Dr. Reddy's (RDY) Q3 Earnings, Sales Increase Year Over Year

Dr. Reddy's Laboratories Limited RDY reported third-quarter fiscal 2022 earnings of 57 cents per American Depositary Share compared with 41 cents (excluding impairment charges) reported in the year-ago quarter.

In third-quarter fiscal 2022, revenues grew 7.8% year over year to $715 million.

Shares of the company have decreased 5.4% in the past year compared with the industry’s decline of 33.8%.

Image Source: Zacks Investment Research

Quarter in Detail

Dr. Reddy’s reports revenues under three segments — Global Generics; Pharmaceutical Services & Active Ingredients (“PSAI”); and Proprietary Products and Others.

Global Generics revenues were INR 44.5 billion, up 9% year over year, in the fiscal third quarter. Growth was led by the company’s new product launches and higher sales volume in key markets.

In December 2021, Dr. Reddy’s received emergency-use authorization to manufacture and market the oral anti-viral drug molnupiravir capsules (200 mg) for treating adult patients with COVID-19 from the drugs controller general of India.

The company launched four products in North America, including Carmustine injection, Ephedrine Sulphate injection, Valsartan tablets and Venlafaxine ER tablets.

As of Dec 31, cumulatively, 91 generic filings were pending approval from the FDA (88 abbreviated New Drug Applications [ANDAs] and three new drug applications). Of these 91 ANDAs, 45 are Para IVs and 24 have first-to-file status.

PSAI revenues were INR 7.3 billion, up 4% from the year-ago quarter primarily driven by new product launches.

Revenues in the Proprietary Products segment came in at INR 1.4 billion, reflecting a decrease of 8% year over year. Revenues in the segment also declined 22% sequentially owing to recognition of a license fee from the sale of its United States and Canada territory rights for Elyxyb (celecoxib oral solution, 25 mg/mL) to BioDelivery Sciences International, Inc. BDSI in second-quarter fiscal 2022.

In August 2021, Dr. Reddy’s entered into a definitive asset purchase agreement with BioDelivery Sciences, wherein the former sold its United States and Canada territory rights for Elyxyb to the latter.

Dr. Reddy’s received an upfront payment of $6 million from BioDelivery Sciences upon closing of the agreement.

Research and development expenses increased 1% year over year to $56 million. The company is undertaking the development of new products targeting various markets.

Selling, general and administrative expenses were $207 million, up 7% year over year higher, resulting from investments in sales and marketing for key brands and higher annual increments.

Our Take

In third-quarter fiscal 2022, Dr. Reddy’s top and bottom lines registered year-over-year growth.

However, the company continues to face price erosion, especially in the North America generics market, which is adversely impacting sales.

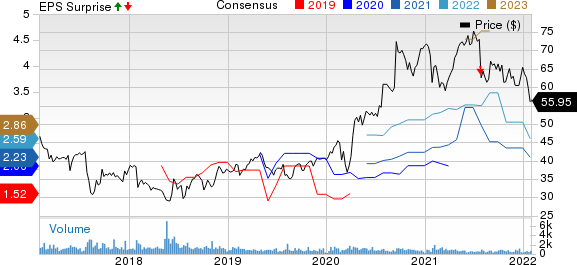

Dr. Reddy's Laboratories Ltd Price, Consensus and EPS Surprise

Dr. Reddy's Laboratories Ltd price-consensus-eps-surprise-chart | Dr. Reddy's Laboratories Ltd Quote

Zacks Rank & Stocks to Consider

Dr. Reddy’s currently carries a Zacks Rank #5 (Strong Sell).

Top-ranked stocks in the healthcare sector include Vertex Pharmaceuticals Incorporated VRTX and Cara Therapeutics, Inc. CARA, both sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vertex’s earnings estimates have been revised 2.5% upward for 2022 over the past 60 days. The stock has increased 4.8% in the past year.

Vertex’s earnings have surpassed estimates in each of the trailing four quarters

Cara Therapeutics’ loss per share estimates have narrowed 1.3% for 2022, over the past 60 days.

Cara Therapeutics’ earnings surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dr. Reddy's Laboratories Ltd (RDY) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

BioDelivery Sciences International, Inc. (BDSI) : Free Stock Analysis Report

Cara Therapeutics, Inc. (CARA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research