DuPont (DD) Launches Tedlar PVF Solutions and PVF Coating

DuPont de Nemours Inc. DD announced that Coryor Surface Treatment Company Ltd. and Nippon Paint Taiwan have introduced a range of new offerings in the Taipei Building Show, Taiwan's largest building materials exhibition, including printed Tedlar PVF solutions and PVF coating.

DuPont collaborated closely with Coryor to launch the printed PVF film solutions on display in the show. This innovative Tedlar-based PVF product is part of Coryor's AAMALON applications series, which focuses on better weathering resistance among other performance benefits. Tedlar films have been tested in the harshest environments for more than six decades. From preventing weathering on solar panels to keeping airplane interiors looking clean and new, Tedlar film provides unrivaled UV and weather durability.

DD will also co-launch a PVF coating solution with Nippon Paint at the Taipei show, in addition to the Coryor printed products. Tedlar PVF coatings are designed for building exteriors, including those exposed to harsh environments, and provide long-lasting finishes for a variety of exterior and interior metal applications.

PVF coatings are unique in providing superior chemical resistance, flexibility, hydrolytic stability and UV stability, while outperforming any current coil and extrusion coating resin on the market. It provides excellent chemical resistance and coating bendability performance, making it an ideal solution for surface protection against corrosion, fading and cracking.

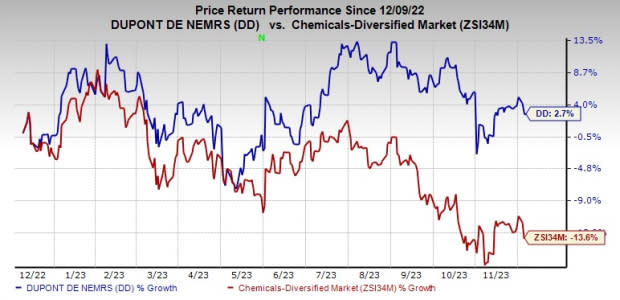

Shares of DuPont have gained 2.7% over the past year against a 13.6% decline of its industry.

Image Source: Zacks Investment Research

The company, on its third-quarter call, said that it now sees net sales for 2023 to be around $12,170 million. Adjusted earnings per share for 2023 are forecast to be around $3.45. Also, Operating EBITDA for 2023 is expected to be around $2,975 million.

For the fourth quarter, demand for consumer electronics is anticipated to remain in line with the third quarter, as indicated by consistent order rates from customers. This will likely result in a sequential sales improvement in the Semiconductor Technologies segment. However, compared with the previous guidance, there are additional challenges stemming from channel inventory destocking and decreased industrial water demand in China.

DuPont de Nemours, Inc. Price and Consensus

DuPont de Nemours, Inc. price-consensus-chart | DuPont de Nemours, Inc. Quote

Zacks Rank & Key Picks

DuPont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Denison Mines has a projected earnings growth rate of 100% for the current year. It currently flaunts a Zacks Rank #1 (Strong Buy). DNN has a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 63% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axalta has a projected earnings growth rate of 5.4% for the current year. It currently sports a Zacks Rank #1. AXTA has a trailing four-quarter earnings surprise of roughly 6.7%, on average. The stock is up around 27.3% in a year.

Andersons currently carries a Zacks Rank #2 (Buy). The stock has gained roughly 47.5% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report