DTE Energy (DTE) Q3 Earnings Beat on Favorable Weather Pattern

DTE Energy Company DTE reported third-quarter 2018 operating earnings per share of $2.13, which outpaced the Zacks Consensus Estimate of $1.74 by 22.4%. The reported figure also improved 43.9% from the year-ago quarter’s figure of $1.48.

On a GAAP basis, the company’s reported earnings came in at $1.84 per share compared with $1.51 in the prior-year quarter.

Highlights of the Release

DTE Energy announced that it invested nearly $1.2 billion with Michigan-based companies through the third quarter of 2018, exceeding its commitment to the Pure Michigan Business Connect local supplier initiative. Notably, this investment includes $380 million spent in Detroit.

Moreover, the company took a significant step toward its goal of reducing carbon emissions by more than 80% by breaking ground on a natural gas-fueled plant worth $1 billion. Per DTE Energy, the Blue Water Energy Center will be the most efficient power plant in the state when it begins producing affordable and reliable low-emission electricity.

Operating net income in the reported quarter totaled $388 million compared with $264 million in the year-ago quarter, courtesy of favorable weather patterns.

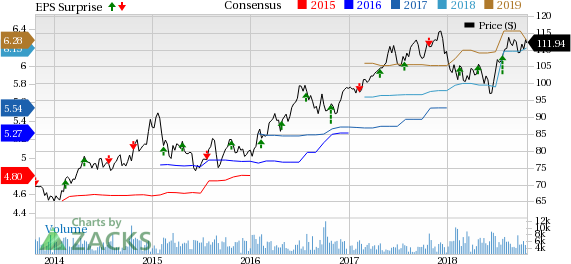

DTE Energy Company Price, Consensus and EPS Surprise

DTE Energy Company Price, Consensus and EPS Surprise | DTE Energy Company Quote

Segmental Details

Utility Operations

DTE Electric: The segment’s operating earnings totaled $304 million, up from $222 million in the prior-year quarter.

DTE Gas: The segment incurred operating loss of $28 million compared with loss of $13 million in the prior-year quarter.

Non-Utility Operations: The operating earnings from Non-Utility operations were $142 million compared with $70 million in the year-ago quarter.

Guidance

DTE Energy raised its 2018 operating earnings per share guidance from the range of $5.94-$6.32 to $6.12-$6.48.

Zacks Rank

DTE Energy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Dominion Energy D is scheduled to report third-quarter 2018 earnings on Nov 1. The Zacks Consensus Estimate is pegged at $1.11.

Eversource Energy ES is scheduled to announce third-quarter 2018 earnings on Nov 1. The Zacks Consensus Estimate stands at 88 cents.

Exelon Corp. EXC is scheduled to report third-quarter 2018 earnings on Nov 1. The Zacks Consensus Estimate is pegged at 86 cents.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DTE Energy Company (DTE) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Exelon Corporation (EXC) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research