Duke Energy (DUK) Arm to Buy 199 MW of Solar Power in Indiana

Duke Energy Corp.’s DUK arm, Duke Energy Indiana, recently reached an agreement with Ranger Power to buy up to 199 megawatts (MW) of solar power from a facility being developed by the latter.

The 20-year power purchase agreement, which is subject to regulatory approval, will assist Duke Energy in powering nearly 35,000 homes in Indiana, thus taking a step forward in its goal to provide reliable and sustainable energy to its Indiana customers. Spread across 1,700-acre land, the facility is expected to be production-ready by September 2025.

Duke Energy’s Growth Prospects in Indiana

Indiana is steadily moving toward a renewable generation mix, in which solar energy can be witnessed to play a significant role. Per the latest report from the Solar Energy Industries Association, Indiana installed nearly 1,641 MW of solar capacity in 2022, boasting an investment of approximately $340 million. The report indicates that solar power accounted for around 1.5% of the total electricity generation in the state.

Going forward, in the next five years, Indiana is likely to enhance its solar generation capacity by adding approximately 9,774 MW of solar assets. Thus, Duke Energy Indiana’ssolar expansion plans in the region, like the latest purchase from Ranger Power, are prudent. Duke Energy Indiana aims to elevate its solar generation capacity in the region by 2,218 MW of solar power and 450 MW of solar energy storage.

Such an aggressive investment strategy will duly assist the company in diversifying its energy mix and achieving its goal of clean energy.

Utilities’ Focus on Solar Expansion

Utilities in the United States are increasingly investing in solar technology, mainly to decarbonize their operations. The latest short-term energy outlook from the U.S. Energy Information Administration shows that solar continues to dominateas the source of new generating capacity in the United States year to date. Apart from DUK, utilities that have expanded their solar portfolio are as follows:

WEC Energy Group WEC: It announced the acquisition of an 80% ownership interest in the Samson I Solar Energy Center in January 2023. A 250 MW project, Samson I is located in Texas.

WEC Energy’s long-term earnings growth rate is 5.8%. Shares of WEC Energy have delivered 1.2% to its investors in the past month.

Ameren Corporation AEE: It recently announced that its arm, Ameren Missouri, has planned to elevate its renewable energy generation capability with 550 MW of solar projects. The company aims to either acquire or construct four solar projects, which will be enough to power more than 95,000 average-sized residential homes.

The long-term earnings growth rate of Ameren is 6.4%. The Zacks Consensus Estimate for 2023 earnings has been revised upward by 0.2% in the past 60 days.

Entergy Corporation ETR: Itsarm, Entergy Louisiana, filed a request with the Louisiana Public Service Commission in March 2023seeking consent for the construction of two solar projects with a combined production capacity of 225 MW. The main aim is to expand its renewable energy portfolio.

Entergy’s long-term earnings growth rate is projected at 5.7%. The Zacks Consensus Estimate for 2023 earnings suggests an upside of 3.9% from the prior-year reported figure.

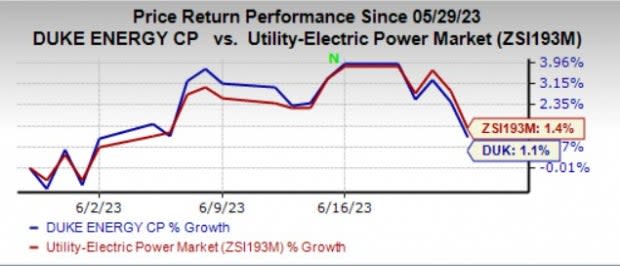

Price Movement

In the past month, Duke Energy shares have increased 1.1% compared with the industry’s 1.4% growth.

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report