Drug, Biotech Stock Q4 Earnings Due on Feb 15: ALNY, BPMC & More

The fourth-quarter 2023 reporting cycle of the Medical sector picked up pace in the last two weeks. The sector mainly comprises pharma/biotech and medical device companies.

The earnings season for the Medical sector started in late January when bellwether Johnson & Johnson reported better-than-expected fourth-quarter results. It beat estimates for earnings as well as sales, primarily due to the strong performance of its Innovative Medicines segment.

Among other drugmakers, Biogen reported weak fourth-quarter results, as it missed estimates for both earnings and sales. Earnings were hurt by a 35-cent closeout cost for Biogen’s controversial Alzheimer’s drug, Aduhelm, and lower revenues. Sales of all important medicines, Tecfidera, Tysabri & Spinraza, declined in the quarter.

Per the Earnings Trends report, as of Feb 7, 56.7% of the companies in the Medical sector — representing 85.8% of the sector’s market capitalization — reported quarterly earnings. Of these, 79.4% outperformed on earnings, while 85.3% beat revenue estimates. Earnings decreased 17.7% year over year, while revenues increased 7%. Overall, fourth-quarter earnings of the Medical sector are expected to decline 18.2%, while sales are expected to rise 6.3% from the year-ago quarter.

While Alnylam Pharmaceuticals ALNY, Blueprint Medicines BPMC and Agios Pharmaceuticals AGIO are scheduled to release their respective fourth-quarter earnings reports before the opening bell on Feb 15, Corcept Therapeutics CORT and Ultragenyx Pharmaceuticals RARE will release theirs after market close.

Let’s see how these biotech/pharma companies might have performed in the soon-to-be-reported quarter.

Alnylam Pharmaceuticals

Alnylam has a mixed earnings surprise history. ALNY’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed on one occasion, delivering an average earnings surprise of 48.25%. In the last reported quarter, Alnylam beat earnings estimates by 171.43%.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) have a good chance of delivering an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

For the quarter to be reported, Alnylam has an Earnings ESP of +58.66% and a Zacks Rank #3, indicating a likely positive surprise. The Zacks Consensus Estimate for adjusted loss per share is pegged at $1.20. You can see the complete list of today’s Zacks #1 Rank stocks here.

Alnylam’s fourth-quarter revenues are likely to have been boosted primarily by its RNAi therapeutic, Amvuttra, approved for treating adult patients with polyneuropathy of hereditary transthyretin-mediated amyloidosis. Givlaari and Oxlumo sales are also expected to have contributed to the company’s top line.

However, revenues generated from Onpattro sales are likely to have continued to decline because of patients switching to Amvuttra.

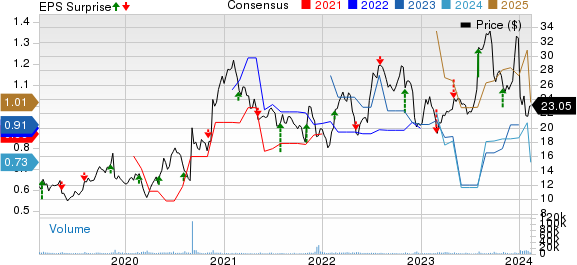

Alnylam Pharmaceuticals, Inc. Price, Consensus and EPS Surprise

Alnylam Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Alnylam Pharmaceuticals, Inc. Quote

Blueprint Medicines

Blueprint Medicines has an impressive earnings track record. It beat earnings estimates in each of the last four quarters, delivering an average earnings surprise of 11.29%. In the last reported quarter, BPMC beat earnings estimates by 7.95%.

For the quarter to be reported, Blueprint has an Earnings ESP of -1.14% and a Zacks Rank #3. The Zacks Consensus Estimate for adjusted loss per share is pegged at $2.04.

Blueprint’s fourth-quarter 2023 revenues are likely to have been boosted by the sales of its only marketed product, Ayvakit, which is currently approved for mast cell disorders in the U.S. and EU markets.

Blueprint Medicines Corporation Price, Consensus and EPS Surprise

Blueprint Medicines Corporation price-consensus-eps-surprise-chart | Blueprint Medicines Corporation Quote

Agios Pharmaceuticals

Agios also has an impeccable earnings track record. It beat earnings estimates in each of the last four quarters, delivering an average earnings surprise of 41.32%. In the last reported quarter, AGIO beat earnings estimates by 2.96%.

For the quarter to be reported, Agios has an Earnings ESP of -2.87% and a Zacks Rank #3. The Zacks Consensus Estimate is pegged at a loss of $1.64 per share.

Agios’ revenues in the to-be-reported quarter are likely to have been driven by the U.S. sales of its only FDA-approved drug, Pyrukynd (mitapivat),for treating hemolytic anemia in adults with pyruvate kinase deficiency.

Agios Pharmaceuticals, Inc. Price, Consensus and EPS Surprise

Agios Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Agios Pharmaceuticals, Inc. Quote

Corcept Therapeutics

Corcept has a mixed earnings surprise history. CORT’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed on the other two occasions, delivering an average earnings surprise of 6.20%. In the last reported quarter, Corcept beat earnings estimates by 27.27%.

For the quarter to be reported, Corcept has an Earnings ESP of -6.12% and a Zacks Rank #3. The Zacks Consensus Estimate for the company’s adjusted earnings per share (EPS) is pegged at 25 cents.

Earlier this January, Corcept reported preliminary fourth-quarter revenues of $135.4 million, reflecting an increase of 31% year over year. The uptick in the sales figure was likely driven by increased sales of its only approved product, Korlym, for Cushing’s syndrome.

Corcept Therapeutics Incorporated Price, Consensus and EPS Surprise

Corcept Therapeutics Incorporated price-consensus-eps-surprise-chart | Corcept Therapeutics Incorporated Quote

Ultragenyx Pharmaceuticals

Ultragenyx has a rather disappointing earnings track record. It missed earnings estimates in each of the trailing four quarters, delivering an average negative surprise of 9.63%. In the last reported quarter, RARE missed earnings estimates by 7.21%.

For the quarter to be reported, Ultragenyx has an Earnings ESP of +6.57% and a Zacks Rank #3, indicating a likely positive surprise. The Zacks Consensus Estimate is pegged at a loss of $1.65 per share.

Ultragenyx’s fourth-quarter revenues are likely to have been driven by the sale of its four marketed drugs, such as Crysvita, Mepsevii, Dojolvi and Evkeeza (in partnership with Regeneron). Earlier this January, the company reported preliminary total revenues (unaudited) of $430-$435 million for 2023, up 18-20% from 2022.

Ultragenyx Pharmaceutical Inc. Price, Consensus and EPS Surprise

Ultragenyx Pharmaceutical Inc. price-consensus-eps-surprise-chart | Ultragenyx Pharmaceutical Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Agios Pharmaceuticals, Inc. (AGIO) : Free Stock Analysis Report

Ultragenyx Pharmaceutical Inc. (RARE) : Free Stock Analysis Report

Blueprint Medicines Corporation (BPMC) : Free Stock Analysis Report