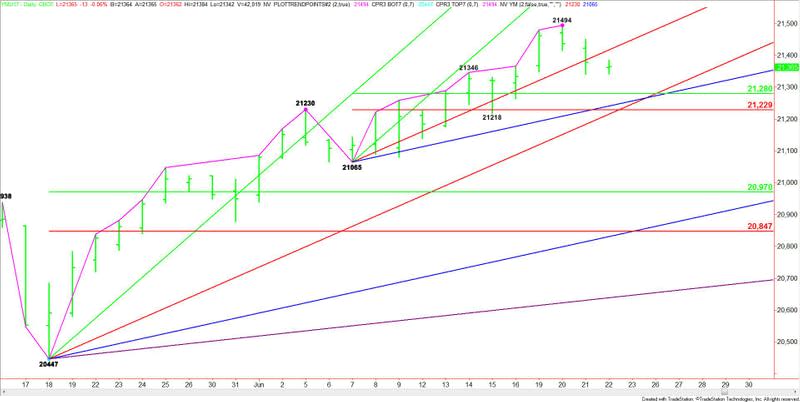

E-mini Dow Jones Industrial Average (YM) Futures Analysis – June 22, 2017 Forecast

September E-mini Dow Jones Industrial Average futures are trading slightly lower and nearly flat on Thursday. There is no motivation for investors to buy aggressively at current price levels and sellers are hesitant because of the recovery in the crude oil market.

Technical Analysis

The main trend is up according to the daily swing chart, however, momentum shifted to the downside with the formation of the closing price reversal top on Tuesday at 21494. A trade through this top will negate the chart pattern and signal a resumption of the uptrend.

The short-term range is 21065 to 21494. Its retracement zone at 21280 to 21229 is the primary downside target.

The main range is 20447 to 21494. If the trend changes to down then its retracement zone at 20970 to 20847 will become the primary downside target.

Forecast

Look for a downside bias today as long as the Dow remains under the uptrending angle at 21417.

If selling pressure increases under 21417 then look for a possible move into the short-term 50% level at 21280. This is followed by a cluster of numbers at 21241, 21229 and 21215.

Since the trend is up, look for a technical bounce on the first test of 21280 to 21215.

If 21215 fails as support then look out to the downside. This could signal the start of a possible correction into at least 20970.

Overcoming 21417 could generate the upside momentum needed to challenge the closing price reversal top at 21494.

This article was originally posted on FX Empire