e.l.f. Beauty's (ELF) Naturium Buyout to Boost Skincare Lineup

The skincare industry has witnessed remarkable growth over recent years, with consumers increasingly prioritizing self-care and wellness. e.l.f. Beauty ELF, known for its commitment to making quality beauty products accessible to a wide audience, has recognized this trend and aims to capitalize on it through its acquisition of Naturium.

Naturium, a rising star in the skincare realm, has quickly gained a reputation for its clinically effective and budget-friendly products. Founded in 2019 by The Center and later joined by the skincare expert Susan Yara, Naturium's net sales have surged by an impressive +80% CAGR over the past two years, with an estimated $90 million in net sales projected for the current year. The brand's emphasis on powerful ingredients, combined with an affordable price point, has resonated with consumers, leading to its rapid growth.

The acquisition aligns well with e.l.f. Beauty's overarching vision of creating a diverse beauty conglomerate. With e.l.f. Beauty's already successful skincare line, e.l.f. SKIN, this acquisition could help the company double its skincare presence to approximately 18% of retail sales.

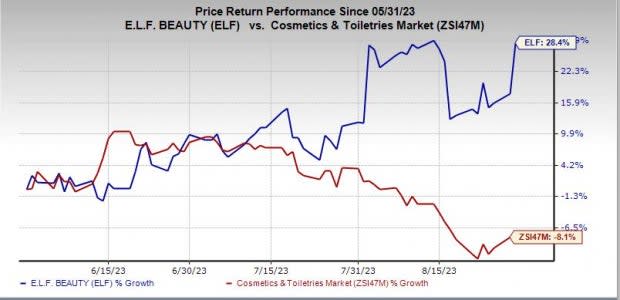

Image Source: Zacks Investment Research

Tarang Amin, the chairman and CEO of e.l.f. Beauty, expressed excitement about the merger, citing the shared values of both companies. He pointed out that the acquisition could serve as a catalyst for unlocking the full potential of the skincare sector, leveraging Naturium's exceptional growth trajectory.

As part of the deal, e.l.f. Beauty is expected to operate Naturium from its Los Angeles headquarters while maintaining the brand's distinct identity and team. The transaction, anticipated to close by Sep 30, 2023, is slated to be financed using a combination of cash, existing credit facility borrowings and e.l.f. Beauty stock.

The purchase price, valued at around $355 million, showcases the attractiveness of Naturium's growth potential. With estimated contributions of approximately $48 million in net sales, $9 million in adjusted EBITDA and 4 cents a share in adjusted earnings for fiscal 2024, the acquisition could be a game-changer for e.l.f. Beauty.

Wrapping Up

e.l.f. Beauty's acquisition of Naturium appears to be a strategic masterstroke that positions the company at the forefront of the evolving skincare landscape. By harnessing Naturium's innovation and accessibility, e.l.f. Beauty could establish an even stronger foothold in the industry.

Shares of this Zacks Rank #2 (Buy) company have risen 28.4% in the past three months against the industry’s decline of 8.1%.

3 More Stocks Looking Red Hot

Here we have highlighted three other top-ranked stocks, namely Inter Parfums IPAR, Ross Stores ROST and Walmart WMT.

Inter Parfums, which manufactures, markets and distributes a range of fragrances and fragrance-related products, currently sports a Zacks Rank #1 (Strong Buy). IPAR has an expected EPS growth rate of 15% for three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales and earnings suggests growth of 19.7% and 14.6%, respectively, from the year-ago reported numbers. IPAR has a trailing four-quarter earnings surprise of 45.9%, on average.

Ross Stores, which operates off-price retail apparel and home fashion stores, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 11.6%.

The Zacks Consensus Estimate for Ross Stores’ current financial-year sales and earnings suggests growth of 6.7% and 18.5%, respectively, from the year-ago reported numbers. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 6.6%.

The Zacks Consensus Estimate for Walmart’s current financial-year sales and earnings suggests growth of 5% and 2.1%, respectively, from the year-ago reported numbers. WMT has a trailing four-quarter earnings surprise of 11.6%, on average.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report