Drug, Biotech Stocks' Q3 Earnings Due on Oct 26: BMY, MRK, BPMC

The third-quarter 2023 reporting cycle of the Medical sector is about to pick up pace this week. The sector mainly comprises pharma/biotech and medical device companies.

The earnings season for the Medical sector started around mid-October when bellwether Johnson & Johnson JNJ reported better-than-expected third-quarter results following the spin-off of its consumer health business. It beat estimates for earnings as well as sales, primarily driven by the strong performance of its Innovative Medicines segment (previously the Pharmaceutical segment). J&J’s Medtech segment revenues also recorded a year-over-year increase but failed to beat the consensus estimate.

Among large drugmakers, Novartis reported better-than-expected third-quarter resultslast week, beating both earnings and revenue estimates. Based on its strong third-quarter performance, Novartis raised its 2023 guidance.

Roche also witnessed a decline in revenues owing to lower COVID-19 test sales earlier this month. Roche’s revenues declined 6% in the first nine months of 2023due to an expected decline in sales of its COVID-19 tests. Excluding COVID products, group sales rose 1% at CER.

Per the Earnings Trends report as of Oct 18, 6.6% of the companies in the Medical sector — representing 24.7% of the sector’s market capitalization — reported quarterly earnings. Of these, 100% outperformed on earnings while 75% beat revenue estimates. Earnings increased 5.6% year over year, while revenues increased 7.5%. Overall, third-quarter earnings of the Medical sector are expected to decline 15.4%, while sales are expected to rise 5.1% from the year-ago quarter.

Bristol Myers BMY, Merck MRK and Blueprint Medicines BPMC are scheduled to release third-quarter earnings on Oct 26. While BMY and MRK are set to report before the opening bell, BPMC will report after the market closes.

Let’s see how these biotech/pharma companies might have performed in the soon-to-be-reported quarter.

Bristol Myers

Bristol Myers has a mixed earnings track record. BMY’s earnings beat estimates in three of the trailing four quarters, missing the mark on one occasion, delivering an average surprise of 1.66%. In the last reported quarter, Bristol Myers’ earnings missed estimates by 12.06%.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) have a good chance of delivering an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

For the quarter to be reported, Bristol Myers has an Earnings ESP of -1.74% and a Zacks Rank #3. The Zacks Consensus Estimate for the company’s current quarter adjusted EPS is pegged at $1.77 per share. You can see the complete list of today’s Zacks #1 Rank stocks here.

Bristol Myers’ revenues in the third quarter are likely to have been boosted by the sales growth of key products like Opdivo, Eliquis, Orencia and Yervoy. The sale of BMY’s newer products like Reblozyl, Breyanzi and Opdualag are likely to have also contributed to the top line.

Bristol Myers Squibb Company Price and Consensus

Bristol Myers Squibb Company price-consensus-chart | Bristol Myers Squibb Company Quote

Merck

Merck has an encouraging earnings track record. It beat earnings estimates in each of the last four quarters, delivering an average earnings surprise of 6.05%. In the last reported quarter, MRK beat earnings estimates by 5.07%.

For the quarter to be reported, Merck has an Earnings ESP of +1.73% and a Zacks Rank #3, suggesting a likely earnings beat this time around. The Zacks Consensus Estimate for Merck’s earnings is pegged at $1.94 per share.

Strong global underlying demand across its business, particularly for cancer drug Keytruda and HPV vaccine, Gardasil, is likely to have boosted sales growth in the third quarter.

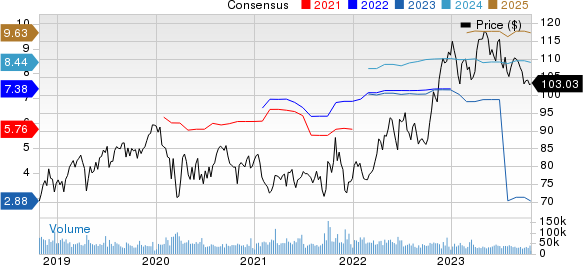

Merck & Co., Inc. Price and Consensus

Merck & Co., Inc. price-consensus-chart | Merck & Co., Inc. Quote

Blueprint Medicines

Blueprint Medicines has an encouraging earnings track record. It beat earnings estimates in each of the last four quarters, delivering an average earnings surprise of 12.10%. In the last reported quarter, BPMC beat earnings estimates by 15.12%.

For the quarter to be reported, Blueprint has an Earnings ESP of -2.81% and a Zacks Rank #3. The Zacks Consensus Estimate for the company’s current quarter adjusted EPS is pegged at a loss of $2.39 per share.

Blueprint’s third-quarter 2023 revenues are likely to have been boosted by the sales of its only marketed product, Ayvakit, which is currently approved for mast cell disorders in the U.S. and EU markets.

Blueprint Medicines Corporation Price and Consensus

Blueprint Medicines Corporation price-consensus-chart | Blueprint Medicines Corporation Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Blueprint Medicines Corporation (BPMC) : Free Stock Analysis Report