Dropbox (NASDAQ:DBX) Posts Q4 Sales In Line With Estimates But Customer Growth Slows Down

Cloud storage and e-signature company Dropbox (Nasdaq: DBX) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 6% year on year to $635 million. It made a non-GAAP profit of $0.50 per share, improving from its profit of $0.40 per share in the same quarter last year.

Is now the time to buy Dropbox? Find out by accessing our full research report, it's free.

Dropbox (DBX) Q4 FY2023 Highlights:

Revenue: $635 million vs analyst estimates of $631.7 million (small beat)

EPS (non-GAAP): $0.50 vs analyst estimates of $0.48 (3.4% beat)

Free Cash Flow of $190.3 million, down 22.8% from the previous quarter

Customers: 18.12 million, down from 18.17 million in the previous quarter

Gross Margin (GAAP): 80.8%, in line with the same quarter last year

Market Capitalization: $11.21 billion

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Document Management

The catch phrase "digital transformation" originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

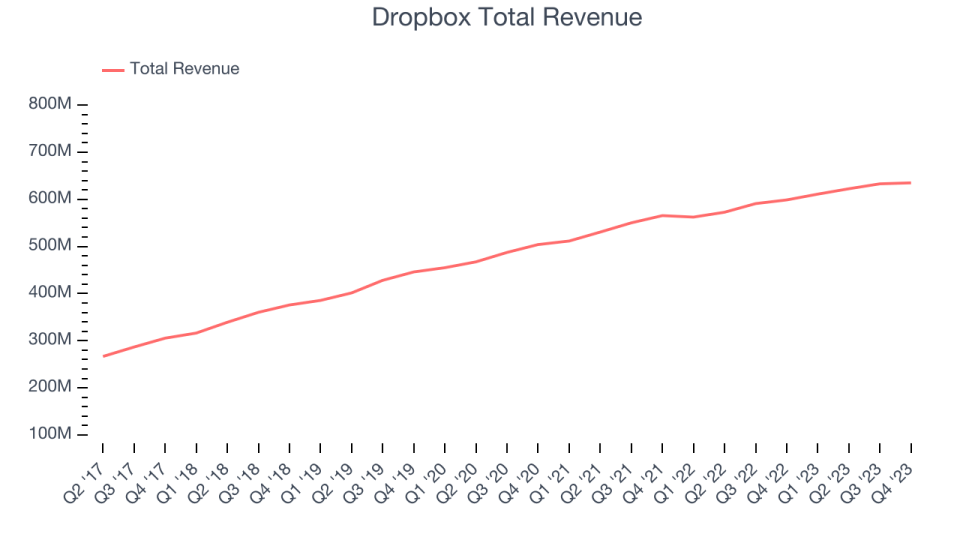

Sales Growth

As you can see below, Dropbox's revenue growth has been unimpressive over the last two years, growing from $565.5 million in Q4 FY2021 to $635 million this quarter.

Dropbox's quarterly revenue was only up 6% year on year, which might disappoint some shareholders. Additionally, its growth did slow down compared to last quarter as the company's revenue increased by just $2 million in Q4 compared to $10.5 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

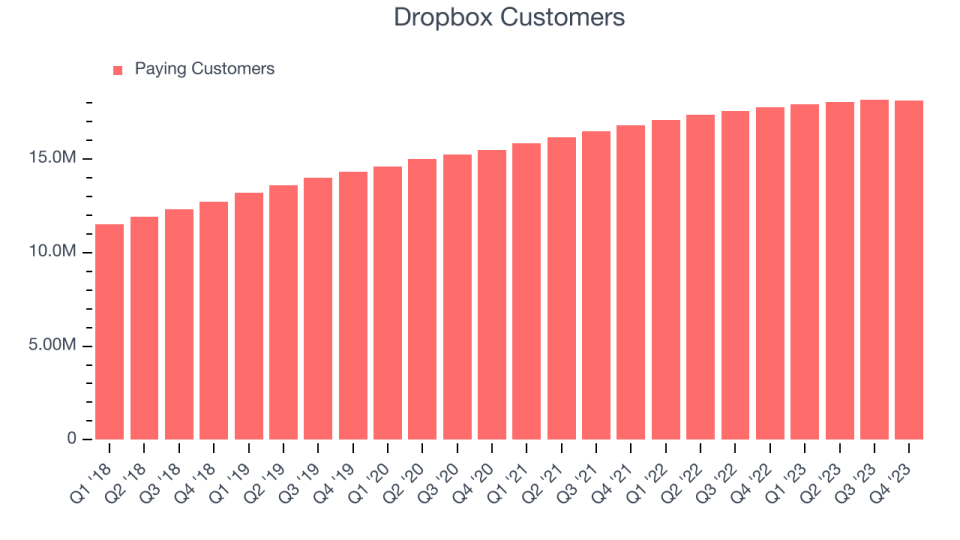

Customer Growth

Dropbox reported 18.12 million customers at the end of the quarter, a decrease of 50,000 from the previous quarter, suggesting that the company's customer acquisition momentum is slowing.

Key Takeaways from Dropbox's Q4 Results

While Dropbox exceeded analysts' revenue estimates this quarter, growth has slowed down, along side with customer acquisition. Overall, this was a mediocre quarter for Dropbox. The company is down 2% on the results and currently trades at $31.89 per share.

Dropbox may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.