E W Scripps Co Reports Q4 Loss Amid Goodwill Impairment, Yet Sees Advertising Growth

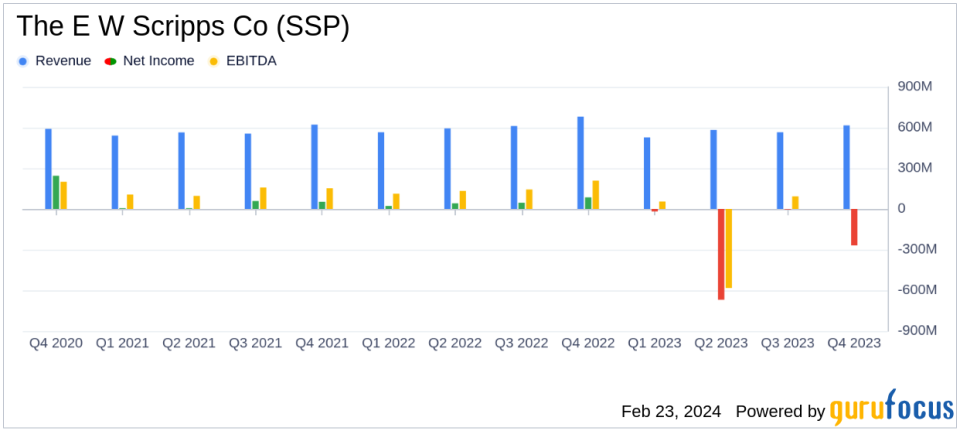

Revenue: Q4 revenue of $616 million, down 9.6% from the prior year.

Net Loss: Q4 net loss attributable to shareholders was $268 million, or $3.17 per share.

Goodwill Impairment: Non-cash goodwill impairment charge of $266 million recorded in Q4.

Local Media: Core advertising revenue up 1%, with distribution revenue increasing 22% in Q4.

Scripps Networks: Q4 revenue down 7%, with a 33% increase in connected TV revenue.

Cost-Savings Initiatives: On track to realize over $40 million in annualized savings by mid-2024.

Debt Management: Mandatory principal payments of $17.1 million made on term loans in 2023.

The E W Scripps Co (NASDAQ:SSP) released its 8-K filing on February 23, 2024, revealing a mixed financial performance for the fourth quarter of 2023. The media company, known for its local and national media brands, reported a decrease in revenue and a significant net loss, primarily due to a non-cash goodwill impairment charge. Despite these challenges, the company's Local Media segment showed resilience with an increase in core advertising revenue and distribution revenue.

Company Overview

The E W Scripps Co operates in the Media - Diversified industry, with a focus on local and national media. Its Local Media segment, which includes approximately 61 local broadcast stations, is a significant revenue generator for the company. Scripps Networks, another operating segment, experienced a revenue decline but exceeded expectations due to better-than-expected connected TV, general market, and direct response revenue.

Financial Performance and Challenges

The company's fourth-quarter revenue was $616 million, a 9.6% decrease from the same quarter in the previous year, which included midterm election revenue. The net loss attributable to shareholders was substantial, at $268 million, or $3.17 per share. This loss was heavily influenced by a $266 million non-cash goodwill impairment charge related to the Scripps Networks segment, as well as $9.4 million in restructuring charges.

Despite the overall loss, the Local Media segment's core advertising revenue increased by 1%, and distribution revenue grew by 22%. This growth is partly attributed to new National Hockey League deals. Scripps Networks' revenue decreased by 7%, but connected TV revenue within this segment grew by 33%, excluding the sunsetting programmatic product.

Financial Achievements and Importance

Amidst the challenges, Scripps has made strides in managing its financial position. The company is on track to realize more than $40 million in annualized savings by mid-2024, primarily from employee severance-related charges. Additionally, Scripps has been proactive in managing its debt, making mandatory principal payments on its term loans and amending its credit facility to increase borrowing capacity.

Key Financial Metrics and Commentary

Key financial metrics from the earnings report include:

"Our fourth-quarter results reflect improvement in the advertising marketplace, both at the core local level and nationally. ... Our advertising revenue results and large distribution ecosystem, combined with our cost-savings initiatives, lay the groundwork for short-term operating performance improvement and firm financial footing as we execute on strategies for future growth." - Adam Symson, President and CEO of Scripps.

Analysis of Performance

While the goodwill impairment and restructuring costs have negatively impacted the company's bottom line, the growth in core advertising and distribution revenue in the Local Media segment, along with the connected TV revenue increase in Scripps Networks, indicate potential areas of strength. The company's focus on cost-savings and debt management also suggests a strategic approach to improving its financial health in the long term.

Looking ahead, Scripps anticipates revenue growth in Local Media and a flat to low-single-digit percent decrease in Scripps Networks revenue for the first quarter of 2024. The company's efforts to carve out a niche in the evolving media landscape, including its ventures into datacasting and connected TV services, reflect its commitment to adapting and finding new revenue streams.

For a more detailed analysis and ongoing coverage of The E W Scripps Co's financial performance, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from The E W Scripps Co for further details.

This article first appeared on GuruFocus.