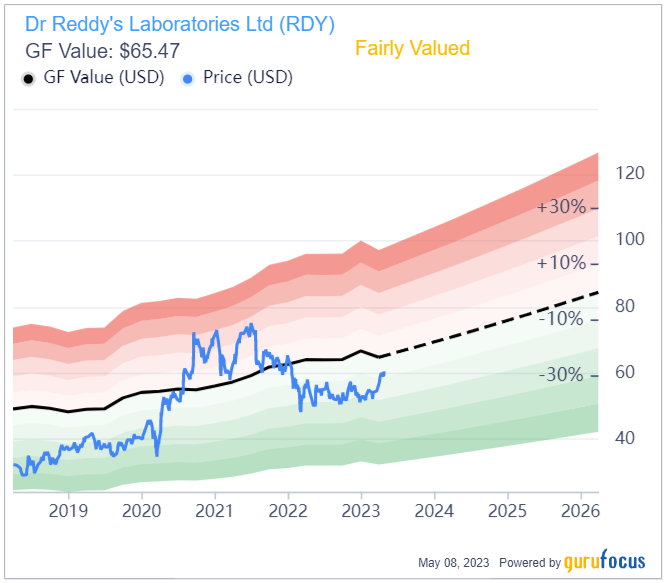

Dr. Reddy's Laboratories Ltd (NYSE:RDY) is one of only 42 stocks that make it through the screener. While it may not be undervalued, it is at least fairly valued according to the GF Value chart.

About Dr. Reddys

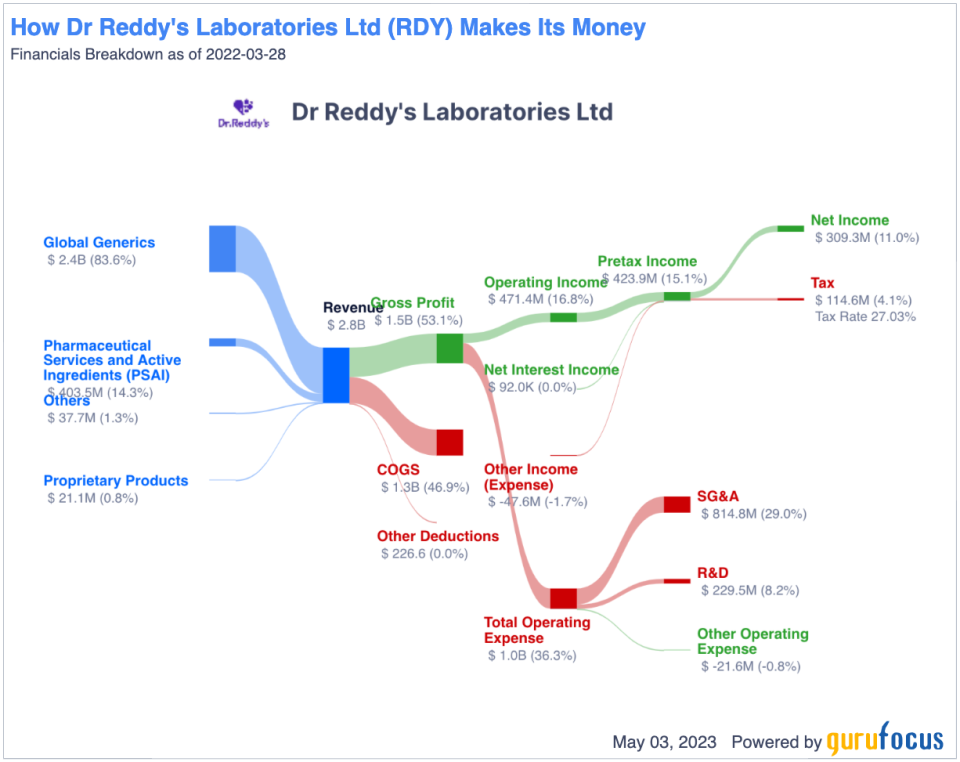

Dr. Reddy's develops and manufactures pharmaceutical products and specializes in low-cost, easy-to-produce generic drugs and pharmaceutical ingredients. This illustration of its income statement shows where it gets its revenues and what becomes of them:

Based in Hyderabad, India and traded on the New York Stock Exchange, it sells its products globally. It has a market cap of $10.18 billion and had trailing 12-month revenue of just under $3 billion.

Profitability

The company gets a GuruFocus profitability rank of 10 out of 10:

Note that it has industry-leading results for the drug manufacturers industry in all but one category. Most importantly for the screener, it enjoys a higher operating margin than 89.50% of peers.

It's worth noting, too, that its return on equity is among the best in the industry at 18.04%, which means it should double in value over four years by my estimates.

Growth

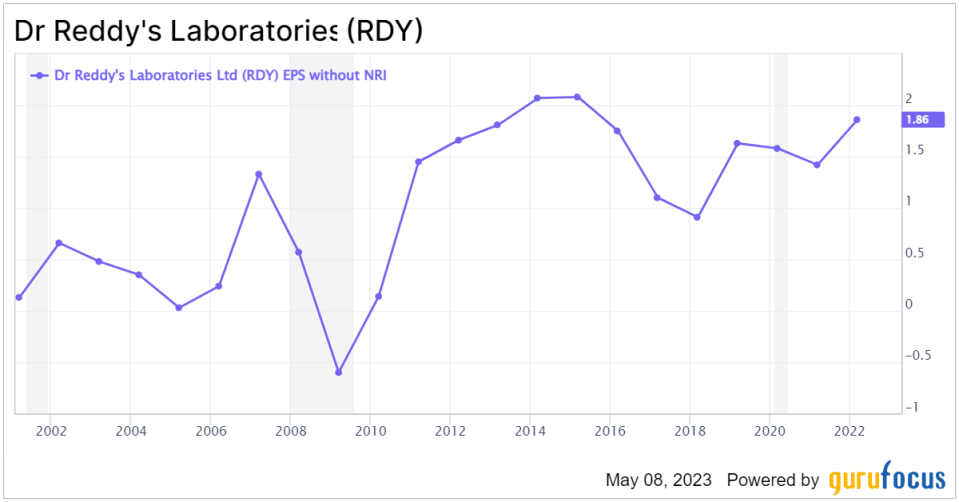

While there are lots of dark green bars on the profitability table, the picture doesnt look as positive for its growth based on the earnings per share without non-recurring items. As this 10-year chart shows, there have been only three "up" years in the past decade.

RDY Data by GuruFocus

Business predictability

Turning to predictability, Dr. Reddys scores 3 out of 5 on its GuruFocus business predictability rank, which meets the screener's minimum. Behind the predictability rank is the ability to consistently generate increased revenues and Ebitda, while keeping costs in line.

To grow its revenue relatively consistently, a company must have a tried and tested marketing strategy and new products that not only maintain current sales levels but also expand its market each year.

In addition, it also must keep its fixed and variable costs under control. That can be particularly difficult when inflation rises, but Dr. Reddys has a continuous improvement initiative.

Margins

Growing margins are the third major criterion for the screener. In this case, expansion means growth of net margin (a minimum of 10% per year) and the operating margin (a minimum of 5% per year).

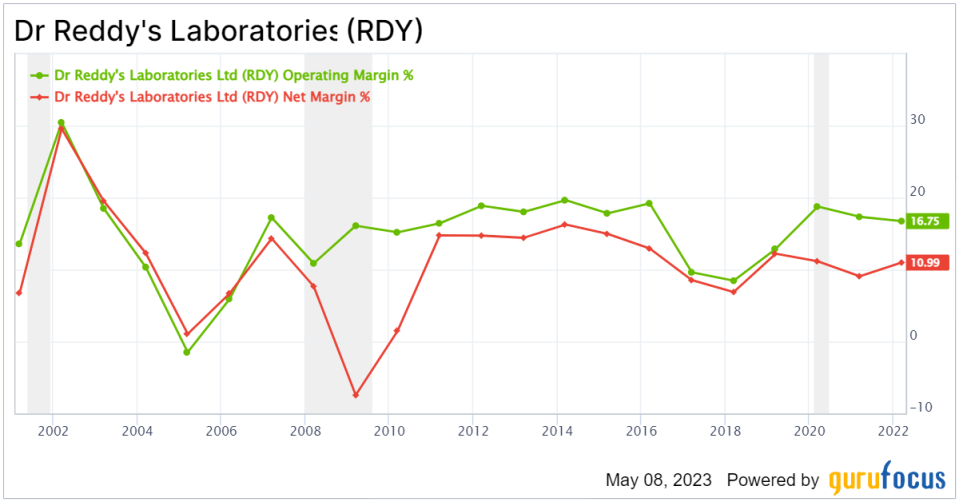

Heres a chart showing the operating margin in green and the operating margin in red:

RDY Data by GuruFocus

Obviously, there has been some improvement over the past five years, but over the past 10 years there has been a decline in these two margins.

Normally, I would take that as bad news, but we have to consider that both margins are still industry-leading, so perhaps they can be seen as normalizing rather than being in trouble.

Taking a closer look, I see that the industrys operating margin median is 5.16%, while the net margin median is 3.29%. Dr. Reddys is a high-flyer compared to most of the industry.

The margins are greater than they were five years ago, so I would grudgingly say they are expanding, but it's something to keep an eye on.

Annual report

How likely is the company to remain profitable, predictable and margin expansive? To assess this, I have taken a look at the company's latest 10K for 2022.

In its annual report for 2022, management reported, In FY22, we filed 10 Drug Master Files and seven ANDAs in the U.S., and launched 157 products across markets. As we can see, the company is growing its pipeline.

It also noted it is ready to grow through acquisitions:

Additionally, our strong balance sheet allows us to remain open to value-accretive inorganic opportunities. We recently acquired the cardiovascular brand Cidmus, and in FY22 also licensed the Voveran range for pain management, the Calcium range and Methergine in India. We entered the highly-regulated pharmaceutical cannabis market in Germany through the acquisition of Nimbus Health GmbH to target the CNS segment.

All of this is part of a consistent strategic orientation:

Over the years, we have reiterated our three strategy pillars leadership in chosen spaces (leading to market leadership), continuous improvement and operational excellence (leading to productivity), and patient-centric product innovation (to meet unmet needs). Our three-year compounded annual revenue growth at 12 percent, and Ebitda and ROCE close to our target at 25%, are evidence of effective implementation and the soundness of our strategy.

I always like to see continuous improvement initiatives, because they mean a company is focused on its costs, but not necessarily to the exclusion of everything else.

Dr. Reddys also cites continuing growth industry-wide:

According to IQVIAs recent report on medicine usage, global medicine spending is forecasted to reach $1.8 trillion by 2026, increasing at a rate of 3% to 6% annually. Trends in medicine use and spending have been impacted by the short term effects of Covid-19, with a cumulative reduction in spending of $175 billion expected through 2026 compared to the pre-pandemic outlook.

Looking forward, analysts at Morningstar Inc. (NASDAQ:MORN) expect EPS without NRI to increase from $2.67 per share last year to $2.88 per share for the current year, then $3.17 per share for the two subsequent years.

Overall, I believe Dr. Reddys Laboratories deserves its place on the screener. It appears to offer slow but steady growth potential for patient investors.

This article first appeared on GuruFocus.