Dycom (DY) Hits 52-Week High: What's Driving the Stock?

Dycom Industries, Inc. DY reached a new 52-week high of $116.92 on Dec 26. The stock pulled back to end the trading session at $116.13, up 1% from the previous day’s closing price of $114.95.

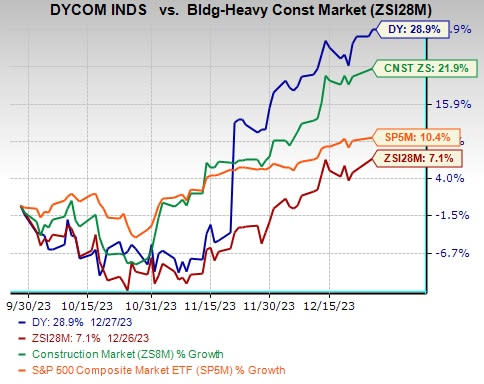

The Zacks Rank #3 (Hold) company’s shares increased 28.9% in the past three months, outperforming the Zacks Building Products - Heavy Construction industry’s 7.1% growth, the Zacks Construction sector’s 21.9% increase and the S&P 500 Index’s 10.4% rise.

The company is benefiting from increased demand from four of its top five customers, attributable to the deployment of gigabit wireline networks, wireless/wireline converged networks and wireless networks. Furthermore, consistent contract wins are boosting its backlog momentum, thus increasing its growth prospects, despite the ongoing macroeconomic uncertainties.

Image Source: Zacks Investment Research

The company’s earnings estimate for fiscal 2024 has moved north to $7.49 per share from $7.30 per share in the past 30 days. The stock portrays a positive trend, indicating robust fundamentals and elevating the expectation of outperformance in the near term, despite an uncertain economic scenario.

Attractive Factors of the Stock

Top Customers Boost Growth: A significant amount of Dycom’s revenues is from its top five customers. In third-quarter fiscal 2024, it witnessed demand growth from four of its top five customers. The company’s largest customer, Lumen, contributed 16.5% to total revenues and rallied 47.1% organically, marking the seventh consecutive quarter of organic growth with Lumen. AT&T, the second-largest customer, contributed 12.8% to total revenues. Comcast contributed 9.8% (up 2.2%) while Verizon represented 9.2% of total revenues and increased 10.3% organically. The company’s fifth customer contributed to 6.1% of revenues and grew 94.9% organically.

On a combined basis, the company’s top-five customers generated approximately 66.7%, 66.2% and 74.1% of revenues during fiscal 2023, fiscal 2022 and fiscal 2021, respectively.

Consistent Contract Wins: Dycom’s diverse portfolio of services, including engineering, construction, maintenance and installation services, has led to its increased demand. The company has secured new contracts from Frontier, AT&T, Charter and various rural fiber construction companies in third-quarter fiscal 2024, which will boost the its growth momentum. Over the last few years, Dycom has successfully increased the long-term value of its maintenance business, which is expected to complement its deployment of one gigabit and wireless-wireline converged networks.

Going forward, we expect the company’s string of contract wins and strong customer relationships to act as growth drivers. It remains positive about substantial opportunities across a broad array, despite prevailing market uncertainties.

Growing Backlog: Dycom’s backlog activity is increasing as it booked new work and renewed existing work. At the end of the fiscal third quarter of 2024, the company’s backlog totaled $6.61 billion, up from $6.12 billion in the comparable year-ago period, and sequentially from $6.21 billion. Of the fiscal third-quarter backlog, $3.83 billion is projected to be completed in the next 12 months.

Dycom remains optimistic about the strengthening industry environment, given strong end-market drivers. Although the recent market trend is a concern for the company, telecommunication networks that are crucial infrastructure for the country are witnessed to be gaining momentum.

Key Picks

Here are some better-ranked stocks from the same sector.

Fluor Corporation FLR presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter earnings surprise of 37.5%, on average. Shares of FLR have increased 14.9% in the past year. The Zacks Consensus Estimate for FLR’s 2023 sales and earnings per share (EPS) indicates an improvement of 12.4% and 197.6%, respectively, from the prior-year levels.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. It has surged 288.2% in the past year.

The Zacks Consensus Estimate for MPTI’s 2023 sales and EPS indicates growth of 30.6% and 156.7%, respectively, from the previous year.

Willdan Group, Inc. WLDN currently sports a Zacks Rank of 1. WLDN delivered a trailing four-quarter earnings surprise of a whopping 850.6%, on average. The stock has gained 24.3% in the past year.

The Zacks Consensus Estimate for WLDN’s 2023 sales and EPS indicates growth of 14.1% and 47.7%, respectively, from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report