Dynex Capital Inc (DX) Reports Mixed 2023 Financial Results with Strong Q4 Performance

Total Economic Return: $1.45 per common share in Q4, contributing to a modest $0.14 per common share for the full year.

Book Value: Increased to $13.31 per common share as of December 31, 2023.

Comprehensive Income: $1.44 per common share for Q4, with a full year comprehensive income of $0.16 per common share.

Net Income/Loss: Net income of $0.39 per common share in Q4, contrasted by a net loss of $(0.25) per common share for the full year.

Dividends: Declared dividends of $0.39 per common share for Q4 and $1.56 per common share for the full year.

Leverage: 7.8 times shareholders' equity as of December 31, 2023, reflecting a strategic management of investment portfolio.

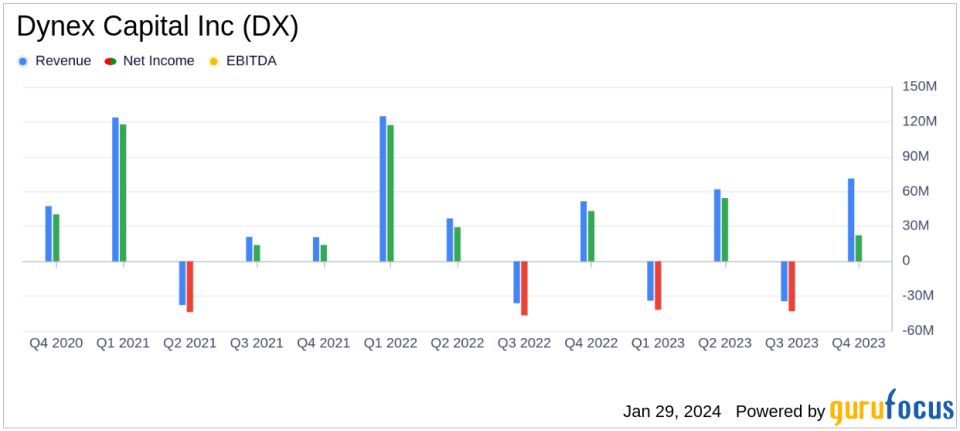

Dynex Capital Inc (NYSE:DX) released its 8-K filing on January 29, 2024, detailing its financial results for the fourth quarter and full year of 2023. The company, a real estate investment trust (REIT) that primarily invests in mortgage-backed securities, navigated a volatile market to deliver a strong fourth quarter, although the full year results were mixed.

Financial Performance and Challenges

The fourth quarter saw a total economic return of $1.45 per common share, or 11.8% of beginning book value, and a comprehensive income of $1.44 per common share. This performance was bolstered by an increase in book value to $13.31 per common share as of December 31, 2023. The full year, however, presented a more subdued picture with a total economic return of $0.14 per common share, or 1.0% of beginning book value, and a net loss of $(0.25) per common share.

The company's performance is significant as it reflects the ability to generate positive returns in a challenging environment. The full year net loss underscores the difficulties faced by REITs in a period marked by interest rate volatility and economic uncertainty. These challenges may lead to problems such as asset devaluation and reduced income from interest rate-sensitive investments.

Financial Achievements and Importance

Dynex Capital Inc's financial achievements, including raising equity capital of $5.9 million during the fourth quarter through at-the-market (ATM) common stock issuances, are important as they provide the company with additional liquidity to manage its investment portfolio and take advantage of market opportunities. The ability to raise capital at a premium to book value also indicates investor confidence in the company's management and strategy.

The company's disciplined investment approach and expertise were highlighted by Chairman and CEO Byron L. Boston, who stated:

"Our shareholders earned a total return of 12% for 2023. We actively managed our mortgage-backed investment portfolio through a historically volatile period. Our strong financial results and returns are a testament to our disciplined investment approach and the expertise of our team."

Key Financial Metrics

Key metrics from the income statement include net interest expense of $(2,277) thousand for the fourth quarter and $(7,931) thousand for the full year. The balance sheet shows an increase in total assets from $3,605,234 thousand at the end of 2022 to $6,369,750 thousand as of December 31, 2023. The cash flow statement details the dividends declared and the capital raised through stock issuances, which are crucial for maintaining liquidity and shareholder returns.

These metrics are important as they provide insights into the company's profitability, asset growth, and cash management strategies, which are critical for investors evaluating the company's financial health and future prospects.

Analysis of Company's Performance

Dynex Capital Inc's performance in the fourth quarter demonstrates resilience and strategic agility in navigating market volatility. The company's focus on Agency mortgage-backed securities, including residential MBS and commercial MBS, has allowed it to capitalize on spread tightening and achieve gains in its investment portfolio. However, the full year results reflect the broader challenges faced by the industry, including the impact of rising interest rates on net interest income.

The company's leverage ratio and the strategic use of derivatives for hedging interest rate risk are indicative of a proactive approach to risk management. The estimated benefit of $23.7 million from amortization of deferred tax hedge gains for the fourth quarter and $80.5 million for the full year further underscores the company's effective use of financial instruments to enhance returns.

Overall, Dynex Capital Inc's mixed financial results for 2023, with a strong fourth quarter performance, reflect both the challenges and opportunities present in the current economic landscape for REITs. Investors and potential GuruFocus.com members interested in the real estate investment trust sector may find value in the company's disciplined approach and strategic management of its investment portfolio.

For more detailed information and analysis on Dynex Capital Inc's financial performance, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Dynex Capital Inc for further details.

This article first appeared on GuruFocus.