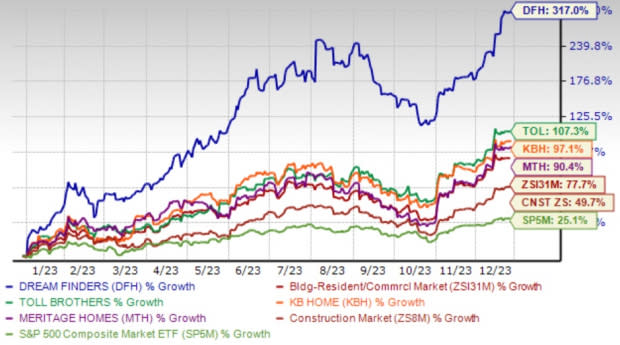

Dream Finders (DFH) Gains 317% YTD: Will it Continue in 2024?

Dream Finders Homes, Inc. DFH shares have skyrocketed 317% since January 2023 compared with the Zacks Building Products – Home Builders industry’s 77.7% growth, the Zacks Construction sector’s 49.7% rise and the S&P 500 Index’s 25.1% improvement.

This Jacksonville, FL-based homebuilder has been gaining from the lack of existing house supply and improving housing demographics. The company’s focus on accretive acquisitions and increasing affordability through its mortgage partner, Jet HomeLoans LLC., has also contributed to its growth momentum, despite uncertain macroeconomic conditions.

Adding to the analyst’s bullish sentiments, this new home construction company delivered a trailing three-quarter earnings surprise of 131.6%, on average. Earnings estimates for 2023 have moved north to $2.51 per share from $2.38 per share in the past 30 days.

Image Source: Zacks Investment Research

This trend is expected to continue in 2024 as well. The estimate for 2024 earnings also moved up to $2.81 per share from $2.62 per share in the past 30 days. This reflects a 12.2% year-over-year gain on 3.5% higher revenues.

Furthermore, solidifying this prospect, the company portrays a Momentum Score of B. Let’s check out the factors strengthening this Zacks Rank #1 (Strong Buy) company’s existing position. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Solid Demand Trends: Dream Finders’ top line is witnessing impressive growth, which is attributable to the improving demand patterns for new homes. The lack of existing house inventory boosted this uptrend, accompanied by a normalizing housing market. Homebuilding revenues in the third quarter of 2023 increased 14% year over year backed by 17% higher home closings.

Given this housing market scenario, the company witnessed a 38% year-over-year rise in net new orders to 1,535 in third-quarter 2023. The cancellation rate was 14.9%, representing an improvement from 25.5% reported a year ago.

The company has optimistic views on the upward trend and intends to maintain it with additional support from managing construction times and increasing inventory turnover.

Accretive Acquisitions: The company is notably benefiting from its accretive buyouts, which it has completed in the past few years. Apart from acquisitions, Dream Finders' growth strategy pivots around organic expansion plans, which help in additional margin expansion.

In October 2021, the company acquired the homebuilding, mortgage banking and title insurance assets of privately-held Texas homebuilder McGuyer Homebuilders, Inc. This buyout came with a backlog of more than 1,845 homes with a value in excess of $1 billion with 5,500 lots under control along with increased geographical reach. Furthermore, in October 2020, it acquired H&H Constructors of Fayetteville, LLC, which extended its product offerings to the first-time and move-up market. Also, this expanded its geographical reach in high-growth markets, Raleigh and Charlotte.

Notable Mortgage Partner: Dream Finders’ mortgage partner, Jet HomeLoans, offers various loan programs to potential homebuyers to make mortgage payments hassle-free. Through this joint venture, the company ensures the affordability of homes, even during uncertain economic conditions.

The diversified loan options are conditioned to cater to the differentiated needs and financial conditions of the potential buyers. This boosts the sales volume as the customers are thoroughly educated on the programs and the company closely monitors its product offerings at the community level to ensure competitive pricing.

Higher ROE: Dream Finders’ trailing 12-month return on equity (ROE) is indicative of its growth potential. The company’s ROE of 38.1% compares favorably with the industry’s 18.2%, which signals more efficiency in using shareholders’ funds than peers.

Three Additional Stocks Outpacing Industry in YTD

Toll Brothers, Inc. TOL: This Fort Washington, PA-based homebuilder has been riding high, given strong market demand, combined with its policy of boosting its supply of spec homes and focus on operational efficiency. Also, the emphasis on affordable luxury communities and its build-to-order model bodes well.

Shares of the company have rallied 107.3% so far this year. Earnings estimates for fiscal 2024 have increased to $12.63 per share from $12.58 over the past seven days. The company’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 29.4%.

KB Home KBH: Based in Los Angeles, CA, KB Home is a well-known homebuilder in the United States and one of the largest in the state. Homebuilding operations include building and designing homes that cater to first-time, move-up and active adult homebuyers on acquired or developed lands.

KB Home has jumped 97.1% year to date. Earnings estimates for fiscal 2024 of $7.21 per share reflects 4.8% year over year growth. The company’s earnings surpassed the Zacks Consensus Estimate in each of the trailing three quarters, the average being 26.7%.

Meritage Homes Corporation MTH: Based in Scottsdale, AZ, Meritage Homes is one of the leading designers and builders of single-family homes. The company primarily engages in building and selling single-family homes for entry-level, first-time, move-up, luxury and active adult buyers in historically high-growth regions of the United States.

MTH delivered a trailing four-quarter earnings surprise of 25.8%, on average. Shares of the company have gained 90.4% so far this year. Earnings estimates for 2024 have increased to $19.47 per share from $19.39 over the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Dream Finders Homes, Inc. (DFH) : Free Stock Analysis Report