Dycom (DY) Regains 7.6% in a Month: Will the Rally Continue?

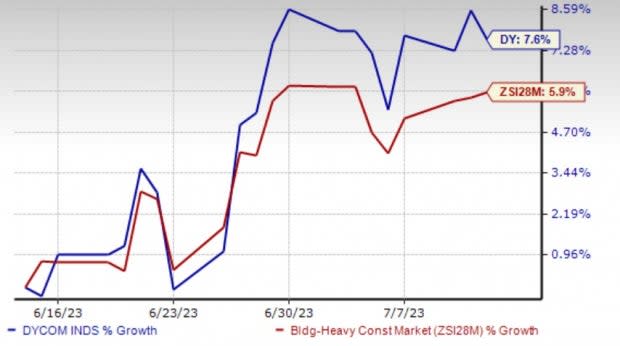

Dycom Industries, Inc. DY has been regaining recently on the back of a solid backlog level and funding from Federal stimulus bills passed over the past few years. In the past month, the stock gained 7.6% compared with the Zacks Building Products - Heavy Construction industry’s 5.9% growth.

DY is also benefiting from higher demand for a single high-capacity fiber network, an extended geographic reach and network planning services.

Let’s discuss the factors that are supporting this Zacks Rank #1 (Strong Buy) company’s growth trajectory.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank stocks here.

Growth Drivers

Robust Backlog: Dycom’s backlog at the end of the first quarter fiscal 2024 totaled $6.316 billion compared with $6.141 billion at fourth-quarter fiscal 2023-end. Of the backlog, $3.482 billion is projected to be completed in the next 12 months. Backlog activity during the fiscal first quarter reflected solid performance as it booked new work and renewed existing work. Dycom expects considerable opportunities across a broad array of customers.

Federal Funding for Infrastructure Bodes Well: Dycom and other leading infrastructure companies have been in the spotlight, given the U.S. administration’s endeavor to boost the infrastructure of the country. Over the past few years, the Federal government has passed many notable bills to fund infrastructure projects related to roads, bridges, clean energy, broadband networks and more.

Apart from the passage of the Infrastructure Investment and Jobs Act in November 2021 and the Inflation Reduction Act (IRA) in August 2022, the passage of the Rural Digital Opportunity Fund allocates $20 billion for rural broadband deployment, which is beneficial for companies like Dycom.

Fiber Network Deployment: Dycom has been constructing or upgrading significant wireline networks across broad sections of the country. These wireline networks are generally designed to provide gigabit network speeds to individual consumers and businesses, either directly or wirelessly using 5G technologies.

A single high-capacity fiber network can cost-effectively deliver services to both consumers and businesses. This enables multiple revenue streams from a single investment. This view is increasing the appetite for fiber deployments as well as creating opportunities.

Increasing access to high-capacity telecommunications continues to be crucial for society, especially in rural America. The Infrastructure Investment and Jobs Act includes more than $40 billion for the construction of rural communications networks in unserved and underserved areas across the country. In addition, substantially all states are commencing programs that will provide funding for telecommunications networks even prior to the initiation of funding under the Infrastructure Act.

Dycom has been providing program management, planning, engineering and design, aerial, underground and wireless construction and fulfillment services for gigabit deployments. These deployments include networks consisting entirely of wired network elements and converged wireless/wireline multi-user networks. Fiber network deployment opportunities are increasing in rural America as new industry participants respond to emerging societal initiatives.

Higher Earnings Prospect & Solid Return: Earnings growth is also a key factor in stock valuation. The Zacks Consensus Estimate for fiscal 2024 earnings of $6.33 per share indicates 41% year-over-year growth. The solid growth rate depicts the stock's promising future.

DY’s superior return on equity (ROE) is also indicative of its growth potential. The company’s ROE is currently 20%, higher than the industry’s 9%. This indicates efficiency in using shareholders’ funds and the ability to generate profit with minimum capital usage.

3 Better-Ranked Construction Stocks Hogging in the Limelight

AECOM ACM is a leading solutions provider for supporting professional, technical and management solutions for diverse industries across end markets like transportation, facilities and government as well as those in environmental, energy and water businesses.

ACM currently carries a Zacks Rank #2 (Buy). Its expected earnings growth rate for 2023 is 6.6%. The consensus mark for ACM’s 2023 earnings has moved north to $3.70 per share from $3.69 in the past 60 days.

Howmet Aerospace, Inc. HWM is a global manufacturer of engineered products serving the aerospace, defense and commercial transportation industries. The company is expected to benefit from higher aircraft production rates and ease of supply chains in the transportation market.

Howmet Aerospace currently carries a Zacks Rank #2. HWM’s earnings for 2023 are expected to grow by 20.7%. The consensus mark for HWM’s 2023 earnings has increased to $1.69 per share from $1.64 in the past 60 days.

Quanta Services Inc. PWR is a leading national provider of specialty contracting services and one of the largest contractors serving the transmission and distribution sector of the North American electric utility industry. The company has been capitalizing on megatrends to lead the energy transition and enable technological development. Initiatives toward a reduced-carbon economy continue to drive demand for PWR’s services and depict incremental growth opportunities.

PWR currently carries a Zacks Rank #2. Its earnings for 2023 are expected to grow by 10.6%. The consensus mark for PWR’s 2023 earnings has remained stable at $7.01 in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report