Dril-Quip, Inc.'s (NYSE:DRQ) Share Price Matching Investor Opinion

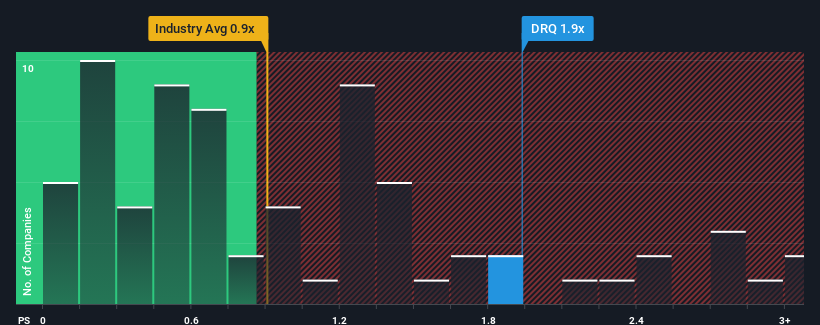

Dril-Quip, Inc.'s (NYSE:DRQ) price-to-sales (or "P/S") ratio of 1.9x may not look like an appealing investment opportunity when you consider close to half the companies in the Energy Services industry in the United States have P/S ratios below 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Dril-Quip

How Dril-Quip Has Been Performing

Dril-Quip could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dril-Quip.

What Are Revenue Growth Metrics Telling Us About The High P/S?

Dril-Quip's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the three analysts watching the company. With the industry only predicted to deliver 9.7% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Dril-Quip's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Dril-Quip's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Dril-Quip shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Dril-Quip with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.