Dril-Quip Inc's Meteoric Rise: Unpacking the 22% Surge in Just 3 Months

Dril-Quip Inc (NYSE:DRQ), a leading player in the Oil & Gas industry, has seen a significant uptick in its stock performance recently. Over the past week, the company's stock price has seen a gain of 4.51%, and over the past three months, it has surged by an impressive 21.82%. The current price of the stock stands at $30.1, with a market capitalization of $1.03 billion.

Understanding the GF Value

The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, Dril-Quip's GF Value is at $30.6, indicating that the stock is fairly valued. This is a slight increase from the past GF Value of $30.35 three months ago, suggesting that the stock was modestly undervalued at that time.

Company Overview

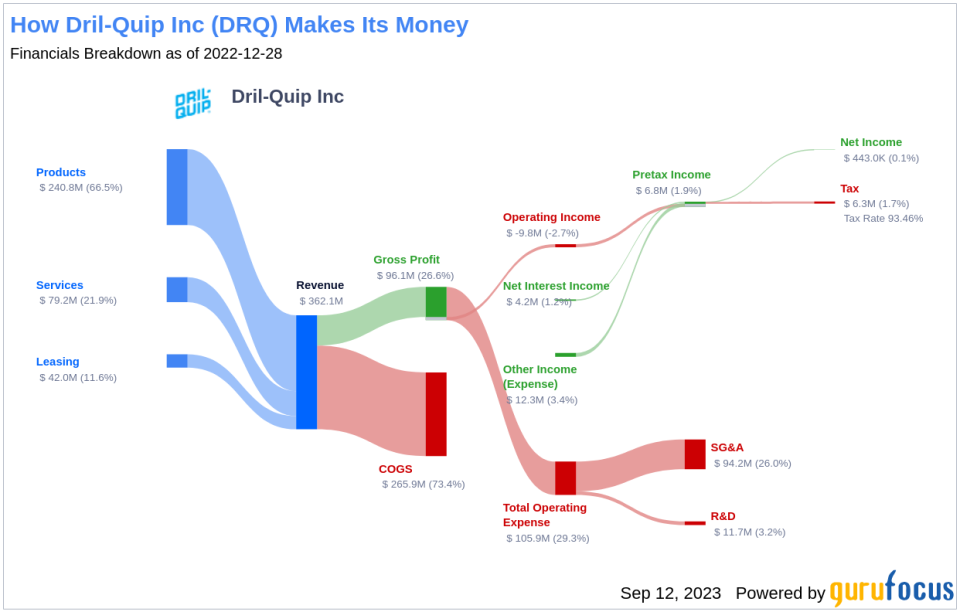

Dril-Quip Inc. is a renowned company that designs, manufactures, sells, and services engineered drilling and production equipment for both offshore and onshore applications. The company's operations are organized into three geographic segments: Western Hemisphere, Eastern Hemisphere, and Asia-Pacific. The company's revenues are derived from product sales, service revenues, and leasing revenues.

Profitability Analysis

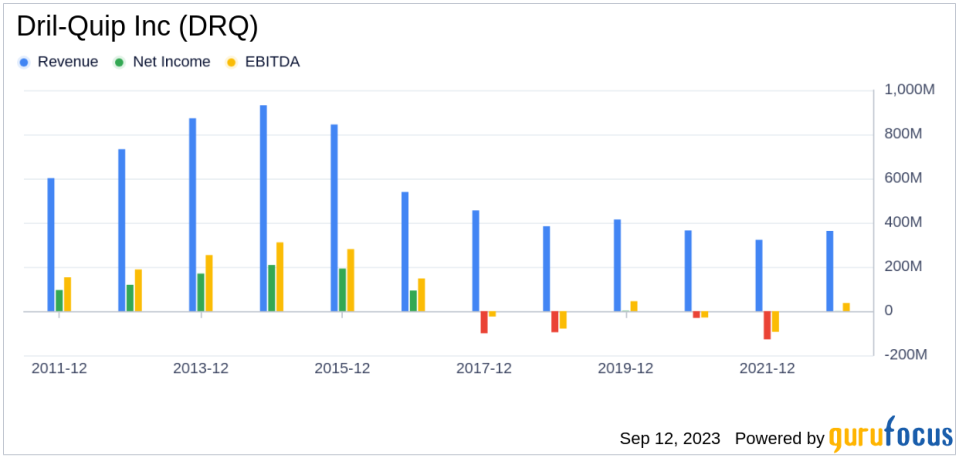

Dril-Quip's Profitability Rank stands at 4/10, indicating moderate profitability. The company's Operating Margin is -1.41%, which is better than 23.4% of companies in the industry. The ROE and ROA are 2.37% and 2.13% respectively, both better than a significant percentage of industry peers. The ROIC stands at -0.64%, better than 32.9% of companies in the industry. Over the past 10 years, the company has been profitable for 6 years, which is better than 59.75% of companies.

Growth Prospects

Dril-Quip's Growth Rank is 1/10, suggesting low growth. However, the company's 3-year and 5-year revenue growth rates per share are -2.90% and -3.40% respectively, both better than a significant percentage of companies in the industry. The future total revenue growth rate is estimated to be 6.09%, which is better than 57.47% of companies.

Major Stock Holders

The top three holders of Dril-Quip stock are Mario Gabelli (Trades, Portfolio), Charles Brandes (Trades, Portfolio), and Chuck Royce (Trades, Portfolio). Mario Gabelli (Trades, Portfolio) holds 1,955,043 shares, representing 5.72% of the total shares. Charles Brandes (Trades, Portfolio) holds 1,612,533 shares, accounting for 4.72% of the total shares. Chuck Royce (Trades, Portfolio) holds 497,845 shares, representing 1.46% of the total shares.

Competitive Landscape

Dril-Quip faces competition from US Silica Holdings Inc(NYSE:SLCA) with a market cap of $1.09 billion, MRC Global Inc(NYSE:MRC) with a market cap of $819.963 million, and ProPetro Holding Corp(NYSE:PUMP) with a market cap of $1.16 billion.

Conclusion

In conclusion, Dril-Quip Inc. has shown a promising performance in the stock market with a significant gain over the past three months. The company's profitability and growth prospects, along with its competitive position in the industry, make it a stock worth watching for potential investors.

This article first appeared on GuruFocus.