DraftKings (NASDAQ:DKNG) Reports Sales Below Analyst Estimates In Q4 Earnings

Fantasy sports and betting company DraftKings (NASDAQ:DKNG) fell short of analysts' expectations in Q4 FY2023, with revenue up 43.9% year on year to $1.23 billion. On the other hand, the company's full-year revenue guidance of $4.78 billion at the midpoint came in 2.3% above analysts' estimates. It made a non-GAAP profit of $0.29 per share, improving from its loss of $0.17 per share in the same quarter last year.

Is now the time to buy DraftKings? Find out by accessing our full research report, it's free.

DraftKings (DKNG) Q4 FY2023 Highlights:

Revenue: $1.23 billion vs analyst estimates of $1.24 billion (0.7% miss)

EPS (non-GAAP): $0.29 vs analyst estimates of $0.18 ($0.11 beat)

Management's revenue guidance for the upcoming financial year 2024 was upgraded to $4.78 billion at the midpoint, beating analyst estimates by 2.3% and implying 30.3% growth (vs 68.4% in FY2023)

Free Cash Flow was -$9.33 million, down from $135.2 million in the previous quarter

Gross Margin (GAAP): 41.8%, down from 43.2% in the same quarter last year

Monthly Unique Payers (MUP): 3.5 million vs analyst estimates of 3.3 million

Average Revenue per MUP: $116 vs analyst estimates of $124

Market Capitalization: $20.46 billion

“DraftKings ended 2023 with excellent performance across customer acquisition, retention and engagement as well as structural sportsbook hold percentage despite the worst stretch of sport outcomes we have seen as a public company in the fourth quarter,” said Jason Robins, DraftKings’ Chief Executive Officer and Co-founder.

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

Casinos and Gaming

Casino and gaming companies that offer slot machines, Texas Hold ‘Em, Blackjack and the like can enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits-have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casino and gaming companies may face stroke-of-the-pen risk that suddenly limits what they do or where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing casino and gaming companies to adapt to keep up with changing consumer preferences such as being able to wager anywhere on demand.

Sales Growth

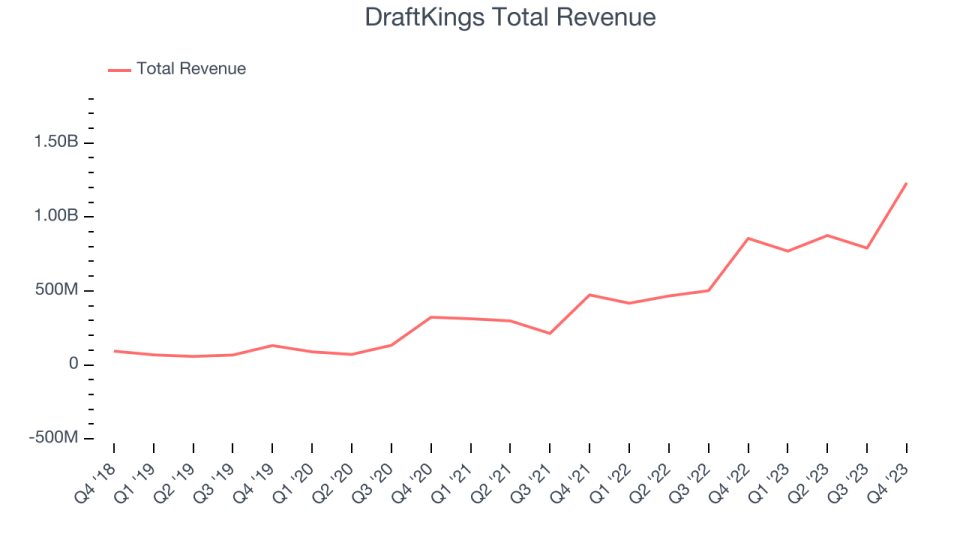

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. DraftKings's annualized revenue growth rate of 74.5% over the last five years was incredible for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. DraftKings's recent history shows its momentum has slowed, as its annualized revenue growth of 68.2% over the last two years is below its five-year trend.

This quarter, DraftKings achieved a magnificent 43.9% year-on-year revenue growth rate, but its $1.23 billion of revenue fell short of Wall Street's lofty estimates. Looking ahead, Wall Street expects sales to grow 27.7% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

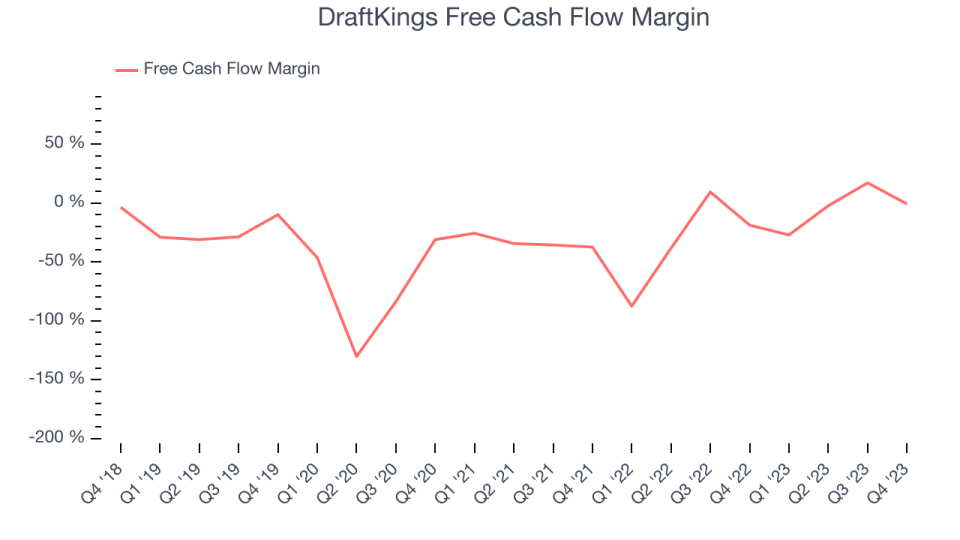

Over the last two years, DraftKings's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 12.9%.

DraftKings broke even from a free cash flow perspective in Q4. This quarter's result was great for the business as its margin was 18.1 percentage points higher than in the same period last year. Over the next year, analysts predict DraftKings will reach cash profitability. Their consensus estimates imply its LTM free cash flow margin of negative 2.8% will increase to positive 6.7%.

Key Takeaways from DraftKings's Q4 Results

We were impressed by how significantly DraftKings blew past analysts' EPS expectations this quarter. We were also glad it raised its full-year revenue and EBITDA guidance. Part of the reason for the guidance upgrade was that the company saw continued momentum in its user base expansion (DKNG is now at 3.5 million monthly unique payers compared to estimates of 3.3 million).

On the other hand, this quarter's average revenue per monthly payer fell short ($116 vs estimates of $124), causing the company to miss Wall Street's revenue and operating margin projections.

During the quarter, DraftKings launched its sportsbook product in Maine and Vermont, bringing its total number of operating states to 24. Pending regulatory approvals, the company also expects to launch in North Carolina on March 11th.

Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. Investors were likely expecting more, however, and the stock is down 3.4% after reporting, trading at $42.97 per share.

So should you invest in DraftKings right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.