Duke (DUK) Rolls Out North Carolina's EV Subscription Program

Duke Energy Corp. DUK recently rolled out an electric vehicle (EV) charging subscription program for its North Carolina customers to promote clean transportation at a cost-effective rate in this state. The company has unveiled this pilot program in collaboration with three vehicle manufacturers namely, General Motors, Ford Motor Company and BMW of North America.

Highlights of the Plan

Per Duke’s 12-month EV Complete Home Charging Plan, the company will provide its North Carolina residential customers with energy worth 800 kilowatt-hours (kWh) per month to charge an EV at home. In return for this, DUK aims to charge a flat monthly rate of $19.99 in its Duke Energy Carolinas service area and $24.99 in its Duke Energy Progress service area.

Customers who own an EV can enroll in the program from the beginning of September and enjoy the benefits of the program from Nov 1, 2023 onward.

Such plans will assist the company in providing smart energy choices for its customers while ensuring grid stability.

DUK’s Take on Electric Vehicles

Electrification in the transportation sector has been on the radar of U.S. utilities as decarbonization remains a major target for the majority of industries across the board. To achieve this, utilities have been taking measures to provide customers with upgraded infrastructure for charging their EVs as well as incentives to promote the electrification of vehicles.

Duke Energy has more than 600 EVs in its fleet, including more than 220 on-road vehicles. To lower emissions from the transportation sector, the company aims at increasing its EV fleet rapidly over the next few years.

By 2030, DUK pledges to convert 100% of its nearly 4,000 light-duty vehicles to electric and 50% of its approximately 6,000 combined fleet of medium-duty, heavy-duty and off-road vehicles to EVs, plug-in hybrids or other zero-carbon alternatives as more of these options become available.

With the solid expansion expected in the U.S. EV market in the next few years, such initiatives by Duke Energy, including the latest rollout of the EV subscription program, should strengthen its footprint in this market.

Peer Moves

Apart from Duke Energy, utilities that have been expanding their footprint in the EV market are as follows:

Entergy Corporation’s ETR eTech program promotes the adoption of electric-powered alternatives to many applications that traditionally require fossil fuels. The program offers customers an incentive for purchasing EV charging infrastructure.

Entergy boasts a long-term earnings growth rate of 5.7%. The Zacks Consensus Estimate for ETR’s 2023 earnings suggests a growth rate of 4.5% from the prior-year reported figure.

PG&E Corporation PCG has proposed to build California’s EV charging infrastructure. As part of PG&E’s 2030 targets, the company is preparing the grid to quickly and safely power at least three million EVs. In the second quarter of 2023, PCG initiated two pilot programs, Empower EV and Multifamily Business and Small Business EV Charger, both designed to improve access to EV charging infrastructure for customers in underserved communities.

The long-term earnings growth rate of PG&E Corp.is 2.5%. The Zacks Consensus Estimate for 2023 earnings calls for a growth rate of 10% from the prior-year reported figure.

CMS Energy Corporation’s CMS Consumers Energy subsidiary is accelerating Michigan's EV transformation, committing to powering an additional 200 new EV charging stations across the state, including 100 fast chargers by the end of 2023. This is part of Consumers Energy's commitment to powering 1 million EVs in the communities it serves by 2030.

CMS Energy’s long-term earnings growth rate is pegged at 7.8%. The Zacks Consensus Estimate for CMS’ 2023 earnings implies a growth rate of 7.6% from the prior-year reported figure.

Price Movement

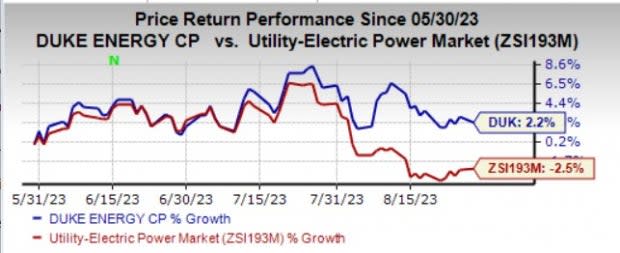

In the past three months, Duke Energy shares have increased 2.2% against the industry’s 2.5% decline.

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Entergy Corporation (ETR) : Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report