Dr. Reddy's (RDY) Q2 Earnings and Revenues Beat Estimates

Dr. Reddy's Laboratories Limited RDY reported second-quarter fiscal 2024 earnings of $1.07 per American Depositary Share, which beat the Zacks Consensus Estimate of 88 cents. In the year-ago quarter, the company reported earnings of 81 cents per share.

In second-quarter fiscal 2024, revenues grew 9% year over year to $828 million, surpassing the Zacks Consensus Estimate of $826 million. Year-over-year growth was primarily driven by growth in core businesses in the North America and Europe regions.

Shares of the company have gained 25.7% year to date compared with the industry’s 10.2% rise.

Image Source: Zacks Investment Research

Quarter in Detail

Dr. Reddy’s reports revenues under three segments: Global Generics, Pharmaceutical Services & Active Ingredients (PSAI) and Others.

Global Generics revenues were INR 61.1 billion, up 9% year over year, in the fiscal second quarter. Growth was primarily driven by new product launches, favorable forex rates and an increase in volumes of existing core products in North America, Europe and Emerging markets, partially offset by price erosion.

During the reported quarter, Dr. Reddy’s launched four new products in the United States.

As of Sep 30, cumulatively, 79 generic filings were pending approval from the FDA (75 abbreviated new drug applications and four new drug applications). Of these 79 pending filings, 41 are Para IVs and 20 have first-to-file status.

PSAI revenues were INR 7 billion, up 9% from the year-ago quarter. The uptick in the revenues from this segment was mainly caused by lower volume pick up by new product launches and favorable forex rates, partly offset by price erosion.

Revenues in the Others segment came in at INR 684 million, up 1% year over year.

Research and development expenses were up 12% year over year to $66 million, driven by increased spending in ongoing clinical studies and developmental efforts. Dr. Reddy’s is focused on building a global pipeline of new products across its markets for both small molecules and biosimilars.

Selling, general and administrative expenses were $226 million, up 13% year over year, primarily owing to investments in business growth and other initiatives.

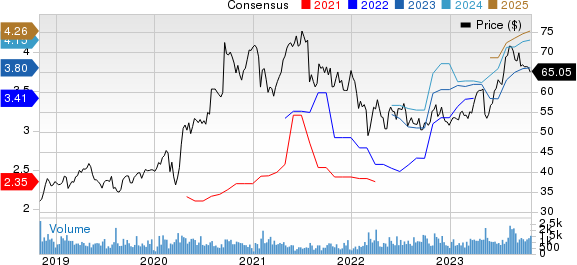

Dr. Reddy's Laboratories Ltd Price and Consensus

Dr. Reddy's Laboratories Ltd price-consensus-chart | Dr. Reddy's Laboratories Ltd Quote

Zacks Rank and Other Stocks to Consider

Dr. Reddy’s currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks worth mentioning are Dynavax Technologies DVAX, Anixa Biosciences ANIX and Adicet Bio, Inc. ACET. While DVAX sports a Zacks Rank #1, ANIX and ACET carry a Zacks Rank #2 (Buy) each at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Dynavax’s 2023 loss per share has narrowed from 23 cents to 22 cents. The estimate for Dynavax’s 2024 earnings per share is currently pegged at 8 cents. Year to date, shares of DVAX have gained 33.7%.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 25.78%.

In the past 30 days, the Zacks Consensus Estimate for Anixa Biosciences’ 2023 loss per share has remained constant at 32 cents. The estimate for Anixa Biosciences’ 2024 loss per share has remained constant at 37 cents. Year to date, shares of ANIX have lost 28.5%.

ANIX beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 26.29%.

In the past 30 days, the estimate for Adicet Bio’s 2023 loss per share has remained constant at $2.93. The estimate for Adicet’s 2024 loss per share has remained constant at $2.40. Year to date, shares of ACET have fallen 85.9%.

ACET’s earnings beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 7.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dr. Reddy's Laboratories Ltd (RDY) : Free Stock Analysis Report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Adicet Bio, Inc. (ACET) : Free Stock Analysis Report

ANIXA BIOSCIENCES INC (ANIX) : Free Stock Analysis Report