Dynatrace Looks Attractive Following Sell-Off as Revenue Growth Should Accelerate

Dynatrace Inc. (NYSE:DT) is a cloud-based observability and security platform that recently reported its third-quarter 2024 earnings. While the stock declined 11% after the announcement, I believe it has created an attractive opportunity for longer-term investors.

Although revenue grew 21% year over year, the growth rate has slowed sequentially, which has dampened investor confidence. However, digging into the report and listening to management commentary, there are quite a few bright spots that point to a possible reacceleration in revenue growth moving forward. The company is actively strengthening its ties with global system integrators and investing in sales capacity to effectively target enterprise customers. At the same time, management remains focused on improving profitability as it streamlines operating expenses and drives deeper product adoption to unlock economies of scale. While Dynatrace has a rivalry with Datadog (NASDAQ:DDOG), I believe it has a robust product pipeline that should allow it to spearhead growth in the mid-20's range over the next two years as it sees its margins improve at the same time. In my opinion, this would allow the stock to see significant upside from its current levels.

About Dynatrace

Dynatrace is an observability and security platform that utilizes artificial intelligence at its core and enables organizations to monitor, analyze and optimize their IT operations, ship high-quality software faster and improve user experiences for better business outcomes.

The company is integrated with multi-cloud ecosystems that include AWS, Azure, Google Cloud, VMware Tanzu and others, which allows it to automatically launch and monitor the full cloud stack. The platform leverages its proprietary real-time mapping system and an open artificial intelligence engine, Davis, to simplify the complexity of these multi-cloud environments by providing visibility and actionable insights to application and operation teams to ensure DevOps success.

The company uses a combination of direct sales and a robust network of partners to go-to-market. In terms of its business model, Dynatrace generates revenue primarily from a subscription-based pricing model. In 2024, subscription revenue is expected to account for 95% of its total sales.

Building the bull case

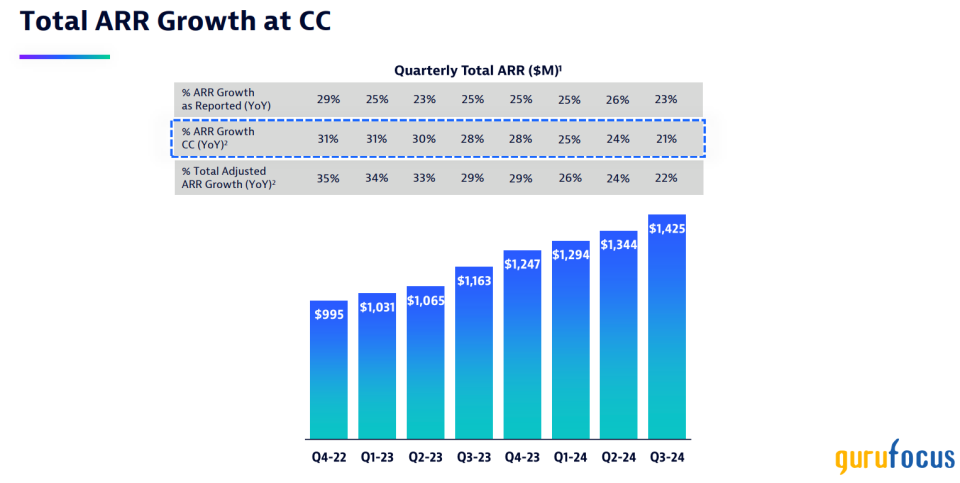

The company recently posted its third-quarter 2024 results, which beat both the top and bottom lines by 2.20% and 14%, respectively. Revenue grew 21% year over year on a constant currency basis to $365 million, out of which subscription revenue contributed 95% of it. One of the reasons the stock declined 11% after earnings could be driven by the fact revenue growth saw a sequential slowdown, which is dampening investor confidence.

The big question is whether Dynatrace is ready to turn the tide or if a few similar quarters could follow. Based on the management's commentary, they sounded optimistic about the company's ability to convert pipeline as the overall macroeconomic environment improves. Furthermore, a report from Gartner suggests that software and IT services segments are expected to see double-digit growth in 2024, driven by cloud spending at 13.80% and 10.40%, respectively, which should bode well to accelerate Dynatrace's top-line growth.

Another bright spot is Dynatrace continues to strengthen its ties with global system integrator partners and hyperscalers, as well as invest in targeted sales capacity to efficiently target larger enterprises in order to drive higher annual recurring revenue (ARR) per customer. Elaborating on the company's relationship to hyperscalers and GSIs, there have been important announcements made recently. First, Dynatrace announced a global alliance with Kyndryl (NYSE:KD), the world's largest IT infrastructure services provider. According to management, this partnership has already resulted in several six- and seven-figure new deals. Moving forward, I believe these partnerships will play a pivotal role in deepening Dynatrace's market position as large enterprises are increasingly seeking unified observability platforms rather than siloed, ad-hoc solutions. As of the third quarter, the company added 209 new logos, while the average ARR per new logo on a trailing 12 months grew 17% to $140,000.

Finally, the management revised revenue guidance for 2024 upwards by 100 basis points to $1.42 billion to $1.43 billion, which would represent a year-over-year growth rate of 23%. At the same time, subscription revenue growth expectation has also been revised upwards by 150 basis points to grow 25% to between $1.35 billion and $1.36 billion. In my view, this indicates management's focus on strengthening its partnership network while scaling its sales team, coupled with a favorable macroeconomic environment, should accelerate revenue growth moving forward.

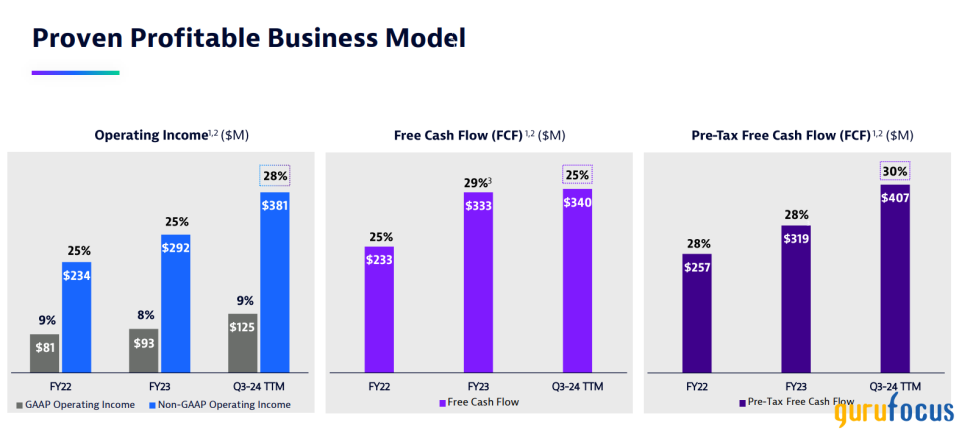

Dynatrace management is laser-focused on improving profitability. As of the third quarter, the company grew its non-GAAP operating income by 29% year over year to $105, which represents a margin of close to 29% and an improvement of 200 basis points. The company continues to expand margins by streamlining its operating expenses, especially in sales and marketing, which account for 32% of total revenue on a non-GAAP basis, compared to 34% of total revenue a year earlier. At the same time, as the company continues to efficiently acquire new customers while driving adoption among existing customers, with a net retention rate of 113%, it allows the company to gain higher economies of scale.

Furthermore, management revised its non-GAAP operating income expectation for the year by 2.4% in its latest earnings call. This would represent a non-GAAP operating margin of 27%, compared to 25% last year.

Building the bear case

The competitive landscape is a concern, although Dynatrace is well positioned with its robust innovation. The company is in direct competition with Datadog, which has been a growth champion so far in the data observability and DevOps space, although we have seen that Datadog's hypergrowth story has been constrained by usage-based revenue and cloud optimization trends. Since Datadog does not report ARR, it is virtually impossible to do an apples-to-apples comparison here. But I see how Datadog's revenue growth trends mirror those of Dynatrace, with growth slowing from prior levels as there is some vendor consolidation occurring in the data observability market. Still, I will note that Datadog is growing faster than Dynatrace.

Where does that leave Dynatrace? In my opinion, the company has driven its market share gains by penetrating into legacy players' market share. The Gartner Magic Quadrant analysis underscores Dynatrace's significant lead, positioning it to replace and outperform competitors. Recently, Cisco (NASDAQ:CSCO) has also demonstrated its intentions to compete with Dynatrace by acquiring Splunk (NASDAQ:SPLK), another incumbent in this space that specializes in on-premise data observability solutions, but has faced challenges in pivoting to the cloud platform model. Meanwhile, the rapid scale of Dynatrace's product iteration has allowed it to launch products that are highly differentiated from most other legacy players in the market. Grail was one of Dynatrace's key offerings, launched in 2022, that has been instrumental in driving Dynatrace's ARR so far.

In addition, the company has shown how to scale its product delivery plans by mirroring Datadog and entering emerging areas of the target market, such as DevSecOps and artificial intelligence and machine learning ops. These initiatives have allowed Dynatrace to accelerate growth while ensuring its robust pace of innovation consistently surpasses expectations.

Tying it together

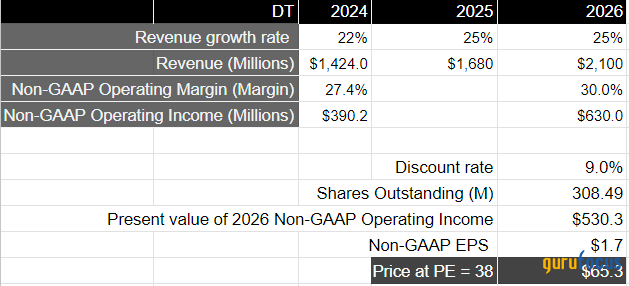

Dynatrace is trading at a forward price-earnings ratio of 52, based on management's expectation of 2024 earnings. Assuming the company sees its revenue accelerate into the mid-20's range into 2026, as its efforts with GSI partnerships and robust product innovation coupled with a favorable macroeconomic environment pay off, the company should produce a total revenue of $2.10 billion in 2026. At the same time, I believe the company's management will continue to remain focused on improving profitability as it streamlines its operating expenses and drives higher economies of scale through deeper product adoption and targeted acquisition. This should allow the company to achieve an additional 300 basis points of improvement in margins from its current level to 30% by 2026. This would translate to a present value of non-GAAP operating income of $530 million, when discounted at 9%, or an adjusted earnings per share of $1.70.

Taking the S&P 500 as a proxy, where it has grown its earnings by 8% on average over the last 10 years, as per Factset, with a price-earnings multiple in the range of 15 to 18, I believe Dynatrace will be trading at a price-earnings multiple that is at least 2.20 to 2.50 times that of S&P 500 in 2026, as earnings growth matures and trends in line with the revenue growth rate in the mid- to high teens beyond that. This would translate to a forward price-earnings multiple of 38, which would mean Dynatrace is currently undervalued and has room for upside of at least 20% to $65 over a three-year investment horizon.

Conclusion

While revenue growth has sequentially slowed for Dynatrace, which is leading to investor pessimism, I believe the company is driving efforts in all the right directions to ensure it can drive deeper market penetration by partnering with GSIs and investing in sales capacity in order to effectively target enterprise customers. At the same time, the company continues to expand its margins while driving deeper product adoption amongst its existing customers. Given the company's competitive positioning, I believe there is a case for optimism as the stock is undervalued at current levels with an upside potential of 20%.

This article first appeared on GuruFocus.