DuPont de Nemours Inc Reports Mixed 2023 Results Amidst Market Challenges

Net Sales: $12.1 billion for FY23, a decrease of 7% year-over-year.

GAAP Income from Continuing Operations: $533 million for FY23, down 50% from the previous year.

Adjusted EPS: Increased slightly to $3.48 for FY23 from $3.41 in FY22.

Operating EBITDA: $2.9 billion for FY23, a 10% decrease from FY22.

Adjusted Free Cash Flow: $1.6 billion for FY23, a significant improvement of 110% over the previous year.

Capital Allocation: Completion of a $2 billion share repurchase and announcement of a new $1 billion program.

Quarterly Dividend: Increased by 6% for the first quarter of 2024.

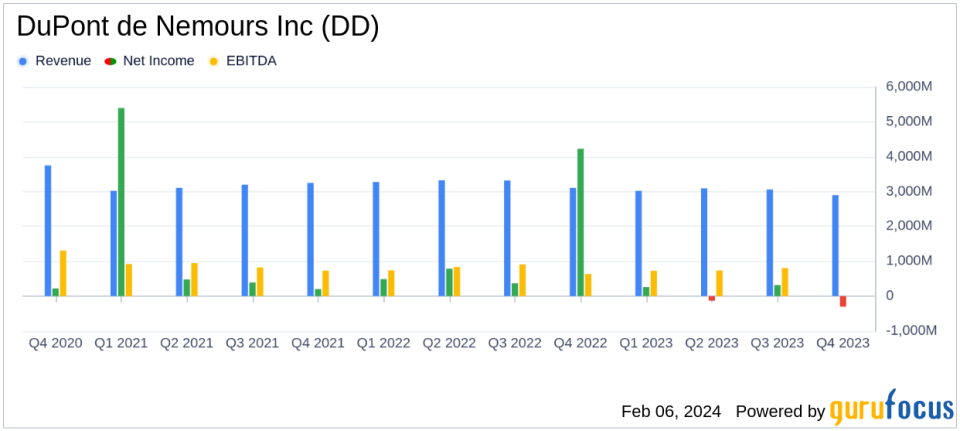

On February 6, 2024, DuPont de Nemours Inc (NYSE:DD) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a global leader in technology-based materials and solutions, faced a challenging year marked by a 7% decline in net sales to $12.1 billion and a 50% drop in GAAP income from continuing operations to $533 million.

Despite these headwinds, DuPont achieved a slight increase in adjusted EPS to $3.48, up from $3.41 in the previous year. The company's operating EBITDA fell by 10% to $2.9 billion, while adjusted free cash flow saw a substantial year-over-year improvement, increasing by 110% to $1.6 billion.

Financial Performance and Challenges

DuPont's performance in 2023 was impacted by inventory destocking across various end-markets and economic softness in China. The company's net sales were affected by a 10% organic sales decline, driven by a 9% decrease in volume and a 1% decrease in price. The most notable volume declines were within the Safety Solutions and Water Solutions segments, particularly in China.

The GAAP loss from continuing operations of $300 million included a significant non-cash goodwill impairment charge of approximately $800 million. This charge was primarily due to the challenging macroeconomic environment impacting construction markets and additional inventory destocking in medical packaging and industrial-based end-markets.

Strategic Capital Allocation

In response to the challenging environment, DuPont continued to execute its capital allocation strategy. The company completed a $2 billion accelerated share repurchase transaction and announced a new $1 billion share repurchase program authorization. Furthermore, DuPont declared a 6% increase to its quarterly dividend for the first quarter of 2024, demonstrating its commitment to shareholder value creation.

Segment Highlights and Outlook

The Electronics & Industrial segment saw a 1% increase in net sales, although organic sales declined by 7%. Operating EBITDA for this segment decreased by 7%. The Water & Protection segment experienced a more significant 15% decrease in net sales and a 13% decrease in operating EBITDA.

Looking ahead to 2024, DuPont's CFO, Lori Koch, anticipates a return to year-over-year sales and earnings growth in the second half, driven by an expected recovery in the electronics market and improved orders within industrial markets as customer inventory levels normalize.

Conclusion

While 2023 posed several challenges for DuPont de Nemours Inc, the company's focus on operational execution, productivity, and cost discipline allowed for significant cash flow improvement. With strategic capital allocation and a positive outlook for recovery in key markets, DuPont is poised to leverage its market-leading positions and accelerate growth in the coming year.

For a detailed analysis of DuPont's financial performance, including full financial statements and non-GAAP measures, please refer to the complete 8-K filing.

Explore the complete 8-K earnings release (here) from DuPont de Nemours Inc for further details.

This article first appeared on GuruFocus.