DSS: Q3 2023 Results Show Hesitation from DSS Customers Due to A Worsening Economy and Government Inaction

NYSE:DSS

READ THE FULL DSS RESEARCH REPORT

DSS (NYSE:DSS) reported Q3 revenues of $4.2 million, down 65% from the year ago’s $11.9 million. Most of the total revenue decline was driven by a $4.4 million decline in Direct Marketing revenues as the company divested Sharing Global Services on May 4th. Direct marketing was down 89% year over year. On April 5th, Sharing was dividended to shareholders with DSS retaining 7% of the shares (25 million shares). On July 1st, after the quarter ended, DSS sold the remaining portion of Direct Marketing to Sharing for $711,000 representing the gross proceeds of the sale of HWH inventory less the cost of goods sold. So in Q4, there is no longer a direct marketing business at DSS.

Printed product sales were down 34% year over year and down 9% sequentially as some orders were delayed due to economic uncertainties and slipped into Q4. We expect a much stronger Q4.

The REIT contributed only $236,000 in revenues versus $1.5 million in Q2 2023 driven by the tenants at AMRE LifeCare being unable to make full rental payments every month. Acute long-term facilities are being affected as Congress has not yet reauthorized Medicare and Medicaid payments back to pre-covid rules after the covid rules ended. Much of our forecast depends on how this is resolved. The bank generated only $108,000 in net investment income due to several loans made going on non-accrual as borrowers struggled to make expected payments and the commodity broker had no revenues. The brokerage business is expected to have variable results due to its banking and trading businesses.

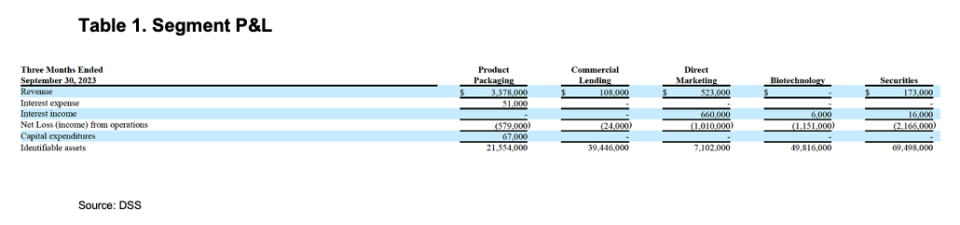

The table below shows segment reporting. All of the businesses reported a loss. The majority of losses were caused by the securities business which lost $2.2 million in the quarter. Impact Biomedical spent $1.2 million. We had expected Direct Marketing to be off DSS’s income statement this quarter, but the non-Sharing portion was not yet wound down. The losses incurred by the two were a total of $2.2 million.

Gross margin in the quarter was negative -45.2% versus 4.2% last year, while gross margin dollars were -$1.9 million. The major component of this negative number was $1.9 million in expenses from the REIT with much lower revenues. Also, Premier had a cost of goods of $556,000 higher than revenues as expenses were reallocated up to the cost of goods from other categories and there was a catch-up. Without this reallocation and catch-up, the gross margin would have been a positive $115,000. We expect for the full year Premier should add up to the typical 15% gross margin.

Operating expenses were $3.2 million, a decrease from $14.7 million last year driven by the spin-off of Sharing. The operating loss was $5.1 million compared to $14.2 million last year.

Other expenses were $1.6 million, with a loss of $1.3 million being from a loss on the sale of assets due to the Sharing divestment transaction. Another $1.2 million was for an additional provision for loan losses from the bank.

Minority interest was a reversal of a $2.3 million loss, versus a $4.6 million loss last year. Loss to common shareholders was $4.3 million, compared to a $20.2 loss last year. The GAAP loss per share was $0.03 versus $0.15 per share a year ago. The average shares outstanding increased by 4% to 140 million shares.

Balance Sheet

On September 30, 2023, DSS had $6.9 million in cash, negative working capital of $49.3 million, and debt of $54.4 million. It also has $11.6 million in marketable securities it could convert to cash. At the quarter's end, it owned $53 million in real estate. During the quarter, the company had a negative free cash flow of $3.2 million not including changes in working capital. The primary shares outstanding as of November 6, 2023, were 140,264,250.

Aside from its $6.9 million in cash as of September 30, 2023, DSS believes it can continue as a going concern, due to its ability to generate operating cash through the sale of its $11.1 million of marketable securities. It also expects to collect principal and interest on its notes receivable of approximately $6.3 million through September 30, 2024, which includes the $5.5 million Puradigm was supposed to pay on May 19th. The company now has a reserve of $2,884,000 against the principal and interest outstanding. The terms of this loan are currently being renegotiated. During Q3 DSS received $908,000 in payments on notes receivable and lent out $400,000.

Its subsidiary Impact BioMedical is in the process of an IPO. Part of the proceeds of the IPO are expected to pay in part, amounts utilized by DSS for Impact BioMedical expenses. This is expected to close in the fourth quarter of 2023.

SHRG is in the process of uplisting to NASDAQ and hopes to raise approximately $15 million. A significant portion of the funds raised from this uplisting will be used to repay loans SHRG owes to DSS.

Finally, it is in negotiations with Pinnacle Bank to extend its note payable of approximately $40.2 million through November 2024. This note payable is currently in default, however, DSS is in the process of renegotiating the terms of this note, which is expected to be completed during the fourth quarter.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.