Dycom (DY) Acquires Bigham, Strengthens Telecom Business

Dycom Industries, Inc. DY acquired Bigham Cable Construction, Inc., a telecommunications construction services provider in the southeastern United States. Bigham generated approximately $140 million in revenues in the last twelve months.

The buyout strengthens Dycom’s customer base and geographic scope. It will also expand DY’s ability to further address growth opportunities in rural broadband deployments.

This apart, the company’s board announced the authorization of a new $150 million repurchase program for the next 18 months in open market purchases. The new program replaces DY’s previous $150 million stock repurchase program, of which approximately $81 million remained outstanding. As of Aug 23, 2023, the company had 29,333,411 shares of common stock outstanding, excluding the dilutive effect of stock options and unvested restricted stock.

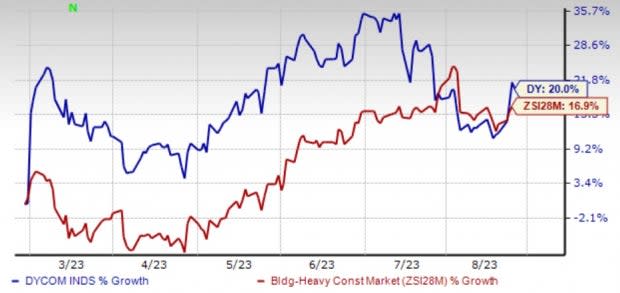

Image Source: Zacks Investment Research

Shares of DY increased by 3.94% on Aug 23 and 20% in the past six months compared with the Zacks Building Products - Heavy Construction industry’s 16.9% growth.

Fiber Network Deployment Bode Well

Dycom has been constructing or upgrading significant wireline networks across broad sections of the country. These wireline networks are generally designed to provide gigabit network speeds to individual consumers and businesses, either directly or wirelessly using 5G technologies.

A single high-capacity fiber network can cost-effectively deliver services to both consumers and businesses. This enables multiple revenue streams from a single investment. This view is increasing the appetite for fiber deployments as well as creating opportunities.

Increasing access to high-capacity telecommunications continues to be crucial for society, especially in rural America. The Infrastructure Investment and Jobs Act includes more than $40 billion for constructing rural communications networks in unserved and underserved areas across the country. In addition, substantially, all states are commencing programs that will provide funding for telecommunications networks even prior to the initiation of funding under the Infrastructure Act.

Zacks Rank & Key Picks

DY carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Construction sector are:

Sterling Infrastructure, Inc. STRL provides transportation, e-infrastructure and building solutions. The Zacks Consensus Estimate for STRL’s 2023 earnings has moved north to $4.09 per share from $3.52 in the past seven days.

STRL’s expected earnings growth rate for 2023 is 29.4% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Fluor Corporation FLR benefits from its diverse presence in various markets, which allows it to reduce the impact of market fluctuations. The company adopts a strategic approach by maintaining a well-balanced business portfolio, enabling it to prioritize stable markets while taking advantage of opportunities in cyclical markets when the timing is appropriate.

FLR presently sports a Zacks Rank #1. Its expected earnings growth rate for 2023 is 128.1%.

Willdan Group WLDN is a nationwide provider of professional, technical and consulting services to utilities, government agencies and private industry.

Willdan Group presently flaunts a Zacks Rank #1. WLDN’s expected earnings growth rate for 2023 is 50%. The Zacks Consensus Estimate for STRL’s 2023 earnings has moved north to $1.32 per share from $1.23 in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report