E-mini S&P 500 Index (ES) Futures Technical Analysis – Strengthens Over 4445.75, Weakens Under 4416.50

December E-mini S&P 500 Index futures are trading higher shortly before the cash market close on Thursday. The benchmark index is in a position to post its bets performance in two months as investors shrugged off concerns over the Federal Reserve’s tapering plans.

At 19:17 GMT, December E-mini S&P 500 Index futures are trading 4442.50, up 58.50 or +1.33%.

Easing concerns over a potential default by Chinese property developer Evergrande also fed into market optimism. Investors also shrugged off data showing sluggish business activity growth and a rise in jobless claims, in line with expectations for a slowdown in economic growth in the third quarter.

Daily Swing Chart Technical Analysis

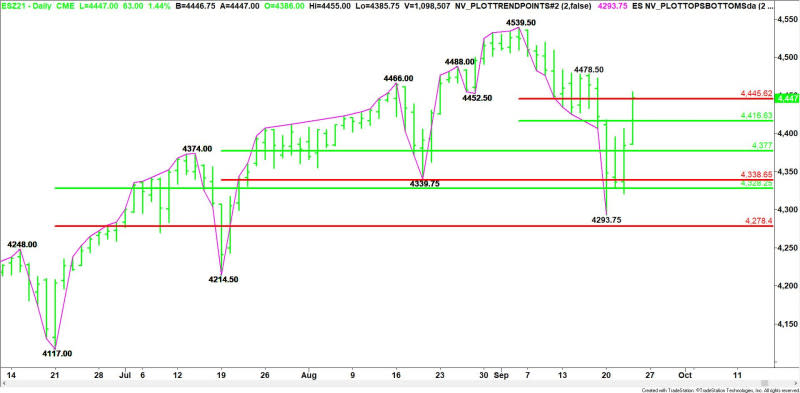

The main trend is down according to the daily swing chart. A trade through 4539.50 will change the main trend to up. A move through 4293.75 will signal a resumption of the downtrend.

The minor trend is also down. A trade through 4478.50 will change the minor trend to up. This will shift momentum to the upside.

The main range is 4117.00 to 4539.50. Its retracement zone at 4328.25 to 4278.50 is support. This zone stopped the selling at 4293.75 on Monday.

The short-term range is 4214.50 to 4539.50. Its retracement zone at 4377.00 to 4338.50 is new higher support.

The minor range is 4539.50 to 4293.75. The index is currently testing its retracement zone at 4416.50 to 4445.75. Trader reaction to this zone will determine the near-term direction of the index.

Short-Term Outlook

The direction of the December E-mini S&P 500 Index into the close on Thursday will be determined by trader reaction to the minor Fibonacci level at 4445.75.

Bullish Scenario

A sustained move over 4445.75 will indicate the presence of buyers. The next upside target is the minor top at 4478.50. Taking out this level will change the minor trend to up.

Bearish Scenario

A sustained move under 4445.50 will signal the presence of sellers. If this move creates enough downside momentum then look for the selling to possibly extend into the 50% level at 4416.50. This is a potential trigger point for an acceleration into the 50% level at 4377.00.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Prediction – Prices Fall Following Bear Flag Pattern Despite Drop in the Greenback

Ethereum, Litecoin, and Ripple’s XRP – Daily Tech Analysis – September 24th, 2021

Silver Price Prediction – Prices Edge Higher on Soft PMI Data

Crude Oil Price Forecast – Crude Oil Markets Continue Bullish Move

USD/CAD Daily Forecast – Canadian Dollar Gains Ground As WTI Oil Moves To New Highs