Dropbox (DBX) Q4 Earnings Beat Estimates, Revenues Up Y/Y

Dropbox DBX reported fourth-quarter 2023 non-GAAP earnings of 50 cents per share, beating the Zacks Consensus Estimate by 4.17% and increasing 25% year over year.

Revenues of $635 million increased 6% year over year and beat the consensus mark by 0.67%.

Total annual recurring revenues came in at $2.523 billion, up 0.3% year over year.

Quarter Details

Dropbox exited the fourth quarter of 2023 with 18.12 million paying users, marking a sequential decline of roughly 0.05 million. The average revenue per paying user was $138.83, up more than $4 year over year.

In the fourth quarter, Dropbox reported a non-GAAP gross margin of 82.3%, up 20 basis points (bps) year over year.

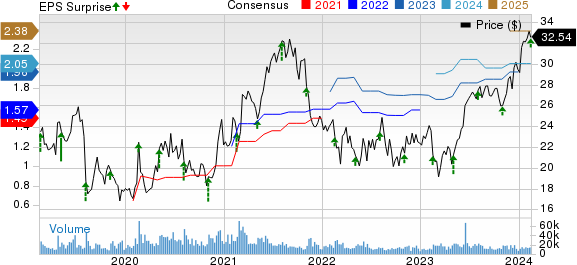

Dropbox, Inc. Price, Consensus and EPS Surprise

Dropbox, Inc. price-consensus-eps-surprise-chart | Dropbox, Inc. Quote

In the reported quarter, research and development expenses were $158.9 million, down 8.5% year over year.

Sales & marketing expenses increased 16% year over year to $111.1 million.

General & administrative expenses jumped 11.4% year over year to $47.7 million.

Dropbox reported a non-GAAP operating margin of 32.2%, up 230 bps year over year.

In the fourth quarter of 2023, DBX recorded a net gain on real estate assets of $158.8 million related to the partial termination of the lease for its San Francisco corporate headquarters.

Balance Sheet & Cash Flow

As of Dec 31, 2023, Dropbox had cash, cash equivalents and short-term investments of $1.36 billion compared with $1.31 billion as of Sep 30, 2023.

In the fourth quarter, Dropbox reported a free cash flow of $190.3 million as compared with $246.5 million reported in the previous quarter.

Guidance

For first-quarter 2024, Dropbox expects revenues between $627 million and $630 million. Non-GAAP operating margin is expected to be roughly 33%.

For 2024, Dropbox expects revenues between $2.535 billion and $2.55 billion. At constant currency, revenues are expected between $2.532 billion and $2.547 billion.

The company expects gross margin to be in the 83-83.5% range for the full year. Non-GAAP operating margin is expected in the 32-32.5% range.

Dropbox expects free cash flow between $910 million and $950 million.

Zacks Rank & Stocks to Consider

Dropbox currently carries a Zacks Rank #3 (Hold).

DBX shares have gained 10.4% year to date, outperforming the Zacks Computer & Technology sector’s growth of 7.5%.

Dell Technologies DELL, Itron ITRI and CrowdStrike CRWD are some better-ranked stocks that investors can consider in the broader sector. While Dell carries a Zacks Rank #2 (Buy), Itron and CrowdStrike sport a Zacks Rank #1 (Strong Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dell Technologies shares have gained 8.1% year to date. DELL is set to report its fourth-quarter fiscal 2024 results on Feb 29.

Itron shares have gained 2.5% year to date. ITRI is set to report its fourth-quarter 2023 results on Feb 26.

CrowdStrike shares have jumped 29.8% year to date. CRWD is set to report its fourth-quarter fiscal 2024 results on Mar 5.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report