DuPont (DD) Opens Adhesives Manufacturing Facility in China

DuPont de Nemours, Inc. DD recently celebrated the official opening of its new adhesives manufacturing facility in Zhangjiagang (ZJG), East China. The new plant will manufacture adhesives for transportation customers, notably in lightweighting and fast-growing vehicle electrification applications.

The facility, having the capacity to fulfill regional needs, is designed to provide a world-class client experience by utilizing cutting-edge process capability and quality, technical support, and great connectivity to transportation for shipping and logistics benefits. A Manufacturing Execution System (MES) is included on the site to optimize the manufacturing process and connect all components of the manufacturing workflow. MES will aid in making the manufacturing process visible, trackable and more reliable.

The Zhangjiagang Free Trade Zone, which is situated in Zhangjiagang City, has special geographic advantages that are crucial to luring high-quality investments from many top international and local companies. The facility is situated at the Yangtze River International Chemical Industrial Park in the ZJG Free Trade Zone.

The facility will produce goods such as BETAFORCE TC thermal conductive adhesives and BETATECH thermal interface materials that support battery thermal management during hybrid/electric vehicle charging and operation. It will also produce battery assembly and sealing with BETAFORCE multi-material bonding adhesives; and BETAMATE broad bake and structural adhesives assist vehicle crash durability and lighter vehicle structures for battery bonding and vehicle body structure.

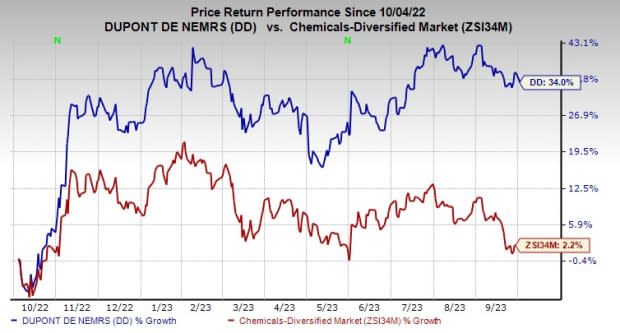

Shares of DuPont have gained 34% over the past year compared with a 2.2% rise of its industry.

Image Source: Zacks Investment Research

The company, on its second-quarter call, said that it expects net sales for 2023 to be in the range of $12,450-$12,550 million. Adjusted earnings per share for 2023 are forecast to be $3.40-$3.50. For third-quarter 2023, the company sees net sales of roughly $3,150 million. Adjusted earnings per share for the quarter are projected at roughly 84 cents.

Zacks Rank & Key Picks

DD currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, The Andersons Inc. ANDE and Hawkins Inc. HWKN.

Carpenter Technology currently carries a Zacks Rank #2 (Buy). The stock has rallied roughly 100.1% in the past year. CRS beat the Zacks Consensus Estimate in three of the last four quarters while meeting in one. It delivered a trailing four-quarter earnings surprise of 9.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Andersons currently carries a Zacks Rank #2. The stock has gained roughly 58.5% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Hawkins currently carries a Zacks Rank #1. The stock has rallied roughly 53.8% in the past year. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 25.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report