DXC Technology (DXC) Falls 15% on Q1 Earnings Miss, Guidance Cut

DXC Technology Company DXC shares plunged 14.7% in Wednesday’s extended trading session after the company reported lower-than-expected first-quarter results and lowered revenue guidance for the full-fiscal 2024. The IT services and consulting company reported first-quarter non-GAAP earnings of 63 cents per share, which came in way lower than the Zacks Consensus Estimate of 82 cents.

The bottom line decreased 16% from the prior-year quarter’s earnings of 75 cents per share. The year-over-year decline was primarily due to lower revenues and higher-than-expected tax expenses, partially offset by a lower share count.

DXC reported revenues of $3.45 billion, which fell short of the consensus mark of $3.56 billion and declined 7% year over year. The top line was negatively impacted by a slowdown in client expenditures. The company noted that several customers have either stopped or pushed their orders in the second half of fiscal 2024 amid the current uncertain macroeconomic environment.

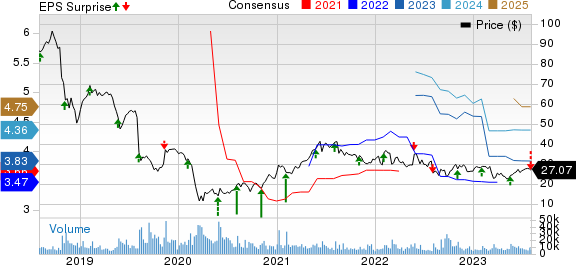

DXC Technology Company. Price, Consensus and EPS Surprise

DXC Technology Company. price-consensus-eps-surprise-chart | DXC Technology Company. Quote

Quarterly Details

DXC’s bookings in the fiscal first quarter were $3.1 billion, reflecting a book-to-bill ratio of 0.89. The trailing 12-month book-to-bill ratio for the company was 1.03 at the first-quarter fiscal 2024-end. Our estimate for bookings and the book-to-bill ratio was pegged at $3.8 billion and 1.06, respectively.

Segment-wise, revenues from Global Business Services (“GBS”) decreased 3.1% on a year-over-year basis to $1.7 billion. Our estimate for the GBS segment’s first-quarter revenues was pegged at $1.73 billion.

However, on an organic basis, the division’s revenues improved 3.3% year over year. The upside was primarily aided by the strong performance of Analytics & Engineering and Insurance Software & BPS offerings, where revenues increased 8.8% and 5.1%, respectively, on an organic basis. However, the GBS segment’s Applications offerings registered a year-over-year organic revenue decline of 0.7%.

Global Infrastructure Services (“GIS”) revenues were $1.74 billion in the fiscal first quarter, down 10.6% year over year. Our estimate for the GIS segment’s first-quarter revenues was pegged at $1.85 billion.

On an organic basis, the division’s revenues decreased 9.9% year over year, which was higher than management’s expectations. The GIS segment’s performance was negatively impacted by a slowdown in customer expenditures, mainly in the resale of IT equipment, such as PCs, networking gear and servers and project work.

Under the GIS division, revenues from Cloud Infrastructure & ITO and Modern Workplace offerings declined 12.7% and 5%, respectively, on an organic basis. However, it registered 6.8% year-over-year organic revenue growth at the Security offering.

The company’s adjusted operating income declined to $224 million in the first quarter from $259 million in the year-ago quarter. The adjusted operating margin contracted to 6.5% from 7%.

Balance Sheet and Cash Flow

DXC exited the fiscal first quarter with $1.58 billion in cash and cash equivalents compared with the $1.86 billion witnessed in the previous quarter. The long-term debt balance (net of current maturities) remained flat at $3.9 billion as of Jun 30, 2023 compared with the previous quarter.

In the first quarter, DXC generated operating cash flow of $127 million and had a negative free cash flow of $75 million. During the quarter, it repurchased 11 million shares for a total consideration of $280 million. The company stated that it is on track to complete the $1 billion share repurchase program in fiscal 2024. DXC had initiated the $1 billion share buyback program in April 2024.

Guidance

DXC lowered its guidance for the full-fiscal 2024. For fiscal 2024, DXC now estimates revenues in the band of $13.88-$14.03 billion, down from its previous forecast in the range of $14.40-$14.55 billion. It now projects the adjusted EBIT margin for the fiscal in the range of 7%-7.5% instead of 8%-8.5% anticipated previously. The company also lowered its adjusted EPS forecast to the $3.15-$3.40 range from the $3.80-$4.05 range projected earlier.

DXC also initiated guidance for the second quarter. For the quarter, the company anticipates revenues between $3.43 billion and $3.46 billion. The adjusted EBIT margin is expected in the range of 6.5%-7%. DXC projects adjusted earnings between 65 cents and 70 cents per share for the second quarter.

Zacks Rank & Stocks to Consider

Currently, DXC carries a Zacks Rank #4 (Sell). Shares of DXC have increased 2.1% year to date (YTD).

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA, Fortinet FTNT and Salesforce CRM. NVIDIA and Fortinet each sport a Zacks Rank #1 (Strong Buy), while Salesforce carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA's second-quarter fiscal 2024 earnings has been revised upward by a couple of cents to $2.06 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 13 cents to $7.79 per share in the past 30 days.

NVIDIA’s earnings beat the Zacks Consensus Estimate twice in the preceding four quarters while missing the same on two occasions, the average surprise being 0.3%. Shares of NVDA have surged 202.9% YTD.

The Zacks Consensus Estimate for Fortinet’s second-quarter 2023 earnings has remained unchanged at 34 cents per share in the past 60 days. For 2023, earnings estimates have remained unchanged at $1.46 per share in the past 60 days.

Fortinet’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 16.4%. Shares of FTNT have rallied 52% YTD.

The Zacks Consensus Estimate for Salesforce's second-quarter fiscal 2024 earnings has been revised upward by a penny to $1.90 per share in the past 60 days. For fiscal 2024, earnings estimates have moved upward by a couple of cents to $7.44 per share in the past 60 days.

Salesforce's earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 15.5%. Shares of CRM have surged 66.3% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

DXC Technology Company. (DXC) : Free Stock Analysis Report