Duke Energy (DUK) Proposes Plan to Promote Green Energy in NC

Duke Energy Corp. DUK recently proposed a new Carbon Plan Integrated Resource Plan (“CPIRP”) for North Carolina. The new resource plan has been proposed in line with the North Carolina Utilities Commission's (“NCUC”) 2022 Carbon Plan, highlighting an optimal cost-effective route to achieve carbon dioxide emission reduction goals.

Highlights of the New CPIRP

The company’s recently filed plan underscores three core energy portfolios for the NCUC to review to achieve carbon neutrality in the most cost-effective way. The three portfolios aim to reach HB 951's interim 70% carbon reduction target by 2030, 2033 and 2035 and carbon neutrality by 2050.

The new plan involves the upgradation of existing plant sites and infrastructure, the smooth retirement of coal plants, enhancing the transmission system and improving the workforce to help customers economize. The CPIRP also aims at deploying 6000 megawatts (MW) of solar power by 2031, 2,700 MW of battery storage by 2031, 5,800 MW of hydrogen-capable natural gas by 2032, 1,200 MW of wind onshore by 2033, pumped-storage hydro of nearly 1,700 MW by 2034 and advanced nuclear of approximately 600 MW by 2035.

The company expects energy savings from these programs to increase sevenfold over the next 15 years. Such plans, if approved, will assist the company in duly achieving its zero-carbon goals in the most cost-effective way while assisting customers in saving on energy bills.

Utilities’ Focus on Carbon Neutrality

Utilities across the United States are increasingly investing in alternate sources of energy, mainly to decarbonize their operations. This has led utility companies to increase their pace of transition by investing significantly in renewable development and reducing CO2 emissions from their operations. Apart from DUK, utilities that have set targets for carbon neutrality are as follows:

American Electric Power Company AEP: It is rapidly reducing its carbon dioxide emission rate to promote green energy. Its intermediate goal is an 80% reduction from the 2005 CO2 emission levels from the company’s generating facilities by 2030, and the long-term goal is net-zero CO2 emissions from its generating facilities by 2045.

AEP boasts a long-term earnings growth rate of 5.6%. The Zacks Consensus Estimate for 2023 sales suggests a growth rate of 3.3% from the prior-year reported figure.

CenterPoint Energy CNP: It has a goal to reach net-zero direct emissions for Scope 1 and Scope 2 emissions by 2035 and a goal to reduce Scope 3 emissions by 20% to 30% by 2035 as compared to the 2021 levels.

The long-term earnings growth rate of CenterPoint is 7.5%. The Zacks Consensus Estimate for 2023 earnings calls for a growth rate of 7.9% from the prior-year reported figure.

CMS Energy Corporation CMS: It aims at achieving net-zero methane emissions by 2030 and net-zero carbon emissions by 2040. The company successfully reduced its methane emissions by more than 20% since 2012 and reduced CO2 emissions by more than 30% since 2005 and achieved 33% combined renewable energy and energy waste reduction through 2022.

CMS Energy’s long-term earnings growth rate is pegged at 7.8%. The Zacks Consensus Estimate for 2023 sales implies a growth rate of 1.4% from the prior-year reported figure.

Price Movement

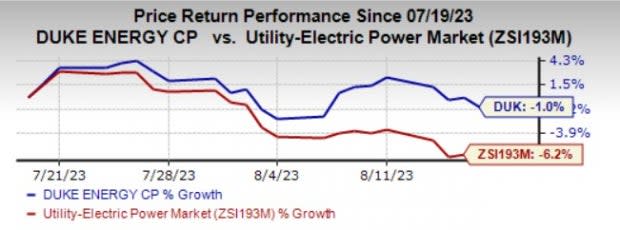

In the past month, Duke Energy shares have decreased 1% compared with the industry’s 6.2% decline.

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report